North America Natural Resources Trendspotter: Oil and gas frenzy drives up dealmaking

- Oil and gas accounts for 51.6% of total deal volume

- Sponsors to become active players after quiet 1H24

A rush to secure prime shale acreage in the US pushed M&A deal volume in North America’s natural resources sector to USD 204.8bn in 1H24 – 66% higher than the first half of 2023, according to Mergermarket data. The surge is expected to continue with private equity and renewable-energy assets playing key roles.

Oil-and-gas transactions accounted for more than half of total deal volume and five of the top 10 deals involved US upstream companies, such as Diamondback Energy’s [NASDAQ:FANG] pending USD 25.8bn acquisition of Endeavor Energy and ConocoPhillips’ [NYSE:COP] proposed acquisition of Marathon Oil [NYSE:MRO] for USD 23.1bn.

These mega deals raised the average size of oil-and-gas transactions in North America to USD 895.6m in 1H24, the second highest since at least 1995, according to Mergermarket data.

Dealmaking in North America’s oil and gas sector is expected to continue for several reasons including consolidation in the US related to non-producing assets that are now profitable under current crude prices; oilfield services companies seeking scale to serve bigger and more geographically diverse customers; and PE firms seeing an opportunity for long-awaited exits, says Jay Moody, managing director at Alvarez & Marsal’s Transaction Advisory Group and head of its energy and infrastructure practice.

M&A activity will likely continue to focus on the Permian Basin, says Austin Elam, partner and co-chair of Haynes Boone’s oil and gas practice group. The basin, which straddles Texas and New Mexico, accounts for about half of US crude oil production, according to the US Energy Information Administration.

Half or more of all oil-and-gas deals in recent years in the US have been in the Permian, according to Jon Hughes, CEO of energy investment bank Petrie Partners. “It’s hard to foresee a world in the next few years where transaction activity is not weighted to the Permian, when you’re talking about the US market,” he says.

Mergermarket reported last month that Permian-focused Franklin Mountain Energy is exploring a sale and other companies such as Hannathon Petroleum, Elevation Resources, and UpCurve Energy could be potential future targets.

Indeed, M&A activity in 2H24 is expected to be mostly driven mostly by small- to mid-sized companies, Petrie Partners Managing Director John Fossum says. “Starting [in] the second half of this year and going on for the next several years [we expect] a reversal of flow… where assets begin to flow back to the smaller companies out of the big companies,” he says.

A handful of large, listed companies have announced plans to shed assets following recent deals. Chevron [NYSE:CVX], for example, wants to sell between USD 10bn-USD 15bn worth of assets as part of its still-pending deal with Hess [NYSE:HES]. Occidental Petroleum [NYSE:OXY] also plans asset sales related to its pending USD 12bn acquisition of CrownRock. And Spain’s Respol [BME:REP] is reportedly planning to sell a 49% stake in its Eagle Ford assets, which could be valued at more than USD 2bn.

Most of these assets, however, are not likely to hit the market until at least early 2025, in many cases due to regulatory delays, says Elam.

And while dealmaking will continue to focus mostly on the US, oilfield service-related M&A activity north of the border could also pick up following projects such as Canada’s Trans Mountain oil pipeline and TC Energy’s Coastal GasLink project completion.

Both projects should create better market pricing for Canadian producers, which should create opportunities for oilfield services providers in the area, says Alvarez & Marsal’s Moody. The addition of 290,000 barrels of capacity to the Trans Mountain pipeline, for example, is expected to help narrow the spread between the US benchmark West Texas Intermediate and the lower-priced Western Canadian Select, increasing the growth potential and profitability of Canadian upstream companies, he added.

PE primed for action

Sponsors are likely to re-emerge in the oil and gas industry – both as buyers and sellers.

There was a total of 10 sponsor buyouts worth USD 2bn in North America’s oil and gas sector in 1H24, a 43.7% drop in deal value from 1H23 and far below the record high of USD 16.4bn in 1H19, according to Mergermarket data.

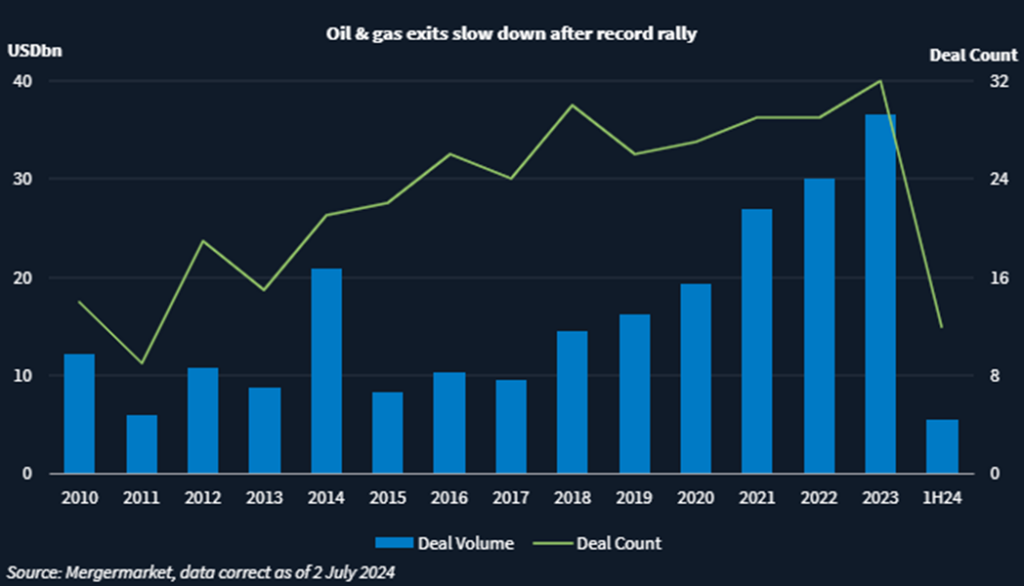

There were 12 oil-and-gas sponsor exits worth USD 5.5bn in North America in 1H24, a 70.3% drop in deal value from 1H23, according to Mergermarket data.

But, to take advantage of the market’s appetite for deals, specialized PE firms have closed or are launching new funds to re-up their investments in US shale assets, with many of them partnering with experienced management teams from companies that have been sold recently, says an industry banker.

The rush to secure shale acreage in the US has also motivated sponsors to prep for exits, says Moody.

Mergermarket last month reported that EnCap Investments was considering launching sale processes for several of its oil-and-gas portfolio companies, including Double Eagle Energy Holdings IV and Grayson Mill Energy. Houston-based EnCap has already agreed to sell producing and undeveloped assets from its sponsored company Ameredev II to Matador Resources [NYSE:MTDR] for USD 1.9bn.

On 8 July, Devon Energy [NYSE:DVN], which lost out on Marathon Oil to ConocoPhillips, announced it has agreed to acquire Grayson Mill Energy’s Williston Basin assets for USD 5bn.

Renewables will shine again

Many renewable-energy players are expected to find themselves with more projects in their pipeline than they can handle and could be forced to sell some of them, says Rob Santangelo, global head of energy and energy transition at Santander.

The increased demand for electricity to power electric vehicle chargers and data centers used for artificial intelligence and cryptocurrency mining is expected to drive M&A activity in the conventional thermal sector, particularly around natural gas-powered plants, which are increasingly viewed as an important piece in the energy transition puzzle, Managing Director and Head of M&A US at Santander Bryan Carlson says.

There have been 110 M&A deals worth USD 23.9bn in North America’s utility and energy-electric power sector – just 8.3% shy of total deal volume in all of 2023, according to Mergermarket data.