North America Industrials Trendspotter: Nearly 50% increase in dealmaking led by construction and aerospace in 1H

- Building products and construction represented almost half of deal value

- Number of deals decreased 8% from 1H23 to 1H24

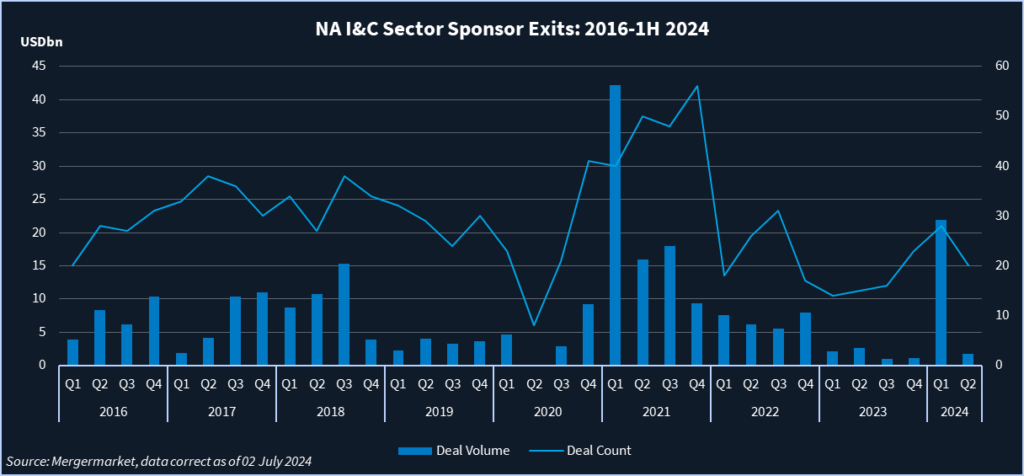

North American Industrials & Chemicals M&A activity soared in the first half despite high interest rates and persistent inflation, according to Mergermarket data. The momentum towards the end of the first half is expected to continue into the second half of the year.

The value of disclosed deals in 1H24 reached USD 74.76bn, up close to 50% from 1H23 when the total deal value in I&C was USD 50.7bn, according to Mergermarket data.

The number of deals in I&C was also about 8% lower from the year-earlier period, at 921 transactions announced for 1H24, compared with 1,010 in 1H23.

Some of the larger transactions include Home Depot’s [NYSE:HD] USD 18.25bn acquisition of SRS Distribution, IFF’s [NYSE:IFF] proposed divest of its Pharma Solutions business to Roquette for USD 2.85bn and Arcline’s USD 1.8bn take-private of Kaman.

Construction building momentum

The construction and building products sector contributed about USD 36bn of deal value on 385 deals announced in 1H24, according to Mergermarket data.

Construction and engineering was the best performing industrials subsector, according to Clifford Chance’s head of M&A, David Brinton. He expects the segments to remain strong in the second half of the year, particularly if interest rates are cut, as anticipated. Dealmaking tied to construction of industrial plants and homebuilding has not abated, Brinton says.

In addition, the Infrastructure Investment and Jobs Act and the Inflation Reduction Act have spurred a wave of new building projects comprising both the maintenance, modernisation and repair of roads, transportation networks and energy grids, but also new industrial plants.

When it comes to automotive, Brinton says that while demand for electric vehicles has cooled, M&A activity in the sector continues. Original equipment manufacturers are focusing on critical supply chain components, most notably batteries. Investments are expected in new types of battery technologies as OEMs look for opportunities to reduce costs and the reliance on battery metals such as lithium, nickel, cobalt and magnesium, Brinton says.

Aerospace & defense M&A takes flight

The aerospace and defense sector contributed about USD 4bn in deal value on 37 deals announced in 1H24, according to Mergermarket data. This doesn’t include Boeing’s [NYSE:BA] proposed USD 8.3bn acquisition of Spirit AeroSystems [NYSE:SPR], which was announced on 1 July.

Three sector advisors said aerospace and defense activity is poised to remain strong in the second half of the year based on the long list of assets on the market and several businesses that are about to come to market. An increase in commercial air travel and heightened geopolitical unrest are buoying sector activity.

Public companies were active traders of A&D assets in 1H24. In addition to Kaman’s take-private, Barnes Group [NYSE:B] is reportedly exploring a sale. And in June, Cognizant [NASDAQ:CTSH] agreed to acquire Belcan for around USD 1.3bn. In the same month, Honeywell [NASDAQ:HON] acquired CAES from Advent International for about USD 1.9bn.

Private equity firms are also actively selling portfolio companies.

With a strong order backlog, an improved lending environment and the need to address operational and strategic imperatives, Clifford Chance’s Brinton expects an increase in M&A activity in the commercial aerospace subsector in the second half of 2024.

Manan Shah, a partner at Renovus Capital, says smaller companies focused on space technology or involved with the Space Force could see acquisition interest based on where government spending is going. Satellite technology, cybersecurity and unmanned aerial vehicles are attractive subsectors, he adds.

Logistics M&A on the go

Craig Decker, managing director at Brown Gibbons Lang, says private equity firms are clamoring to exit logistics companies bought several years ago.

Some logistics companies could fetch EBITDA multiples in the 9x to 12x range, Decker says. Acquirers in the logistics sector are looking at specialized service providers, he says. For example, I Squared Capital, an infrastructure investment manager, acquired WOW Logistics, an integrated supply chain solutions provider, for an undisclosed amount.

A sector banker says transport infrastructure funds will go after infra assets in the “core-plus” sectors—non-traditional, relatively undeveloped yet low-risk markets. Infra funds want to diversify beyond traditional assets such as ports, airport hubs, or toll roads, he adds.

Sweden-based EQT’s purchase last year of Atlanta-based Lazer Logistics, a provider of outsourced yard management services—or monitoring safe, efficient, and low-carbon shipment of goods—and trailer spotting services, with 6,000 fleet assets, is one example. Other specialized trucking assets could also be swallowed up by infra firms, the banker adds.