It’s in the game: How a USD 55bn power play may trigger more M&A

-

Private equity now driving gaming deals, with 85% of this year’s total

-

EA buyout highlights IP value, gaming-Hollywood convergence

-

Opportunities emerge in lower middle market, periphery assets

When the sale of video game publisher Electronic Arts was announced two weeks ago, jaws dropped across the gaming and finance worlds.

The USD 55bn deal – led by Saudi Arabia’s Public Investment Fund (PIF) alongside Silver Lake and Affinity Partners, the Miami-based firm founded by Jared Kushner – is the largest leveraged buyout in history.

It also raised a question echoing through boardrooms from Los Angeles to London: Is this the dawn of a new wave of gaming M&A, or a one-off geopolitical statement?

For some, the answer is clear. “This feels like an outlier – a one-off,” said Todd Holman, a managing director at Union Square Advisors.

The deal announcement is surprising and atypical, he said, especially given the involvement of a sovereign wealth fund and Kushner, the son-in-law of US President Donald Trump.

Holman likened the move to the Saudis’ creation of LIV Golf – a bid for influence rather than a purely commercial play – and contrasted it with Microsoft’s 2023 acquisition of Activision Blizzard, which had clear strategic logic around cloud and subscription services.

The EA deal, he said, feels more like a “trophy asset.”

Matthew Doull, senior managing director of technology investment banking at B. Riley Securities, has advised gaming companies for nearly 15 years. He sees the EA transaction as an extension of Saudi Arabia’s broader push into entertainment and digital media.

“It reminds me of the Scopely transaction Savvy did in 2023,” he said, referring to Savvy Games’ – wholly owned by PIF – purchase of Los Angeles-based mobile studio Scopely for USD 4.9bn. “At that time, everyone thought the valuation was way above market. Looking at EA, it’s hard not to see this as all about Saudi strategic interests. The financial rationale is tougher to pin down – they’re paying a very full price.”

Savvy’s Scopely deal ultimately paid off when Monopoly Go became a global hit, Doull noted. “Maybe the same could happen here – say, if Battlefield 6 wildly exceeds expectations.”

Sports franchises, he added, have strong long-term tailwinds, and EA’s focus on sports gaming such as Madden and EA Sports FC (formerly FIFA) aligns with the Saudis’ other investments.

The acquisition puts PIF in the same league as Microsoft and Tencent – two of gaming’s global superpowers. “They’ve put themselves in rare company,” said Doull. “Given the Crown Prince’s well-known affinity for gaming, it’s consistent with his interests.”

Private equity enters the chat

While private equity has shown interest in gaming before, EA’s sale marks a turning point.

The landmark deal has tilted the M&A scales from strategics to sponsors.

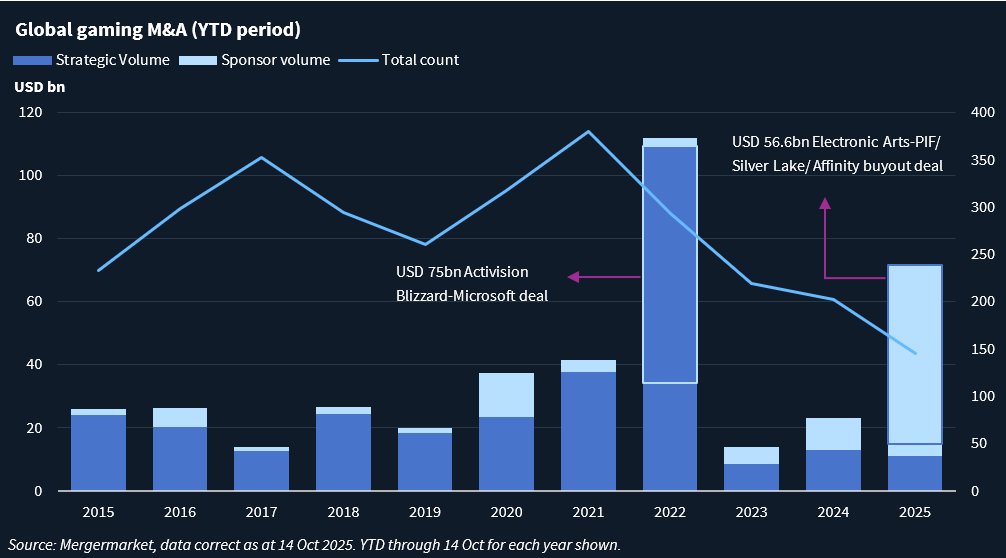

Globally, gaming M&A has reached USD 71.5bn in 2025, with sponsors accounting for roughly 85% of that total, according to Mergermarket data. This is the first year in the past decade in which private equity globally has driven more gaming M&A than strategics.

