Year of the Megadeals – M&A Highlights FY25

A surge in megadeals since the summer has renewed optimism among dealmakers that mid-market activity will follow, setting the stage for a stronger 2026.

After-deal momentum stalled earlier in the year amid post-Liberation Day uncertainty, the second half of 2025 saw strategics and private equity firms make bold moves to position themselves for the future.

Expectations of a lighter-touch regulatory environment, alongside inflationary pressures and a fast-evolving industrial landscape, spurred large-cap corporates and sponsors to place long-term bets on assets with thematic resilience.

This trend led to a wave of record-breaking deals, including Paramount’s largest all-cash bid to date and the largest leveraged buyout on record for Electronic Arts.

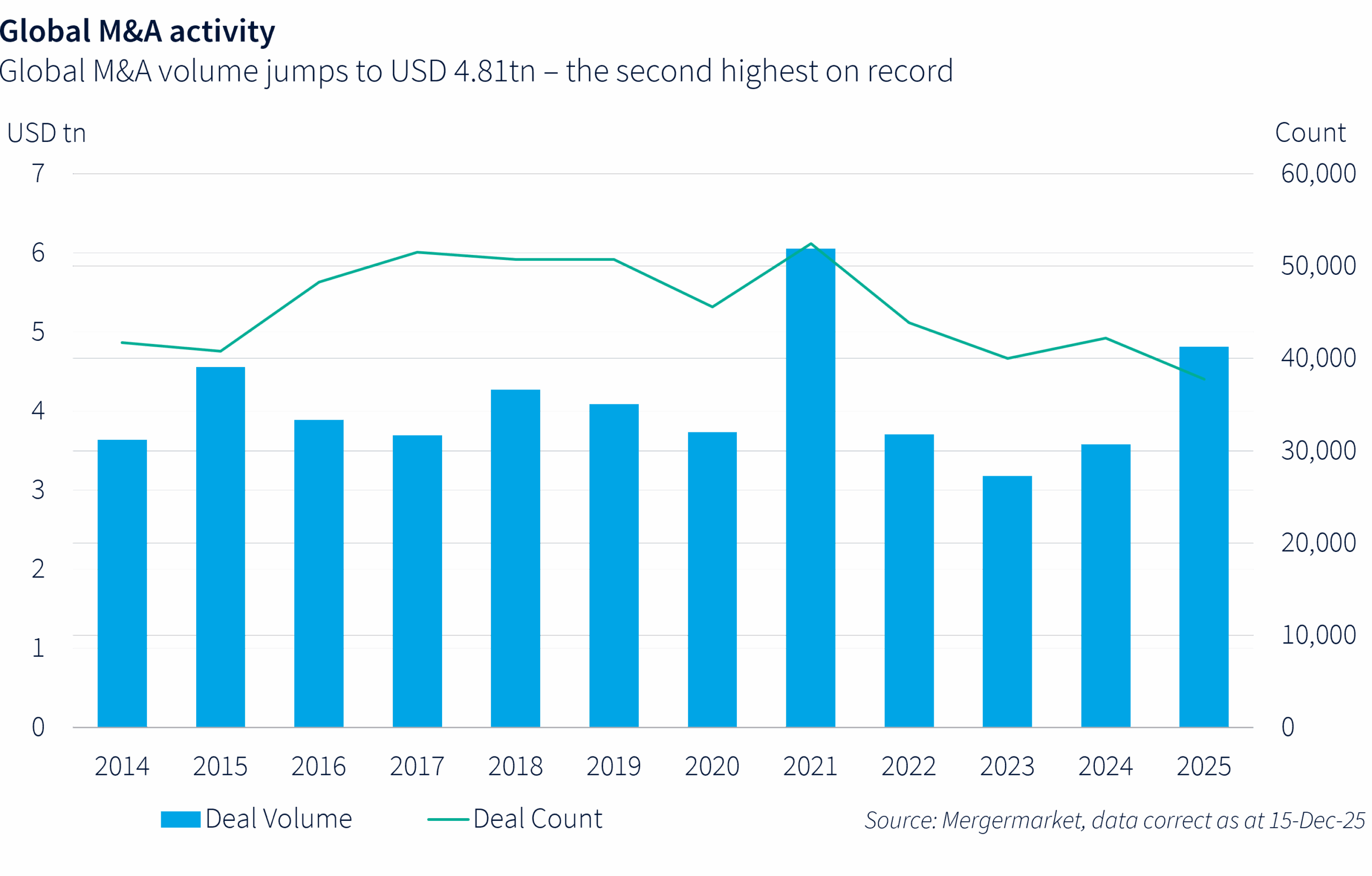

As a result, global M&A jumped 41% year-over-year to USD 4.81tn in 2025, the second-highest total on record after 2021. A record 70 megadeals, each valued at more than USD 10bn, drove the rebound and contributed USD 1.53tn, while a further 367 transactions in the USD 2bn–10bn range added another USD 1.46tn.