Nutkao sale progress could point to sponsor exit opportunities in European chocolate sector – LTE Charts of the Week

LTE Charts of the Week showcase the power of Mergermarket’s Likely to Exit (LTE) predictive analytics engine. Find more financial sponsor exit opportunities by activating a two-week trial to Mergermarket or log in if you are a subscriber.

- Mars’ 2023 acquisition of Hotel Chocolat was third-largest chocolate deal of past decade in Europe

- Sector activity remains strong with first-round bids for Italy’s Nutkao to be submitted by end-April

- Preziosi Food, Goldeck Suesswaren and Halo Foods among potential early-stage sector exit opportunities – Mergermarket LTE

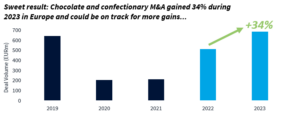

Chocolate and confectionary manufacturing M&A in Europe tallied up to EUR 685m in 2023, up 34% year-on-year. It was mostly driven by the GBP 571m (EUR 652m) acquisition of Hotel Chocolat in November last year by consumer giant Mars.

And there could be more chocolate and confectionary manufacturing deals to come. Nutkao, the Piedmont, Italy-based chocolate spreads producer, was put on the market by White Bridge Investment late last year and has attracted the attention of chocolate manufacturing peers Baronie in Belgium and Spain-based Natra. Indicative offers should be submitted at the end of April as reported last week.

Halo Foods, the UK-based snack bar producer, has been put up for sale by its parent Peak Rock Capital, driving its LTE Score to 60 out of 100, this news service reported on 3 April. Preziosi Food, the Italy-based confectionary manufacturer owned by Vertis and HAT SGR has also attracted interest from financial sponsors including DEA Capital and Fondo Italiano d’Investimento as reported in March. Preziosi has an LTE Score of 57.

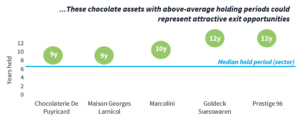

Germany-based confectionary maker Goldeck Suesswaren, has the longest hold period of all confectionary assets tracked by Mergermarket. The manufacturer of Zetti-branded confectionary recently sold a minority stake to German private equity firm WMS.

Marcolini, the Belgium-based chocolate manufacturer, also has a long hold period and could be ripe for an exit. It has been owned by NEO Investment Partners for 10 years and has an LTE Score of 19.

Mergermarket’s Likely to Exit (LTE) algorithm predicted an exit for BC Partners from Forno d’Asolo, an Italian producer of pastries, earlier this year. The sponsor hired Rothschild to find a buyer for the pastry manufacturer in October and announced its exit in February this year for an estimated USD 1.2bn (EUR 1.1bn). Forno d’Asolo had an LTE Score of 64 at the time the deal was announced.

With Forno d’Asolo and Hotel Chocolat both recently acquired and plenty more deals in the pipeline, it could be another sweet year for chocolate and confectionary M&A in 2024.

LTE Scores are generated using a machine-learning algorithm developed by ION Analytics data scientists, engineers, and journalists leveraging 20+ inputs from more than a decade of proprietary Dealogic deal data and M&A intelligence published on Mergermarket. Find out more about the score’s predictive capabilities in Mergermarket’s LTE Predictive Scoring Whitepaper.

Note: Data correct as of 11 April 2024.

Source: Mergermarket.ionanalytics.com