Linquest, Precision Aviation, Novaria among early-stage exit candidates – LTE Charts of the Week

LTE Charts of the Week showcase the power of Mergermarket’s Likely to Exit (LTE) predictive analytics engine. Find more financial sponsor exit opportunities by activating a two-week trial to Mergermarket or log in if you are a subscriber.

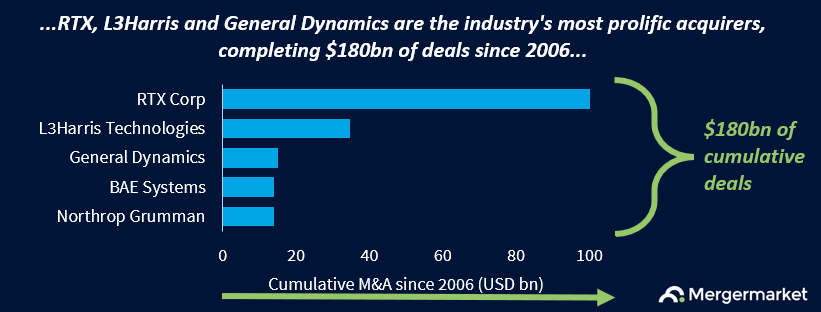

- RTX Corp, L3Harris, General Dynamics among sector’s most prolific acquirers

- Top five sector names have completed USD 181bn of deals since 2006, 49% of total

- Aerospace and defense M&A up 17% in 2023 with strong start to 2024

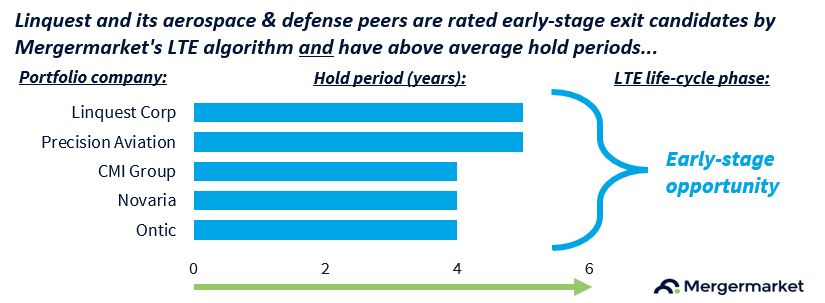

Linquest, Precision Aviation and Novaria are among a host of financial sponsor-backed exit opportunities in a buoyant market for aerospace and defense M&A in North America, according to Mergermarket’s Likely to Exit (LTE) algorithm.

The three names are not yet known to be involved in a sales process, and have Likely to Exit (LTE) Scores in the 20 to 30 range, indicating they are earlier-stage deal candidates. They also have holding periods which are longer than the model’s median exit benchmark of three years and 10 months, according to Mergermarket data, potentially placing them in the sweet-spot for a deal.

Linquest, a Los Angeles-based space systems technology provider, falls into the earlier-stage LTE Score bucket, with a score of 20. Owned by financial sponsors Madison Dearborn and CoVant, it was acquired in 2018 for around USD 165m, this news service reported at the time. Linquest could be an attractive target for large defense contractor peers, sector advisors told this news service in 2021.

Precision Aviation, an aircraft parts and maintenance, repair and overhaul (MRO) operation, could also be in the exit sweet-spot, according to Mergermarket’s predictive model. Atlanta-headquartered Precision Aviation was acquired by GenNx360 Capital Partners for roughly USD 140m during 2018.

A sale of the business was explored late in 2021 off marketed EBITDA of USD 30m to USD 40m, this news service reported at the time, but no deal was agreed. GenNx360 put the business into a continuation fund last year and agreed to a USD 400m deal with Neuberger Berman and Blackstone Strategic Partners to provide committed capital for growth and M&A.

Fort Worth, Texas-based precision components producer Novaria was acquired by KKR for an estimated USD 600m in 2019, this news service reported at the time, and is another earlier stage exit candidate. It has completed a string of acquisitions under KKR’s ownership, the latest of which was the purchase of aerospace hardware provider Anillo Industries for an undisclosed sum last month.

All three companies’ backers have an opportunity to take advantage of improving M&A sentiment around the aerospace and defense sector.

Leading acquirers in the sector include industry heavyweights RTX Corp [NYSE:RTX], L3Harris [NYSE:LHX] and General Dynamics [NYSE:GD]. The sector’s top five names accounted for USD 180bn of M&A in North America since 2006, almost half of all sector deal value, according to Mergermarket deals data.

Aerospace and defense M&A increased 17% to USD 17bn in 2023. Sector dealmaking is off to a quick start in 2024, too, with USD 2.3bn deals announced through 4 March, up sharply from USD 347m in the same period a year earlier.

Mergermarket has reported on a number of aerospace and defense processes in the past month. These include Moeller Aerospace, GS Precision, Powerhouse Engine Services, AllClear Aerospace, Farsound Aviation, Parker Meggitt Composites and Applied Composites.

LTE Scores are generated using a machine-learning algorithm developed by ION Analytics data scientists, engineers, and journalists leveraging 20+ inputs from more than a decade of proprietary Dealogic deal data and M&A intelligence. Find out more about the score’s predictive capabilities in Mergermarket‘s LTE Predictive Scoring Whitepaper.

Note: Data correct as of 6 March 2024

Source: Mergermarket.ionanalytics.com