Irish M&A soars to new heights — Dealspeak EMEA

Summary

- Intel-Apollo EUR 9.9bn deal boosts M&A volumes as Ireland’s economy grows faster than expected

- Centric Health explores options; Irish TMT sector ripe for deals

- Ireland’s low-tax economy drives M&A growth, despite prospect of international tax deal

The continuing success of Ireland’s low-tax and business-friendly economy has resurrected the country’s M&A.

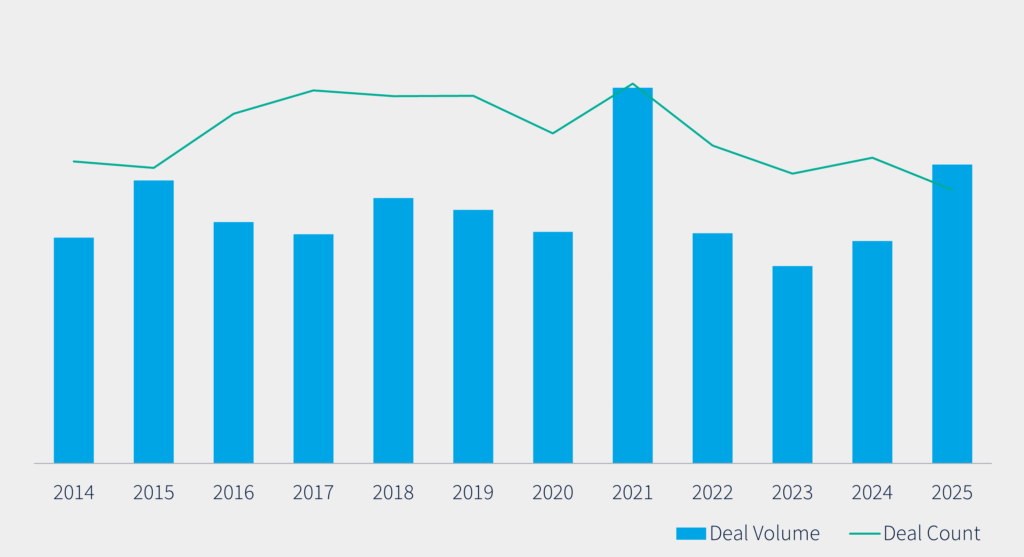

Irish M&A has blossomed year to date (YTD), according to Mergermarket data. Volumes in YTD24 are EUR 19.1bn over 214 deals, which more than doubles the full-year (FY) score for 2023.

The YTD24 result is a decade-long record, although it falls a little short of YTD13, when EUR 20.8bn spread over 46 transactions was registered.

The previous record came as Ireland was preparing to leave a bailout scheme in December 2013. Its economy started to grow again the next year after a long recession, leading to commentators describing it as the Celtic phoenix from about 2015.

The YTD figures have received a bump from a mega-deal in June. Intel [Nasdaq:INTC] agreed to sell a 49% stake in an Irish joint venture called Fab 34 to Apollo [NYSE:APL], which will invest USD 11bn (EUR 9.9bn) in the business.

The Fab 34 deal is so large that Ireland’s full year (FY) figures are already in record-breaking territory. The previous decade-long record was FY21, when EUR 17.5bn of M&A volumes was recorded across 378 deals. The FY13 figure of EUR 21bn over 79 deals is likely to fall in 2024 if the last four months of the year continue to show healthy dealflow.

Intel test

It is no coincidence that Intel is at the heart of the M&A boom. The Silicon Valley-based semiconductor manufacturer was one of the first US multinationals to spot the potential of Ireland.

The government began cutting taxes in the 1980s. Intel set up a large subsidiary in 1989, which is now one of the country’s biggest employers. Other large tech companies followed in its footsteps, paving the way for the so-called Celtic tiger years between the mid-1990s and the 2007 credit crunch.

Intel began work on Fab 34 in 2019, with a view to doubling its manufacturing capacity in the country. It opened in Leixlip in September 2023, with Apollo deploying funds for the high-volume manufacturing (HVM) facility, which is designed for wafers using the Intel 4 and Intel 3 process technologies

Once bitten, twice shy

Ireland’s macro scene could make elected officials elsewhere jealous. The economy has been growing much faster than expected, leading to a budget surplus of EUR 8.6bn in 2024 – the country’s third consecutive surplus.

Elected officials see the surpluses as a windfall from taxes generated by multinationals like Intel.

The country’s leaders remain cautious due to the hard lessons learnt between 2007 and 2013. Also, the Organisation for Economic Co-operation and Development (OECD) is working on an international tax deal, which potentially threatens the Irish model of setting low rates for multinationals in years ahead.

Even so, M&A in Ireland is likely to continue to generate deals in the meantime. One company to watch is primary care chain Centric Health. Its sponsor, Five Arrows Principal Investments (FAPI), has mandated Houlihan Lokey to explore options, Mergermarket reported in July. The fast-growing company has EBITDA of up to EUR 30m.

Irish technology, media and telecoms (TMT) is a hot area for dealmakers. Situations that could come to market include BT Ireland, which is held by BT Group [LON:BT]; and subsea electricity project Greenlink Interconnector, which is owned by Partners Group.

It only needs a handful of large deals in September to December for the country to smash its M&A record from FY13. Whether or not that happens, we can safely say that the Celtic phoenix is flying right now.