Market stumbles create new obstacles for issuers eyeing December window – ECM Pulse North America

- Investors evaluating stocks carefully amidst volatility

- Collapse in risk appetite began weeks ago, deepens

- Issuers start to push back listing timelines into 2026

The government shutdown has ended, the SEC is clearing filings again, and the IPO window is technically open. Yet, the government’s reopening has collided with a burst of volatility that has reshaped the way issuers and investors are thinking about the rest of the year.

The market spent much of the past week reacting to sharp swings in tech and artificial intelligence-linked equities, a delayed jobs report, and a collapse in risk appetite that began weeks ago and left many companies reconsidering their December plans.

The shock came immediately after Nvidia’s results. The company delivered strong earnings and raised guidance, but after an initial rally, sentiment reversed hours later. The Nasdaq moved from a near 3% intra-day gain to a steep late-session decline, and selling spread across crypto and other growth sectors.

The rollercoaster move set the tone for the week, with several AI-adjacent stocks falling sharply, and investors struggling to discern between fundamental strength and overvalued hype.

The return of economic data did not help. The September jobs report beat expectations on headline payrolls but showed a higher unemployment rate, which only added to the uncertainty around whether the Federal Reserve will lower interest rates at its next meeting.

This backdrop has left bankers and issuers navigating an uncomfortable contradiction: the market is open, but fraught with worry.

William Blair’s managing director Dan Polsky said November has been “choppier than September and October,” adding that volatility has forced investors to evaluate each company more carefully. The pick-up in volatility has pushed investors to focus more on protecting their books, which has influenced how they evaluate new issuance.

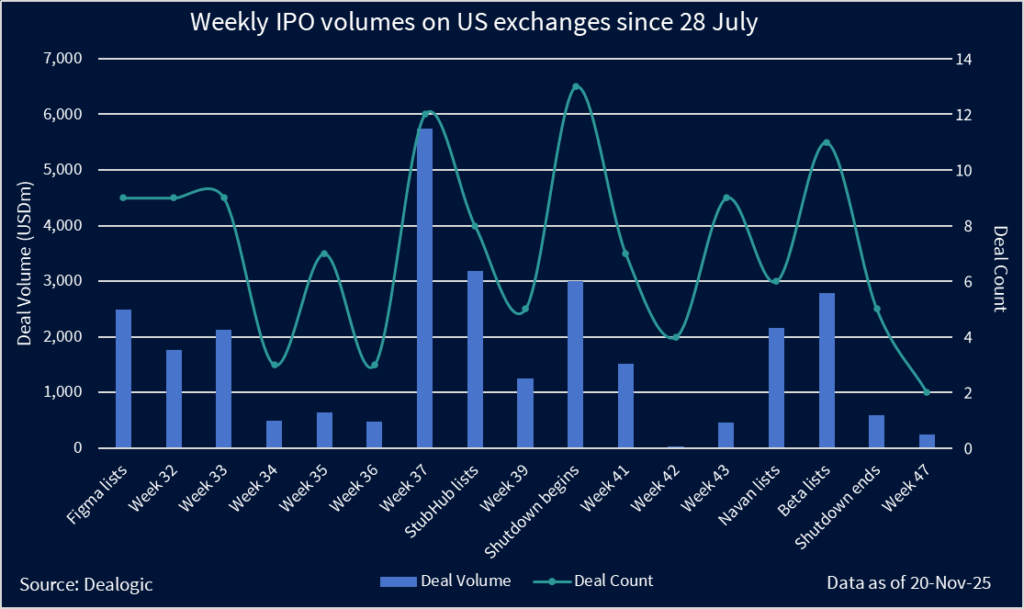

According to Dealogic, November opened with six IPOs raising about USD 2.16bn, followed by a brief pick-up to 11 deals totaling roughly USD 2.79bn once the shutdown ended. Activity then faded quickly. Week 46 produced five deals raising about USD 584m, and the following week saw only two deals raising about USD 253m. The pattern suggests a short burst of post-shutdown enthusiasm followed by a decisive pullback as volatility rose.

The calendar now forces issuers into a narrow corner. Companies targeting the first week of December need to have their S-1s and F-1s publicly filed by now. The following week provides another window, but offers weaker participation, as institutional attention shifts to the holidays and year-end. Only issuers already on file have genuine flexibility, and most are reluctant to trade unless conditions stabilize. Some will wait it out until next year.

William Blair’s Polsky said growth-oriented long-only investors who analyze individual companies “will remain engaged regardless of December versus January,” while investors who treat IPOs as an asset class “may sit out.”

He added that November’s volatility has made conversations more cautious, even though “there remains constructive investor sentiment across many sectors.”

Other bankers are seeing similar behavior. A senior equity capital markets banker in San Francisco said issuers face a difficult combination of holiday timing and risk-off sentiment. He said dealmakers are facing the reality that late-year IPOs will be hard to execute, even though several companies still want to move.

Another banker in New York who advises technology IPOs observed how damaging the recent trading sessions have been to sentiment. A few of his clients have already decided to pause their listings, he said, adding that there is not much time left for new launches in the embattled tech sector anyway.

These elements have pushed some issuers to consider early 2026 instead of forcing a December listing that risks low engagement and high flip potential. Companies that wait too long may need to update their financials or adjust their equity story, which creates additional work, but also offers the benefit of launching into a cleaner market.

The SEC’s return to work has restored the mechanics of the IPO process, but the decision to launch remains defined by sentiment rather than procedure. Investors are active, though more deliberate, and volatility has raised the threshold for new issuance.

Polsky said the market still supports high-quality issuers, but he noted that investors are approaching each deal with greater scrutiny. He added that long-only interest remains intact, even as momentum capital steps back.

With several companies publicly on file, the next two weeks will capture how much of the pipeline chooses to engage during the narrow December window and how much shifts into next year. The market may be functional again, but it is not yet comfortable.

As one of the bankers put it: “A lot of stocks are getting absolutely smoked,” and that alone is enough to make issuers reconsider what is possible before the year closes.