LGT Capital Partners eyes Asia PE secondaries, leans into China

LGT Capital Partners is leaning into China. This means continued support for top-performing local managers when they return to market with new funds. It also means more secondaries.

“We see particularly attractive opportunities in China, with valuations at levels not seen since the global financial crisis and high-quality assets available at discounts,” Doug Coulter, a Hong Kong-based partner at LGT, said of secondaries. “We are well-positioned to invest in Asia, including China, which is a contrarian view in 2025.”

LGT has disclosed its involvement in one deal in 2025 to date: it was one of two anchor investors in a USD 500m continuation vehicle (CV) comprising assets drawn from several China funds managed by IDG Capital. In the first five months of the year alone, the firm claims to have priced several dozen Asian secondaries with an average discount of 65% to net asset value (NAV). About half were below this level – most of them in China.

Without commenting on specific deals, Coulter noted that LGT Capital Partners is assessing both GP-led and LP-led opportunities in China, where pricing in the current market can be at 50% to 80% below NAV. He emphasised that while pricing is an important factor, the firm’s primary focus is on the quality of the underlying assets and the manager, whether evaluating secondary opportunities in China or across Asia.

Asset quality is viewed, in part, through an ease-of-exit lens: Portfolios should include one or two assets on track for listing or even liquid post-IPO positions. Manager quality goes hand-in-hand with alignment of interest: GPs are expected to roll all carried interest from the selling fund into the CV.

“We have participated in transactions priced at par when there was strong conviction from the manager, clear alignment in terms of GP commitment and a clear path to liquidity,” Coulter explained. “We value situations where teams demonstrate meaningful commitment and where risk can be managed quickly and effectively.”

Evolving portfolio

LGT’s 2007-vintage debut fund in the Crown Asia-Pacific Private Equity series was 80% primary fund commitments and 20% secondaries and co-investment. Fund V, which closed on USD 1.65bn in 2022, was an even split, and this is expected to remain the case going forward. LGT is said to be in the market with Fund VI, targeting USD 1.25bn. Coulter declined to comment on fundraising.

“We aim to be a long-term solutions partner to GPs,” he said. “Providing primary capital and wearing an LP hat remains our core business and ensures continued access to high-quality direct deal flow. While we typically allocate around half of our capital to primaries, the remainder is invested in secondaries and co-investments. This balanced approach reflects how the private equity market has evolved.”

The median size of funds backed by LGT under the flagship Asia strategy since 2020 is USD 550m, and 90% of funds are USD 2bn or smaller. Individual commitments vary in size because the firm may draw on other pools of capital. These include the Princely Portfolio – a nod to LGT’s owner, the Princely Family of Liechtenstein – which also allocates to larger funds. Co-investments are in the USD 10m-USD 200m range.

Across this matrix of primaries, secondaries and co-investment, the goal is to be equally weighted between Asia’s four major markets: Australia, China, India, and Japan. Some tweaking at the margins means South Korea and Southeast Asia can be included as well.

This reflects a new normal characterised by weak sentiment on China and a consequent reluctance among Chinese managers to launch new funds. In times past, the country accounted for 40%.

On a global basis, LGT’s portfolio is approximately 15% Asia, and there’s a long-held ambition – it may play out across three or four fund cycles – to increase this percentage. Rising secondaries deal flow could speed up this journey.

Many Western LPs are wary of exceeding single-digit exposure to the region, even at a time when US-heavy portfolios are being reconsidered. Coulter recognises that Europe is favoured right now for reasons of familiarity and strong fund performance in the small to mid-cap space. However, the rationale for avoiding Asia defies macroeconomic logic and the fundamental need for diversification.

“Choosing not to invest in Asia because of a reduced appetite for China is not a sustainable strategy. Even if investors limit their direct exposure to China, it will continue to be the world’s second-largest economy and a leader in many sectors of the global economy,” he said.

“Many investors have a large concentration in the US, but market dynamics evolve – Asia continues to offer diversification benefits within global private equity portfolios. And this regional diversification remains essential.”

Parsing performance

Recent performance doesn’t help. LPs had grown accustomed to an annual cash flow yield of 25% from top performers in their global private equity portfolios; capital came back within four years, roughly synchronising with fundraising cycles. With yields falling substantially, less capital is returned across that same stretch, so there is a natural reluctance to re-up at the same quantum as before.

Asia is widely perceived as the worst offender, with limited distributions to show for years of valuation markups. That said, LGT has seen a sharp increase in capital yield from its Asian portfolio in 2025. The gap between top-quartile managers and the rest remains wider than in other markets – underlining the importance of accessing likely outperformers – but the region is moving in the right direction.

While increased IPO activity in Shanghai, Hong Kong, and India is a contributing factor, it only represents a small portion of the exit market. LGT is also encouraged by the growth in sponsor-to-sponsor transactions as assets move up the size spectrum.

