K-Drama – South Korea’s TV and movie studios see green light for deals

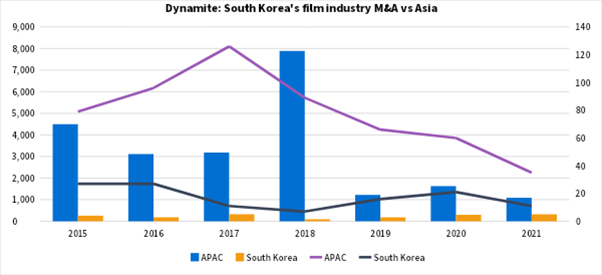

Similarly, mergers and acquisitions in the country’s film industry have been on an upward trajectory since 2018. So far this year, South Korea’s film industry has undertaken 11 deals worth USD 324m, surpassing last year’s 21 deals worth USD 300m by deal value. The country’s share of Asia Pacific’s film industry M&A has also been on the rise. Year to date, it accounts for 29% of the region’s USD 1.12bn in M&A across 36 transactions. China remains at No. 1 with 11 deals worth USD 373m, followed by Japan (USD 306m; 9 deals), Singapore (USD 50m; 1 deal) and Hong Kong (USD 34m; 3 deals).

In South Korea, more than 600 small-sized independent studios exist, such as Squid Game’s producer Siren Picture, in addition to units of large media or artist management groups.

Setting the M&A Scene

As the popularity of traditional TV wanes, the rise of over-the-top (OTT) streaming platforms has driven much of the growth capital raises and M&A. JTBC Studios, which raised KRW 400bn (USD 366m) last December, has made a string of acquisitions in the last year. Domestically, the producer of popular Korean TV series “SKY Castle” and “Itaewon Class” has acquired Anthology Studio, plus stakes in OTT streaming platform Tving, online content creator Contents Zisum and Climax Studio. In May it went international, buying 80% of Los Angeles-based Wiip, the TV studio behind HBO’s “Mare of Eastown”.

The country’s largest mobile messenger Kakao [KRX: 035720] – flagged as an eager buyer earlier this year – was among 2021’s leading investors in the entertainment industry. It acquired YouTube content creator 3Y Company for KRW 18bn in August and movie film producer Zip Cinema for KRW 17.99bn in September.

Crossover talent

In South Korea’s largest film sector deal this year, game developer Com2Us [KOSDAQ: 078340] paid USD 138m for a 38.11% stake in Wysiwyg Studio [KOSDAQ: 299900], the South Korean visual effects company that produced Netflix space blockbuster “Space Sweepers” starring Song Joong-ki.

CJ ENM’s [KOSDAQ: 035760] subsidiary Studio Dragon [KOSDAQ: 25340], producer of “Hometown Cha Cha Cha” and “Sweet Home”, paused deal activity this year. But it had already expanded through M&A since its IPO In 2017, tripling its valuation to USD 2.4bn. A year ago, it entered an equity swap with South Korea’s largest internet portal Naver [KRX: 035420], which included sharing intellectual property on entertainment content, including webtoons. CJ ENM is expected to do more deals, having held talks about acquiring a controlling stake in SM Entertainment [KOSDAQ:041510], one of South Korea's leading artist agencies.

The country that gifted the world K-pop hits like BTS’s Dynamite is now bestowing another: film and television production. That is making several across the media universe jockey for position in true Gangnam Style.

[widget id="11238" widget_title="South Korea’s top five film sector acquisitions (2015 – 2021 YTD)"]