Market for Brazilian renewable power assets becomes selective amid generation cuts

The market for renewable power assets in Brazil has turned more selective amid growing mandatory cuts in wind and solar generation, said a financial advisor and an industry executive.

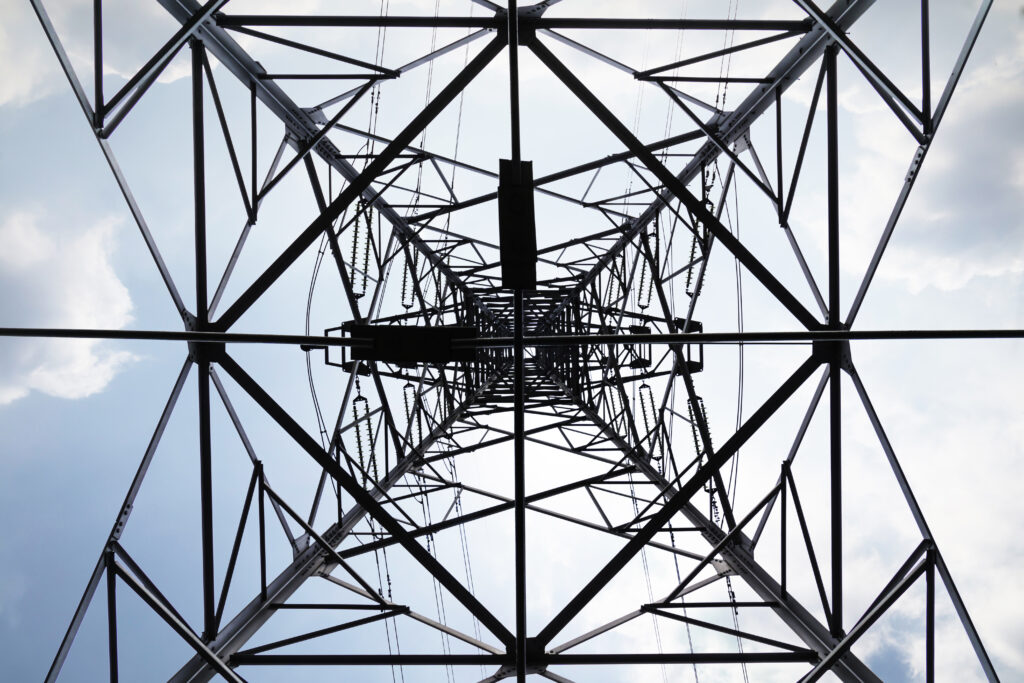

Brazil’s electricity grid operator ONS has had to increasingly mandate reductions or halts in electricity generation to maintain system stability as the country lacks infrastructure to absorb peaks of supply caused by solar and wind power. Investment in system infrastructure has not kept pace with the increasing renewable power capacity, which has been boosted by subsidies and the gradual opening of the deregulated market to new entrants.

There is greater caution in the market, but there is also a search for slightly more sophisticated models, protection, and risk management, said Marcelo Maitelli, M&A director at Grupo Ludfor, a Bento Gonçalves, Rio Grande do Sul-based energy management and solutions company. This is leading to asset price declines, a trend towards more realistic and selective valuations for these assets, the executive said. “The market will no longer reward growth at any cost,” he added.

The escalation of curtailment levels in the national grid has made it very difficult to make investments in greenfield power projects, including M&A, said Eduardo Tobias Ruiz, managing partner at São Paulo-based financial advisory firm Watt Capital. This leads capitalized players to focus on acquiring operational assets or greenfield projects associated with assets already in operation such as solar and wind plants, he added. “Whenever greenfield investment — and M&A of these projects — becomes less attractive, M&A of operating assets picks up,” Ruiz said.

Curtailment directly impacts generation predictability and contract reliability, Maitelli said. “It has become clear to us that we must consider curtailment when pricing assets,” Maitelli said. It reinforces the importance of not only looking at the asset, but also at tests with peak levels, he added. Ludfor is currently looking for acquisitions, as reported.

At the same time, these losses have pressured players with high exposure to curtailment to sell operational assets urgently to raise cash, Ruiz said. “Those with greater exposure to wind and solar centralized generation are experiencing significant financial difficulties,” Ruiz said. “Unless a less burdensome solution is found for generators regarding the financial consequences of curtailment, these players will gradually move toward bankruptcy protection,” he added.

“Naturally, this creates opportunities to buy distressed assets at discounted prices,” Ruiz said. Diversified companies investing in different generation sources, transmission, or distribution have more resilience to withstand curtailment losses, he added.

Interest in well-positioned assets remains high, Maitelli said. “For instance, a well-located photovoltaic plant with a stable connection has much more value than an asset that is theoretically cheaper but subject to grid constraints,” the executive noted.

Furthermore, from the buyers’ perspective, high interest rates mean lower valuations and potential upside for the acquired asset in the future, when interest rates fall, Ruiz said. Brazil’s interbank interest rate is currently at 14.90% per year.

Ongoing opportunities in the space include EDF, which reportedly tapped BofA to sell 50% of its Brazil renewables unit.

Raízen, the renewable energy company owned by Cosan and Shell, has been selling power assets as part of a larger asset sale program, as reported.

Rio Alto Energias Renováveis, a large debt-ridden solar generator, is reportedly seeking a new partner after IG4 desisted from investing in the company.

Compensation

ONS curtailment grew 230% in January to August this year compared to the same period of 2024, according to a press report citing a study by Volt Robotics, a São Paulo-based business consultancy. The cuts corresponded to 17% of Brazil’s wind and solar power capacity in the period, or 3,256 MW average, leading to potential losses of BRL 3.2bn (USD 600m) for generators in this period only, the report said.

Affected generators, which seek compensation for the losses, blame Brazil’s lack of infrastructure to absorb renewable power peaks.

While promising compensation when it is due, the government claims that most of the curtailment corresponds to a lack of demand, which was poorly calculated by the companies themselves.

While centralized generators have been curtailed, distributed generation has so far remained relatively protected. Regulator Aneel is now mulling submitting large distributed generation plants to curtailment without affecting micro and mini distributed generation (MMGD) systems.

Curtailment also has an impact on self-generation, said Juliana Melcop, a lawyer at São Paulo-based Veirano. Generators required to supply energy to their self-generator partners are worried about who should bear the costs of curtailment, she said. “Generators try to pass on [costs] to consumers, [while] consumers try to pass [costs] back to generators,” Melcop said.

As reported, companies have flocked to close self-generation partnerships as the government tried to remove exemptions from the modality through a provisional measure 1,300/2025.

Earlier this year, the government sent provisional measures 1,300/2025 and 1,304/2025 to Congress seeking to mitigate several problems in the electricity sector, including curtailment and the exemption of sector fees for self-generation. Pressed by the proximity to Brazil’s 2026 general election, however, Congress stripped PM 1,300 of controversial matters and passed it basically to extend gratuity of electricity for low-income families consuming up to 80kWh, which was adopted in mid-2025.