Midmarket M&A slumps amid Trump policy shifts – Dealspeak North America

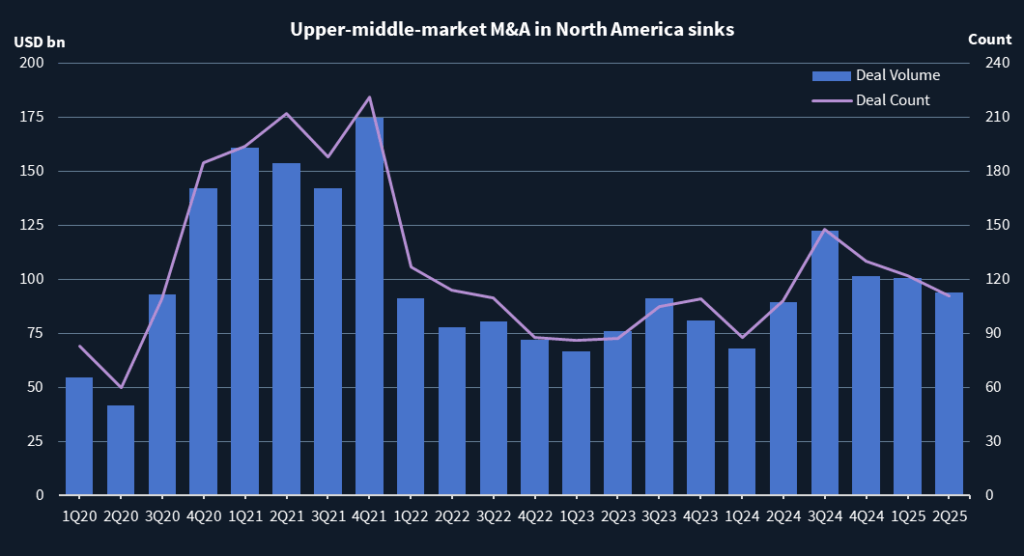

- Upper-middle-market M&A down 25% in 2025

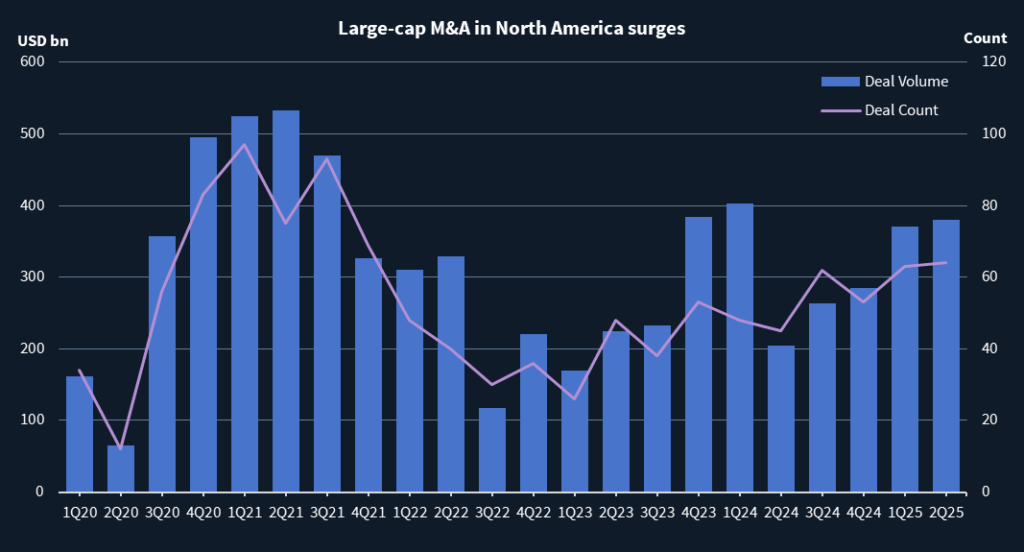

- Large-cap deals surge amid search for growth

- Tax reform, sector tailwinds may revive midmarket

In what has become a tale of two markets, North American M&A is increasingly bifurcated.

Middle market dealmaking has continued to slide in 2025, with participants citing policy uncertainty, tariff exposure, and valuation mismatches as key headwinds. By contrast, large-cap transactions have accelerated, driven by corporates needing growth in a sluggish economy and wanting to future-proof themselves in the face of artificial intelligence.

According to Mergermarket data, upper-middle-market M&A – defined here as deals valued between USD 500m and USD 2bn – has seen the steepest decline. After peaking in 3Q24, both deal count and volume fell roughly 25% over the next three quarters to 111 deals totaling USD 93.8bn in 2Q25.

