North America TMT Trendspotter: Dealmakers eye late-year M&A rebound after 1H24 volume surge

- Sponsor buyout volume rises sharply, while number of deals remains muted

- Advisors say cybersecurity, media and entertainment deals poised for breakout

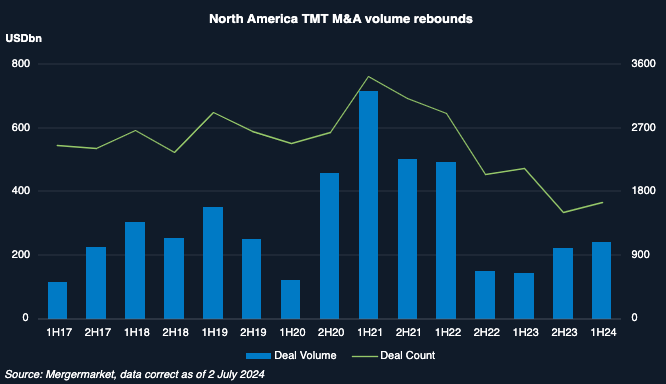

A growing number of large North American technology, media and telecommunications transactions helped lift first-half volume above last year’s decade lows, as dealmakers suggest the bottom is in place and point to improving conditions for a long-awaited M&A recovery.

Volume for TMT deals announced in 1H24 totaled USD 239.6bn, up 68% from the USD 142.6bn tallied in 1H23, Mergermarket data shows. Gains were paced by an 89% increase over 2H23 in the amount spent on deals in computers and electronics – which includes software – and telecommunications, which grew 10% from 2H23.

The number of transactions fell 23% from a year earlier. In an illustration of the lingering slump, the 1,650 deals recorded in 1H24 marked the second-lowest number of transactions in a half year since 2H13. Only 2H23 saw fewer deals during the past decade.

Advisors are near unanimous that the M&A environment is bouncing back more slowly than they expected but suggest that widely anticipated interest rate cuts and the passing of the November presidential election will drive a surge of activity in late 2024 and into 2025.

The five largest TMT transactions of the first half were announced in the first two months of the year, including Synopsys’ [NASDAQ:SNPS] USD 35bn acquisition of Ansys [NASDAQ:ANSS], and Hewlett Packard Enterprise’s [NYSE:HPE] USD 14bn buy of Juniper Networks [NYSE:JNPR].

This week, reports surfaced that Google parent Alphabet [NASDAQ:GOOG] is near a USD 23bn deal to acquire cloud security provider Wiz.

Driving these large deals in the tech sector are “corporates looking to acquire next-generation technologies as well as engaging in market consolidation moves,” says Richard Hardegree, vice chairman at UBS [NYSE:UBS].

Software deals – which comprise more than 60% of TMT deals in 1H24 – fell to 998, on pace for the fewest number of transactions in the space since 2014. Activity around artificial intelligence technologies is also accelerating, both in terms of financings and M&A. “There have been smaller AI tuck-ins, but we are starting to see some bigger deals as well, with focus on bringing in AI talent,” says Wayne Kawarabayashi, COO and head of M&A at Union Square Advisors.

A long-awaited capitulation by capital-starved companies that opt to sell rather than raise and further dilute has not meaningfully begun to take root in many sectors.

“There’s still a bid-ask spread,” says Sam Shah, co-head of Macquarie Capital, Americas, and global head of software and services. In 60% to 70% of transactions, counterparties remain divided over “that last turn or two,” causing many sellers to simply wait, he says. There are a lot of “quiet processes [and] shopping” going on, Shah says.

One sector advisor notes a possible “window of opportunity” whenever rates start to come down and noted people are preparing now to be ready for the expected uptick in technology valuations. A change in political party after the presidential election could further drive an increase in M&A heading into 2025, the advisor says.

Advisors and market participants were split on the impact of the November election on M&A. A recent survey by KPMG of 100 CEOs found 62% plan to put off major M&A and large capital investments until after the November election. “That kind of data portends an uptick after the election,” says Greg Sward, KPMG’s US TMT strategy practice leader.

