Medicaid cuts not what the doctor ordered for healthcare M&A – Dealspeak North America

- US healthcare activity stalls to lowest level in a decade

- State-level reimbursement uncertainty complicates dealmaking

- Abound Health and MedSuite among stalled deals

For healthcare dealmakers, the federal One Big Beautiful Bill Act (OBBBA) – which cuts Medicaid payments to states by approximately USD 1tn over 10 years – is anything but beautiful.

The law’s 15% cut to the federal program that provides free or low-cost health coverage has left buyers and sellers uncertain about valuation, stalling transactions for healthcare companies reliant on Medicaid revenue.

“Medicaid exposure has become the single biggest valuation barrier in healthcare M&A this year,” said Henry Criss, CEO of Fraum Health, a Hilton Head, South Carolina-based restorative medicine and wellness-care practice.

Initial offers are now coming in one to two EBITDA turns lower than comparable deals a year ago, and many deals are stalling in diligence or being re-traded late in the process, he said.

“We’re getting bids that are all over the map,” added Dave Opalek, a director with Lawrence, Evans & Co., a healthcare advisory firm focused on the lower middle market. “There are so many variables at play – OBBBA, the government shutdown, global uncertainty – that we’re not entirely sure what everybody’s hot-button issues are now. Some people are just taking a pass.”

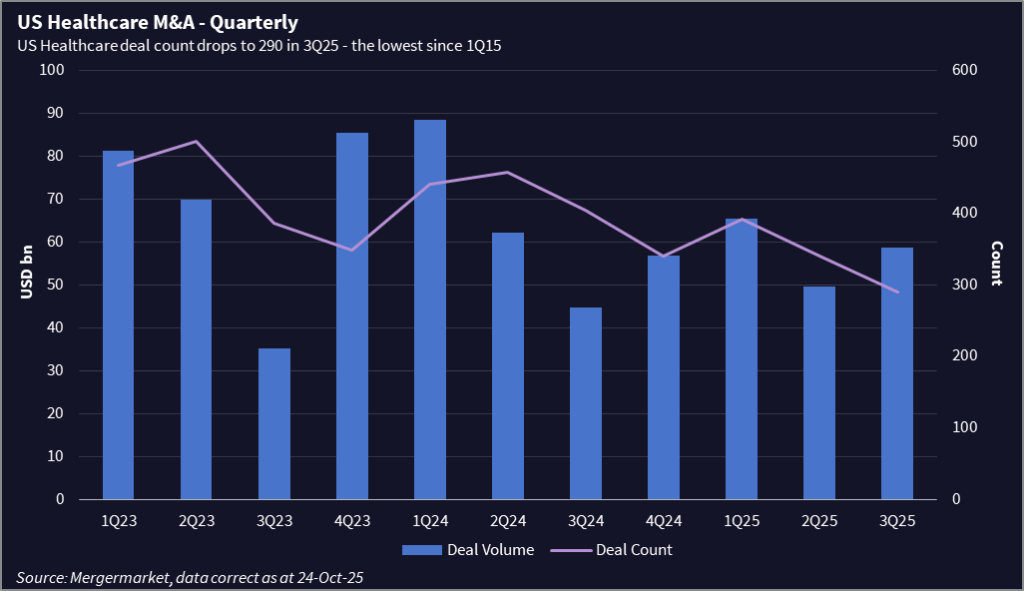

US healthcare M&A activity has declined to the lowest level in more than a decade, even if some mega deals have kept dollar volume reasonably healthy. The number of transactions in 3Q25 fell 28% year over year to 290, the lowest quarterly total since 1Q15, according to Mergermarket data.

Deals on ice

Mergermarket has reported on several stalled processes recently, including those of MedSuite, a Knoxville, Tennessee-based healthcare technology provider, and Charlotte, North Carolina-based Abound Health, a behavioral health provider.

MedSuite’s sale effort via Baird ended in early September after sponsor Greater Sum Ventures paused due to market conditions and policy uncertainty. The HCIT company offers revenue cycle management and electronic medical records (EMR) for Medicaid- and Medicare-funded behavioral health and home health.

Abound, backed by Housatonic Partners, pulled its sale process in September after three rounds of bids amid valuation concerns tied to rate cuts in North Carolina – where Abound has a roughly 60%-70% concentration of business.

Lawrence, Evans & Co is marketing a chronic-care management company with exposure to California, home to 15 million Medicaid enrollees, the most in the nation.

“Many buyers have declined or revised values over concerns about Medi-Cal reimbursements,” said Managing Partner Neil Johnson.

Another headwind in the state is newly enacted regulations targeting private equity and hedge fund investments in healthcare.

“It’s a double whammy some buyers don’t want to deal with,” he said.

Multi-state muddle

Medicaid is a federal-state partnership that gives states broad discretion over how to allocate their federal Medicaid dollars.

In Colorado, for example, the state needed to fill a USD 783m budget hole, of which USD 90m was attributable to federal Medicaid cutbacks. The state imposed 1.6% spending cuts across the board to healthcare providers, then imposed more drastic cuts for outpatient psychotherapy, substance-abuse diagnostics, and pediatric autism services.

Home-care services such as private-duty nursing and unskilled care were spared anything more than the baseline cut, offering a potential safe haven for investors.

Providers are used to multi-state differences, but the OBBBA cuts and its upcoming tightening for Obamacare eligibility “are another level of complication,” said Ryan Thurber, a healthcare regulatory compliance and transactional attorney with Polsinelli.

Many groups are waiting for reimbursement patterns to stabilize, and investors are focusing more on providers that can demonstrate efficiency and measurable quality outcomes.

“This is not a retreat from the Medicaid space,” noted Dr. Amar Rewari, chief of radiation oncology at Luminis Health and a former investment banker.

“The need for these services continues to rise, especially in behavioral health and home healthcare. But until there is clearer alignment between federal guidance and state implementation, deal activity will likely center on smaller partnerships or targeted affiliations rather than large-scale consolidations.”

Winners and losers

The looming Medicaid cuts will push some providers, including health systems providing care for children, to consider M&A to achieve greater scale and offset the major impacts of OBBBA, said Julie Sutherland, a health principal with EY-Parthenon, Ernst & Young LLP.

“If we look at pediatric providers alone, where about 60% of emergency department visits for mental health are covered by Medicaid, we foresee even stronger headwinds for financial viability than what these hospitals face today,” she said.

Despite the turbulence, some are thriving.

“The companies getting traction are the ones that can demonstrate a strong ROI within 12 months,” said Steven Collens, CEO of the Chicago-based health technology incubator Matter. Conversely, “those without a track record, customers, or strong ROI data face steep challenges,” he said.

Phil Kim, healthcare partner at Jackson Walker, LLP, said the Medicaid turmoil has presented strategic opportunities for well-prepared buyers and sellers.

He recently advised a mid-sized healthcare provider with significant Medicaid revenue to recalibrate its valuation model using forward-looking reimbursement trends and operational efficiencies, enabling a successful exit. “Companies hesitant to move forward risk missing a narrowing window to capitalize on market adjustments,” Kim said.