Source: Mergermarket, data correct as at 02-Sep-2025 (Upper-middle-market M&A = deals valued at USD 500m-USD 2bn)

Outsized impact

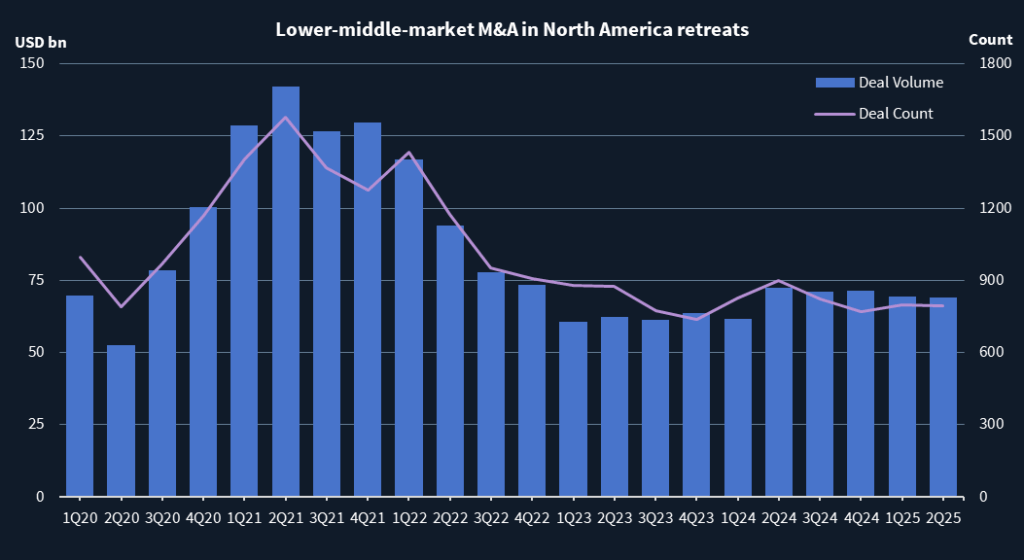

Lower-middle-market activity – defined as deals valued between USD 10m and USD 500m – also retreated, though less sharply, with 793 deals worth USD 69bn in 2Q25, down from 899 deals totaling USD 72.4bn in 2Q24.

Dealmakers point to policy instability as the primary headwind. The delayed passage of the federal budget reconciliation bill – signed into law on 4 July – and a stop-start rollout of retaliatory tariffs have created a challenging environment for mid-sized businesses.

“Middle market businesses have a simpler supply chain, a less diversified customer group, and generally not as robust of a balance sheet,” said Kevin Desai, PwC’s US Deals Leader. “If I’m a middle market business and I put all my manufacturing operations in Mexico or Malaysia, then a country-specific retaliatory tariff is going to have an outsized impact.”

This vulnerability has made investors more cautious. “For PE investors investing into the middle market, the risk profile is probably a little too high to do a deal at the valuations that are still being asked for in the market,” said Desai. “You would have to accept a reduction in value, given the risk profile change in the business.”

The result has been a persistent bid-ask spread, keeping many deals from closing.

Source: Mergermarket, data correct as at 02-Sep-2025 (Lower-middle-market M&A = deals valued at USD 10m-USD 500m)

Go big

By contrast, large-cap M&A – deals valued at USD 2bn or more – has gained momentum, climbing for four consecutive quarters from 45 transactions worth USD 204bn in 2Q24 to 64 deals totaling USD 379.7bn in 2Q25.

Partly that is because multinationals that manufacture in dozens of countries around the globe can better withstand policy shocks given their more diversified supply chains.

But the surge in megadeals also comes from necessity. With GDP growth projected at just 1.4% in 2025 and 1.6% in 2026, according to the Federal Reserve’s June forecast, many large corporates are turning to M&A to meet growth targets and reposition for the AI era.

“A lot of those corporate buyers are in need of some level of growth and business model change,” Desai said. “If you look at a lot of the AI-driven deals, it’s a non-AI business buying an AI business.”

Public market dynamics are also fueling activity.

“If I’m a large public company, to hit my 1Q26 earnings estimates, I have to start acting now,” Desai said. “That is also adding fuel to the M&A fire.”

Source: Mergermarket, data correct as at 02-Sep-2025 (Large-cap M&A = deals valued at USD 2bn+)

Potential thaw

Still, there are signs of a potential thaw in the middle market.

The 2025 budget reconciliation law – also called the “One Big Beautiful Bill” – either extended or made permanent provisions from the 2017 Tax Cuts & Jobs Act, providing clarity and financial flexibility for some sectors.

“The tax bill definitely provided some firepower to certain sectors to go do deals,” Desai noted. “Bonus depreciation, interest deduction cap changes, and R&D expensing – these give a better cashflow profile to businesses.”

The reinstatement of 100% bonus depreciation for equipment, the shift from EBIT to EBITDA for interest deductions, and restoring expensing of domestic research and development (R&D) costs are expected to reduce tax liability and incentivize asset-based acquisitions, according to KPMG.

“If I’m a middle market business, looking to diversify my supply chain, well now I can start building or acquiring assets in other countries and getting some bonus depreciation on it,” added Desai. “It’s provided some flexibility to take different risks.”

Sector-specific tailwinds are also emerging.

The defense sector received funding provisions totaling USD 156.2bn in FY25 for shipbuilding, missile defense, and munitions, among other areas.

Meanwhile, tariff clarity is improving and could reenergize midmarket dealmaking. “If you are not affected by tariffs, you can get busy,” Desai said. “If you are affected in a big way, then you probably have some homework to do – either repivot your supply chain or diversify your customer base, which could be done through M&A.”

For now, the gap between risk and reward is too wide for mid-sized businesses, while large-cap buyers are seizing the day.