“This development reflects a maturing ecosystem. Similar trends have supported the evolution of private equity in the US and Europe, and we expect to see more of that in Asia,” Coulter said.

If this offers a snapshot of the future, feeding into the broader shift in mindset from growth to buyout, then, in other respects, Asia is revisiting the past. Coulter believes the industry is dialling back to circa 2005 in terms of expectations and allocations – but with a thinned-out manager set comprising those with track records, more institutionalised setups, and an understanding of previous missteps.

Investors pivoted towards Asia following the global financial crisis, seeking growth and assuming China’s economic ascent would translate into strong returns. Between 2010 and 2020, 28% of all capital raised for Asia strategies went to China-focused managers, according to AVCJ Research. If renminbi-denominated funds are included, this share rises to 59%.

“In 2019, about one-third of global private equity capital raised was allocated to Asia, with China also emerging as the largest venture capital market. The pace of deployment was too fast, from single-digit percentages 15 years earlier. This inevitably weighed on returns,” said Coulter.

“The key issue was that returns were never available at scale, as many investors were used to in the US market. Of course, some managers and deals performed spectacularly well, but a more gradual approach to building exposure would have produced stronger results.”

Doubling down

The best reference point for this reset is arguably India, where a surge in investment between 2006 and 2008 was followed by four years of limited exit activity. LPs quickly became reluctant to re-up, resulting in a significant slowdown in fundraising, a reduction in the number of GPs, and a re-examination of best practices in areas such as valuations, operational improvement, and the pursuit of liquidity.

LGT reduced its exposure to local managers by number, but doubled down on the relationships it retained. In recent years, that market has become a regional leader in terms of exits. The firm is now doing the same in China, reasoning that GPs with strong track records can flourish in an environment characterised by strategic discipline, smaller funds, realistic valuations, and limited competition.

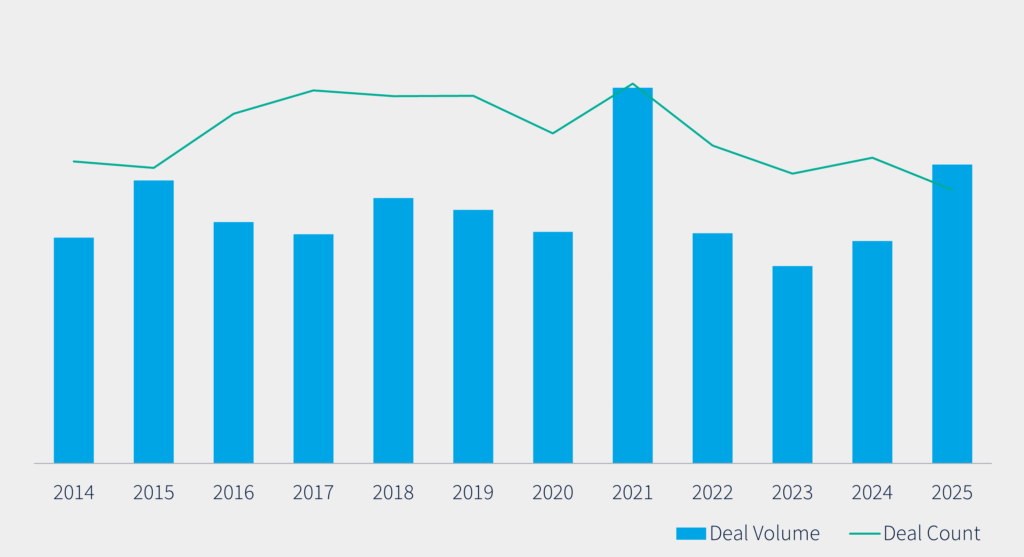

Private equity and venture capital fundraising has dropped off substantially in the last three years, and not just in China. Allocations to Asia-based funds, excluding the renminbi space, reached USD 60.1bn in 2024, less than half the 2022 total. Less than USD 50bn has been raised in 2025 to date, and two pan-regional funds account for about 40% of that.

Coulter acknowledges that conditions are challenging for less proven managers. While LGT can back first-time funds, it generally wants to see some kind of track record and teams that put meaningful personal capital into the GP commitment. “We meet with many emerging managers, but our due diligence process is rigorous, and the bar remains very high for a new team,” he said.

As to ecosystem risks, excessive optimism in Japan and India is top of mind. In India, for example, there is concern that managers are preoccupied with new investments and fundraising, and perhaps less focused on realisations despite plentiful liquidity. However, looking at Asia broadly, Coulter’s positive outlook is reinforced by capital withdrawing at a time when he sees continued opportunity.

“Investor behaviour in Asia has historically been procyclical. In 2021, capital flowed into the region rapidly, particularly in China, and those vintages will likely underperform,” he said.

“Now the market has shifted, with investors scaling back activity and closing Asian offices. Ironically, this period of restraint could create attractive entry points and very strong vintages for Asian private equity.”