Michael Zeuner, Managing Partner at WE Family Offices, on the evolution of private capital allocation

Michael Zeuner, Managing Partner at WE Family Offices, provided valuable insights into the evolving landscape of private capital allocation, emphasizing the importance of understanding family needs, assessing tolerance and capacity, and ensuring alignment of interests with general partners. His expertise and strategic approach offer a comprehensive view of wealth management for ultra-high-net-worth families.

Background of Michael Zeuner

- Career Journey: Michael Zeuner shared his extensive experience in wealth management, starting at Chase Manhattan Bank in the late 90s, transitioning to JP Morgan Chase, and eventually moving into the family office space in the mid-2000s.

- WE Family Offices: Michael leads WE Family Offices alongside two other managing partners, serving around 100 families globally, with a focus on the US, Latin America, and Europe. These families collectively control nearly $20 billion in assets.

Key Topics Discussed

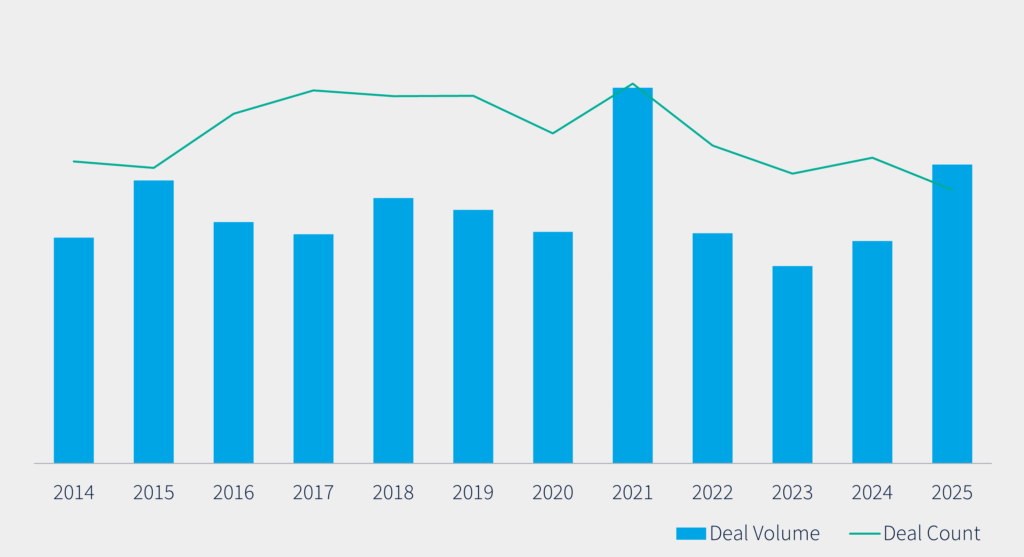

Trends in Private Capital Allocation

- Understanding Family Needs: Michael emphasized the importance of understanding a family’s complete financial picture, including their balance sheet, leverage, cash flow, and investment objectives.

- Tolerance and Capacity: He explained the concepts of tolerance (ability to lock money up for long periods) and capacity (cash flow to fund lifestyle) for private market investing. Families must avoid becoming forced sellers, which can lead to significant losses.

Assessing Tolerance for Private Market Investing

- J Curve Effect: Michael discussed the J Curve effect, where early returns on private market investments are often negative due to fees, requiring investors to have the stomach to ride through initial losses.

- Key Questions: He highlighted the importance of assessing an investor’s tolerance by examining their cash flows and spending plans.

Fee Structures and Market Trends

- Flat Retainer Fee: WE Family Offices charges a flat retainer fee for advice, ensuring alignment with clients’ interests.

- General Partner Fees: Michael noted the ongoing debate about the fees charged by general partners in private equity, emphasizing the need for alignment of interests and the value added by experienced managers.

Role of Wealth Advisors and General Partners

- Portfolio Construction: Michael stressed the importance of diversification and the role of general partners in constructing well-diversified portfolios.

- Alignment of Interests: He outlined the criteria for selecting aligned general partners, including their registration as investment advisors, their own capital in the fund, and the proportion of their compensation from performance fees.

Future of Private Banking and Multifamily Offices

- Private Banking: Michael acknowledged the essential role of private banks in providing financial products and services, while distinguishing their role from that of wealth advisors.

- Growth of Multifamily Offices: He predicted continued growth in the multifamily office space, driven by the need for integration and holistic financial management for ultra-high-net-worth families.

Skills Required for Multifamily Office Advisors

- Technical and Strategic Expertise: Advisors need a combination of technical knowledge and strategic skills to understand the whole financial picture and develop close relationships with families.

- Buying vs. Selling Skills: Michael emphasized the importance of advisors having a buying skill set, focusing on understanding and meeting families’ needs rather than selling financial products.

Investment Outlook and Market Uncertainty

- Diversification: Michael highlighted diversification across asset classes, equity styles, and geographies as a key investment strategy in the face of uncertainty.

- US Role in Global Financial System: He discussed the potential foundational changes in the US’s role in the global financial system, driven by changing trade policies and international relations.

Key timestamps:

00:07 Introduction to the Fireside Chats

01:10 Overview of We Family Offices

02:03 Understanding Private Capital Allocation

04:15 Assessing Tolerance and Capacity for Investment

06:02 Identifying Red Flags in Investor Tolerance

08:22 Fee Structures in Wealth Management

09:51 The Shift Towards Direct Investing

13:10 Evaluating General Partners in Investments

15:01 The Role of Manufacturers vs. Distributors

17:40 The Future of Private Banking

19:17 Growth of Multifamily Offices vs. Single Family Offices

20:11 Integration Needs for Wealthy Families

22:10 Skill Sets Required in Multifamily Offices

24:26 Investment Strategies and Market Outlook

26:59 Uncertainty in the Global Financial System