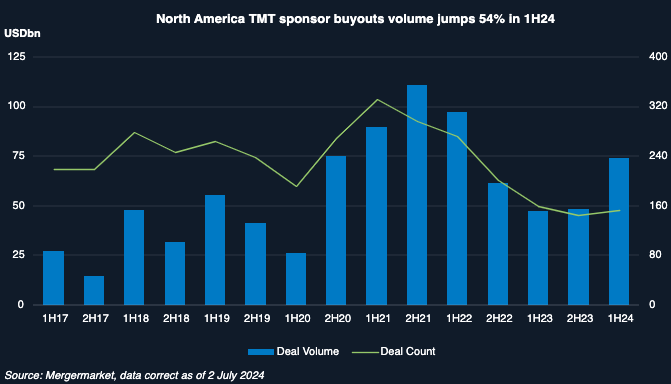

Sponsors wade in

Buyouts by private equity painted a mixed picture in the first half. After recording the fewest number of buyouts for a six-month period in a decade during 2H23, the number of such deals rose about 5% in 1H24 to 154, according to Mergermarket data.

Nearly 60% of those deals were announced in 1Q, with buyouts slipping to just 62 transactions in 2Q, the lowest quarterly number since 2Q13.

Despite the lower count, buyout volume in 1H24 was up 54% from 2H23, to USD 74.2bn, led by KKR’s [NYSE:KKR] USD 10bn buyout of Cotiviti Holdings and Permira’s USD 6.9bn take-private of Squarespace [NYSE:SQSP].

While persistently high interest rates remain a headwind, so too is continued weakness in sales of sponsor-owned assets, a key driver of M&A activity during the peak years of 2020 and 2021.

Sponsors that bought assets at elevated prices during the post-pandemic period have been forced to wait longer to grow into the desired valuations for exit, says David Humphrey, global head of TMT and co-head of the North America PE business at Bain Capital Private Equity.

“There have been fewer realizations from 2020 and 2021 vintages,” he says. There will begin to be some monetization of those deals in the next two to three years if equity and credit markets stay strong, “but it’ll take time,” Humphrey adds.

Still, conversations are happening, and activity is increasing, he says. Impaired financing markets that helped slow sponsor activity at the start of the slowdown in 2022 have fully recovered, driven by competition among private credit and big banks, dealmakers and advisors say.

Signs of recovery

Increased activity by sponsors is an especially welcome sign in cybersecurity, which along with much of the software space was hit particularly hard by the private equity pullback.

After spending much of 2023 on the sidelines, financial sponsors are exhibiting a significant pickup in activity, says Keith Skirbe, co-head of the global cybersecurity practice at Houlihan Lokey.

He cites Thoma Bravo’s USD 4.9bn take-private of Darktrace [LON:DARK], announced in April, as one of several examples of sponsors meaningfully wading back into cybersecurity.

Strategic acquirers, too, are becoming more active, as public market valuations show increasing strength, giving them more currency with which to conduct M&A. Cloud providers, networking providers, cybersecurity pure plays looking for consolidation and private equity firms looking for rollups are all possible players in cybersecurity M&A, says Union Square’s Kawarabayashi.

Target valuations have moderated in some cases, with a few one-time unicorns trading at deep discounts from their highs of just a few years ago.

Software firm Akamai Technologies [NASDAQ:AKAM] last month completed a USD 450m purchase of application security provider Noname Security, which was valued at USD 1bn during its USD 135m funding round in 2021, notes Skirbe.

Also last month, Fortinet [NASDAQ:FTNT] agreed to buy cloud security platform Lacework. Terms of the deal were not disclosed, but industry sources say the purchase price was a small fraction of the USD 8.3bn valuation garnered when it raised a USD 1.3bn Series D in 2021.

Media represents another space likely to see increased transactions, as secular challenges drive tie-ups in the video streaming space, says Carlos Jimenez, managing director at Moelis.

Jimenez is part of the team that advised Skydance Media and RedBird Capital Partners on the USD 8bn deal with Paramount Global [NASDAQ:PARA], announced this month. The Paramount transaction is just the beginning, as the current plethora of unprofitable video streaming services is expected to get whittled down to just four or five competitors, Jimenez says.

Bid-ask spreads in the music space are also coming down, with companies like Downtown Music Holdings among the latest names to hit the market in the vibrant sector.