New entrants could shift car wash M&A back into drive – Dealspeak North America

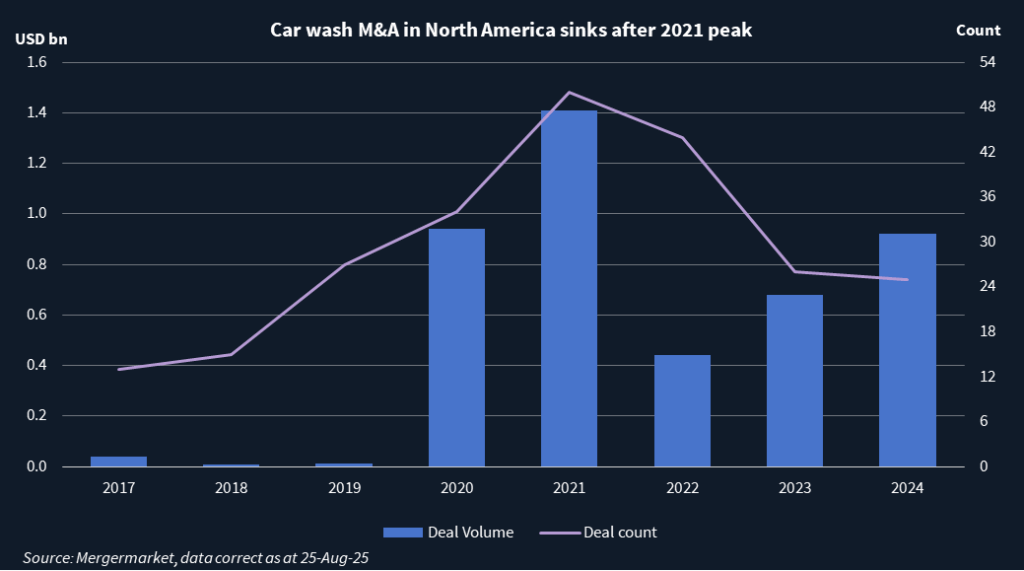

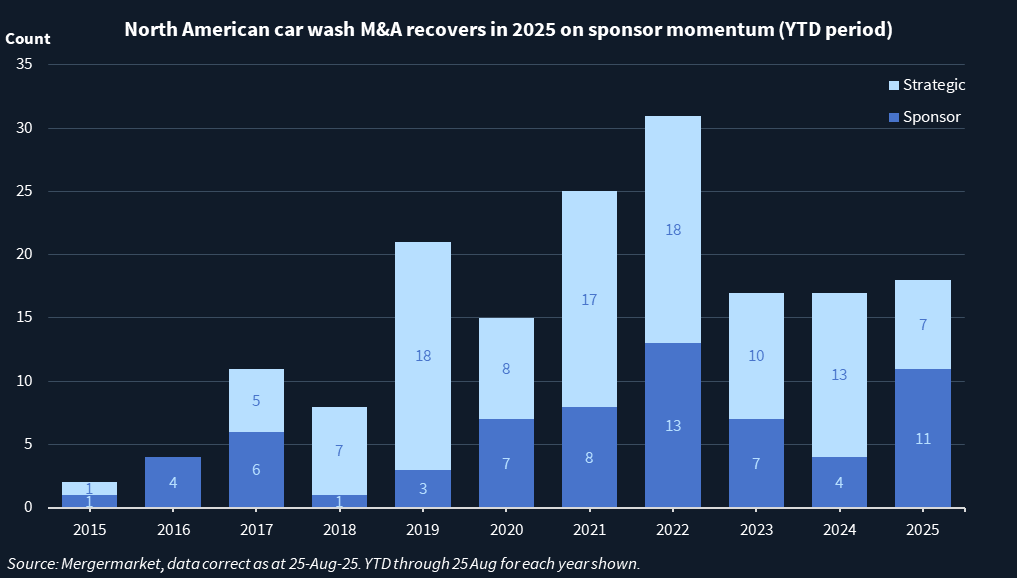

After a prolonged slowdown in car wash M&A, a fresh wave of investor interest is beginning to restore momentum to a sector that had largely stalled.

“I’m cautiously optimistic,” said Justin Hales, a senior banker at Goldman Sachs’ Global Banking and Markets group. “We’ve seen some businesses achieve strong growth over the last few years, and as a result there continues to be interest from those wanting to invest in the sector.”

