Morning Flash EUR: Carlsberg bid for Britvic proves hard to swallow in Copenhagen

Our analysts pick out hints of future material developments in M&A and ECM situations to produce an exclusive report that offers short and long-term actionable ideas (no investment action should be taken without further investigation). If you have ideas for coverage, please email [email protected]

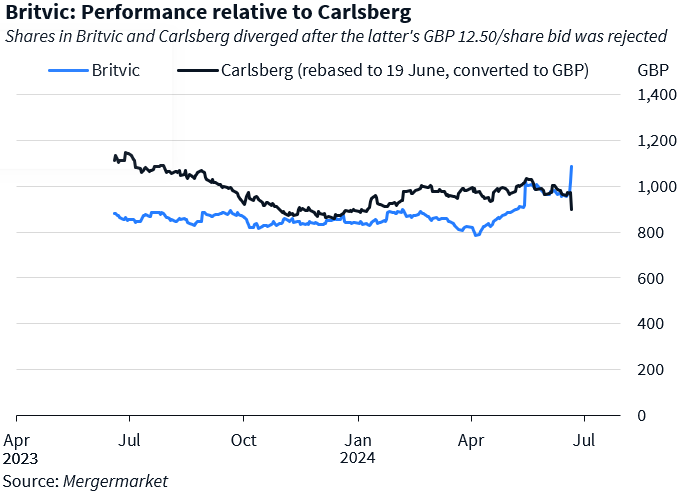

Shares in Carlsberg [CPH:CARL.A/B] sank almost 8% in this morning’s trading session after it said it was mulling an offer for soft drinks producer Britvic [LON:BVIC].

Britvic has already turned down two offers of GBP 12 and GBP 12.50 per share, according to stock exchange filings from the two companies this morning.

But rationale for a big Carlberg offer increase now looks limited, according to analysis by The Morning Flash, and Britvic’s board may need to soften its stance if an agreement is to be reached.

Britvic’s board argued Carlsberg’s latest offer “significantly undervalues” the business but that claim looks like a bit of a stretch to The Morning Flash.

Carlsberg’s latest bid values Britvic at GBP 3.8bn including debt – about 13x EBITDA for the 12 months ending 31 March 2024. It’s a valuation which looks reasonable relative to the trading multiples of London-listed comparables as well as recent precedent deals in Europe.

Peers like Coca-Cola Europacific Partners [LON:CCEP], AG Barr [LON:BAG] and Nichols [LON:NICL] trade at valuations between 10x and 13x EBITDA for the comparable period, according to data provided by Fidessa and compiled by FactSet.

Heineken [AMS:HEIA] agreed a EUR 300m sale of its soft drinks subsidiary Vrumona to Royal Unibrew [CPH:RBREW] at 12x EBITDA last year. Financial sponsor KKR acquired a majority stake in bottler Refresco during 2022 in a transaction which valued the target at around EUR 7bn and also at a 12x EV/EBITDA multiple.

Carlsberg will be wary of increasing its bid too much as a result. Its firepower also looks a little stretched. On the latest, rejected terms, Carlsberg’s pro-forma leverage would rise from 1.5x to above 3x, according to calculations by The Morning Flash.

Shares in Britvic were up around 7% in this morning’s trading session at GBP 10.88, a 15% spread to the rejected offer. Britvic’s board’s argument around undervaluation is supported by the relatively meagre premium on offer. At 29% above the target’s undisturbed price, directors and shareholders would perhaps prefer more to support a deal.

Investors in Britvic include a variety of asset managers including Goldman Sachs, Invesco, NN Group and FMR, according to its latest annual report. Oslo-based hedge fund Incentive AS, headed by investor Svein Høgset, is also on the shareholder register with an investment dating back to at least 2018. Incentive has a 4.9% stake in the target, according to its latest disclosure late last year.

Big share price declines on Carlsberg this morning could indicate that a sizable offer increase is unlikely for now. Britvic’s board may need to soften its stance if a deal is to be agreed.