Oil & gas divestitures, midstream consolidation, and PE deals to drive 1H M&A – North America Natural Resources Trendspotter

- Oil majors could pare portfolios

- Activity to expand beyond Permian Basin

- Trump’s FTC likely to ease energy regulation

Last year’s gusher of mega-deals by oil and gas majors, including Diamondback’s [NASDAQ:FANG] USD 28.1bn acquisition of Endeavor Energy Resources, could prompt a slew of divestitures, industry experts told Mergermarket. The midstream and oilfield services sectors will also continue to consolidate.

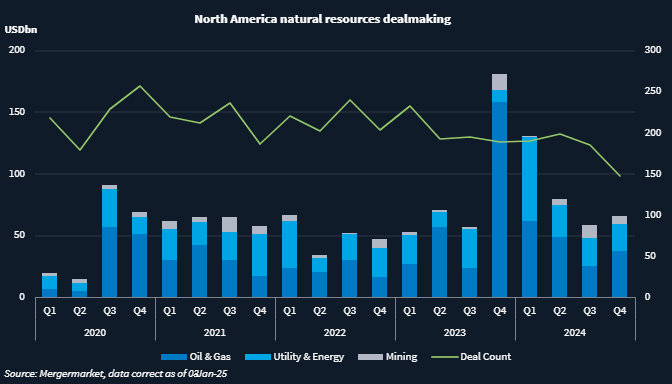

Oil and gas M&A volume in 2024 reached USD 173.9bn, or 51.2% of North America’s total natural resources deal volume, according to Mergermarket data.

Large companies that completed M&A deals in the last 12 to 18 months are now scouring their portfolios for non-core assets to divest. Historically, every large corporate M&A consolidation wave “is followed typically 18 to 24 months after the fact with a large run of asset-level divestitures, as the pro-forma businesses assess their post-M&A portfolios. We’re very early stage of that,” noted J.P. Hanson, managing director and global head of Houlihan Lokey’s Oil & Gas group.

In November, ExxonMobil [NYSE:XOM] agreed to sell some non-core Permian assets to Hilcorp Energy for around USD 1bn following its USD 68.3 acquisition of Pioneer Natural Resources. And in September, Occidental Petroleum [NYSE:OXY] closed the sale of certain Delaware Basin assets in Texas and New Mexico to Permian Resources [NYSE:PR] for USD 818m following its USD 12bn acquisition of CrownRock.

When it comes to these divestitures, “the thing to watch particularly is how the buyers are getting financing because the equity window really hasn’t reopened for oil and gas stocks yet,” said Jon Hughes, chairman and CEO of energy-focused boutique investment bank Petrie Partners.

Wider swath of geographic activity

M&A activity will also heat up in regions beyond the prolific Permian Basin, said Stephen Trauber, managing director, chairman, and global head of Energy and Clean Technology at Moelis.

For example, deal activity has picked up in the Uinta Basin, in northeastern Utah. In November, Ovintiv [NYSE:OVV] announced it sold all of its Uinta assets to FourPoint Resources for about USD 2bn. And in October, SM Energy [NYSE:SM] closed its acquisition of an 80% stake in EnCap Investments-backed XCL Resources’ Uinta assets also for USD 2bn.

The Mid-Continent (Mid-Con) Basin, which extends from North Dakota to Texas and from Colorado to Pennsylvania, is also “becoming an area where people are looking for opportunities, maybe at a little bit lower cost, trying to take advantage of what they see as rising natural gas prices,” Trauber noted.

Midstream catches wave

Trauber and others expect a rush of midstream deals within 12 to 24 months following the upstream consolidation surge.

“The fact that we’ll see an uptick in drilling and development bodes really well for the midstream industry,” said Chris Cottrell, partner in Seyfarth’s Houston energy practice. “I think that particular sector is ripe for M&A.”

For example, US President-elect Donald Trump is expected to lift the pause on liquified natural gas (LNG) exports, which could lead to a “lot more demand and interest in midstream,” said Mona Dajani, global co-chair of Baker Botts’ energy infrastructure and co-chair of the energy sector. “We’re going to see a lot more mergers that would result in more suppliers able to provide processing, transport, storage and export services.”

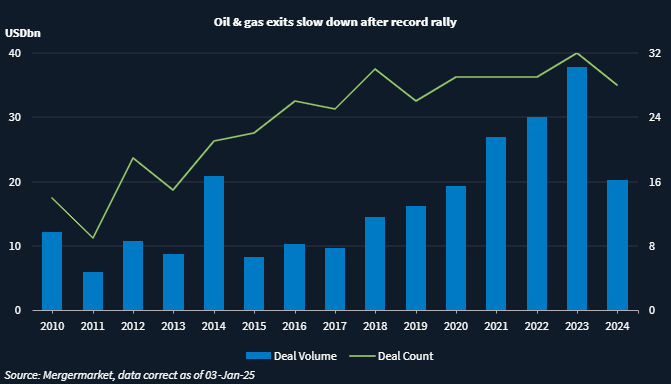

Private equity firms have taken advantage of this M&A activity to exit portfolio companies, as Mergermarket reported in November.

There are a lot of pent-up PE sell-side transactions that need to get done, said Travis Wofford, chair of the Corporate Department in Houston and vice chair of the Global M&A Practice at Baker Botts. “But one of the great things about where we are right now, especially in oil and gas, is we’re in a very good position to have deal execution with actual closing certainty, not just from a regulatory perspective, but pricing,” he said.

Some deals include Stonepeak Infrastructure Partners’ sale of WTG Midstream to Energy Transfer [NYSE:ET] for USD 3.1bn and Global Infrastructure Partners’ sale of EnLink Midstream and Medallion Midstream to ONEOK [NYSE: OKE] for USD 5.6bn.

There were 28 sponsor-led oil and gas exits worth USD 20.2bn in 2024, down from USD 37.8bn across 32 deals in 2023, according to Mergermarket data.

Portfolio companies that were held in continuation funds and secondaries could also come to market, Wofford said. Many of those are “going to get a deal done. They were just buying time,” he added.

PE firms are expected to continue partnering with infrastructure and energy companies, said Brittany Sakowitz, a corporate partner in Kirkland & Ellis’ Houston and Austin offices who concentrates on mergers and acquisitions and private equity.

“Structured equity is an attractive solution because you have equity features, so you’re not treating it as debt on a balance sheet, but you’re also getting the reputational support of the private equity fund, and you’re able to hit a broader investor base than you could by doing something in the public market, or just going to a traditional lender,” she said.

In November, EQT [NYSE:EQT] announced it agreed to form a new midstream joint venture (JV) with Blackstone [NYSE:BX]. Under the terms of the agreement, funds managed by Blackstone Credit & Insurance will provide EQT USD 3.5bn in cash for a non-controlling interest in the JV.

As deals keep getting bigger, “we’ll see more clubbing of private equity firms,” with other investors joining sponsors such as pension funds, wealth funds, non-traditional hedge funds and family offices, said John Grand, co-head of Vinson & Elkins corporate practice group.

Regulatory boost

Trump’s election is also expected to be a boon to the energy sector. The President-elect has nominated Andrew Ferguson, a current Republican FTC Commissioner, to take the helm from Lina Khan, who has been a vocal opponent of the fossil fuel industry.

Khan’s replacement could lead to a “really significant increase in deal activity,” said Baker Botts’ Wofford.

However, a friendlier regulatory environment does not guarantee a boost in M&A activity as the pool of attractive assets continues to shrink and companies re-evaluate their organic growth opportunities, this news service reported in December.