Goldman Sachs advised on one of the sector’s marquee deals in 2024: KKR’s reported USD 850m investment in Quick Quack Car Wash, which has since expanded from 230 to 286 locations.

Hales said deal conversations are active across the board – from acquisitions and divestitures, to hold periods and the potential for continuation vehicles.

“The industry has evolved over the last few years, and we are starting to see a new reality in the sector,” he said.

Gearing up again

Amplify Capital Group, a boutique M&A advisory firm for the car wash space, is currently marketing five deals worth a collective USD 700m in enterprise value, some of which could close this year, according to Founding Partner Jeff Pavone.

All five gained significant traction in the second half of 2025, after a slow start to the year due to continued high interest rates and initial uncertainty surrounding the Trump administration’s economic policies, he said.

“We were on the sidelines in the first half,” said Pavone. “Now, sponsors have switched course and are coming back. These are quality deals that weren’t getting done a year ago.”

Pavone attributes the resurgence to reopening credit markets and ample dry powder among private equity firms. What’s more, many car owners are signing up for memberships that provide a lucrative and predictable stream of income for operators, proving attractive to investors.

New entrants have provided a boost to a moribund sector, infusing some needed liquidity and optimism. Besides KKR, sponsors such as Oaktree Capital Management, Firmament Group and AEA Investors have made significant moves in the past two years:

- Oaktree took a majority stake in Whistle Express in 2023. Whistle Express then acquired Take 5 Car Wash from Driven Brands in February 2025 for USD 385m. The combined entity now operates 530 locations across 23 states, making it the US’s largest express car wash operator.

- Firmament made a strategic investment in Sparkle Express Car Wash Group in April 2024. The membership-based brand has 19 locations across three states.

- AEA acquired a majority stake in Splash Car Wash from Palladin Consumer Partners for undisclosed terms in April 2025. Splash operates 65 locations across Connecticut, Massachusetts, New York, and Vermont.

Lessons from the last cycle

While most deal values remain undisclosed, sources estimate platforms are paying about 10x-11x EBITDA now, significantly down from the mid-teens to 20x range financial sponsors paid in 2021-22, when many rushed headlong into the sector.

Platforms are now showing “greater sophistication” in taking advantage of the changing dynamics and better values in the market, added Hales.

John Roush, founder and CEO of Express Wash Concepts, a Columbus, Ohio-based operator of more than 122 car washes in six states, said some early post-COVID investors lacked car wash or even retail-sector experience – moves he called “insanity.”

“Everyone operating today has made massive adjustments to their plans,” said Roush. “Don’t buy over-priced car washes, put in true management teams to operate them, and do lots of training, support, and marketing.”

Contrarian view

Not everyone is convinced the sector is on a solid footing. Harry Caruso, founder and CEO of Car Wash Advisory, which does sell-side advisory and capital raising of up to USD 500m for operators, sees no quick-and-easy fix for sponsors that overpaid in the previous cycle.

The typical private equity playbook – buy, cut costs, exit – doesn’t work so well with car washes, which can achieve EBITDA margins of 65% if run independently and properly, he noted.

“There are no synergies in car wash acquisitions,” Caruso said. “In fact, it’s negative beyond the regional basis. The largest costs are labor, water, and electricity – overhead that can’t be taken out.”

Caruso said roughly eight platforms valued at more than USD 750m each have been shopped in the past 12 months, with only one resulting in a transaction – Palladin’s sale of Splash to AEA.

“We’re either going to see continuation vehicles or a massive changing of hands among portfolio companies,” he said. “My prediction is CVs.”

At least six continuation vehicles are currently being discussed by sponsors who bought high and have watched car wash valuations drop, Caruso said. “This is the wrong use of a continuation vehicle – avoiding losses rather than capturing upside.”

Zips Car Wash, one of the country’s largest operators, was placed into a continuation vehicle in May 2022 by its backer, Atlantic Street Capital Management. Three years later, Zips filed for Chapter 11, from which it emerged in May.

Despite the lingering hangover from early-decade exuberance, Pavone remains bullish. “While it’s true that some platforms testing the market have nowhere to go today, there is a shift in mindset to buy-and-build, and worrying about an exit later,” he said. “The new entrants are buying at a discount and at a better entry point.”

Even firms that paid a hefty premium by today’s standards may double down, he added. “They are going to want to get bigger.”