In addition to Silver Lake and Affinity Partners, firms such as Aleph, Altor Equity, CVC Capital, Emona Capital, EQT, Haveli, and Providence Equity have been active across the sector.

Corporate consolidators include Microsoft, Sony, Tencent, Alphabet, EA, and Saudi-backed Savvy Games.

Year-to-date volume in gaming M&A is second only to 2022, when Microsoft announced its USD 75bn Activision Blizzard deal.

But deal count has dropped sharply from 2021’s pandemic-driven peak.

Globally, just 146 deals have been announced this year – down 25% from last year and more than 60% from the same period in 2021. North America saw the steepest decline, with only 32 deals, half of last year’s total at this time and a quarter of what was seen in the first ten months of 2021.

Notable deals this year include Scopely’s acquisition of Pokémon GO maker Niantic’s gaming business for USD 3.5bn; UK-based CVC Capital Partners’ USD 3.5bn majority stake in Istanbul-based mobile gaming company Dream Games; and Tencent’s USD 1.3bn investment into Saint-Mandé, France-based Ubisoft’s carveout of Assassin’s Creed, Far Cry, and Tom Clancy’s Rainbow Six into a separate unit.

Treasure hunt

A Los Angeles-based consultant specializing in gaming said the EA sale could become a catalyst that reignites dealmaking across the sector.

A wave of downstream M&A could follow – not just among studios, but across infrastructure, distribution, and analytics platforms, he said.

With Activision Blizzard and now EA off the board, few large independents remain.

Take-Two Interactive – home to Grand Theft Auto and NBA 2K – is now the biggest publicly traded gaming pure play. “Take-Two has scarcity value,” said Doull. “But no one will move until Grand Theft Auto VI launches. There’s too much riding on that release.”

Meanwhile, Warner Bros. Games has become the subject of M&A speculation after parent Warner Bros. Discovery announced plans to split into two companies. The move could free its gaming arm for reported suitors such as Paramount, Sony, and Comcast.

Ubisoft is another take-private candidate, but its subscale USD 1.23bn market cap and French labor constraints make synergies difficult, the consultant noted. The company hired advisors for a strategic review earlier this year, ahead of its aforementioned carveout.

Valve, a Bellevue, Washington-based game developer and distribution platform, is a highly coveted takeover target in the private sector.

The EA deal also highlights the growing value of intellectual property across the media landscape. Gaming and Hollywood are converging fast.

Paramount is developing a Call of Duty film with Activision, and Mattel Films plans to adapt the classic arcade game Whac-a-Mole alongside TriStar. Film versions of The Last of Us, Super Mario Bros., and Fallout have already proven the crossover appeal.

“The line between the controller and the cinema screen is blurring,” the consultant said.

Deals could flow downstream

For smaller investors, the action isn’t in billion-dollar buyouts – it’s in the ecosystem around them.

Whenever there is a mega-deal like EA, it spurs activity, said Karl Schade, managing partner at Presidio Investors. But the opportunities for firms in the lower middle market aren’t in publishers. They’re in the periphery – the “picks and shovels” of gaming, he said.

Presidio targets service and support businesses fueling the industry – from education and coaching platforms to engineering consultancies, marketing agencies, talent management, and accessories makers.

A few years ago, Schade said, he’d see two or three gaming-related companies come to market each year; now that number has quadrupled.

Large, diversified publishers trade at 12x–25x forward EBITDA, while mobile developers fetch 6x–12x trailing multiples. Lower middle market periphery assets typically trade at 5x–8x, depending on growth, Schade added.

With the world’s largest buyout reshaping the leaderboard, the game has changed – and every player, from sovereign funds to indie studios, just got a new reason to hit “start.”