IPO market splits between can-do and can-wait – ECM Pulse North America

- Aspen Insurance and Chagee demonstrate successful deal characteristics

- Growth, resilience, and investor familiarity key to success in current market

- Pipeline companies diverge on IPO approach

It’s been a spring of fits and starts for ECM bankers, and patience is running thin.

After months of handwringing over turbulent macro forces, a strong earnings season has fed some optimism back into market. But the sense from bankers who have been obsessing over timing revisions is that, while the worst may be behind us, the path forward remains rocky.

Markets may no longer be seeing huge daily percentage swings, and Trump’s tariff rhetoric has softened just enough to let fundamentals begin to reassert themselves. “If you’ve got decent cash flow, some growth, and no Southeast Asia supply chain exposure, you’re in a different category altogether,” one banker said.

Still, IPO windows are reopening case by case, not broadly. “The Nirvana for us is obviously, can we finally stop having all these false starts?” another banker said. Deals need to prove they belong, and that starts with performance.

Aspen Insurance and Chagee are two recent examples of what works: mid-size transactions, specialist demand, and rational pricing. Both were benchmarkable, well understood by investors, and crucially, faced little competing supply.

Aspen, backed by Apollo, returned to the public markets more than six years after being taken private, raising USD 397.5m at the midpoint of its USD 29–31 range. The company secured a valuation of USD 3.05bn after its shares jumped 10.8% on Thursday. The IPO, which valued the insurer at about USD 2.76bn, had been long anticipated and priced for broad institutional support. “It was on file for a while, well followed and benchmarkable,” a banker said. “In this market, that’s half the battle.”

Ironically, Chagee is a Chinese tea chain. But, despite being a cross-border listing at a time of extreme US/China tension, the company successfully raised USD 411m by pricing at the top of its USD 26–28 range.

Chagee sold 14.7 million American depositary shares. The deal benefited from strong regional demand and a consumption-driven growth narrative tied to China’s stimulus efforts.

This restrained formula is resonating. Portfolio managers, especially long-only funds, still need to be invested. Most cannot afford to sit entirely in cash, even in uncertain markets.

Sponsors are responding accordingly. With pressure mounting to return capital to LPs, they are willing to test the public waters if the risk-reward calculus makes sense.

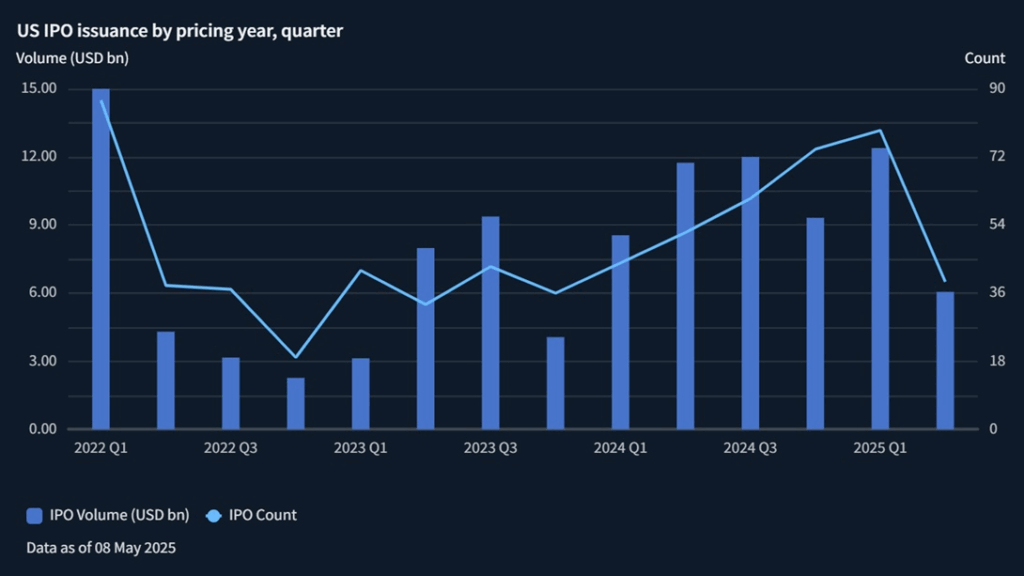

Still, a handful of IPOs do not make a market. The first quarter saw several high-profile listings falter, some due to execution, and others due to misaligned timing or mispriced assets.

Two ways

In this environment, the formula is simple for a successful deal. A company must have some growth, resilience, liquidity, and investor familiarity. The market will be unyielding on these quality demands; everything else can wait.

While volatility has eased, macro uncertainty has not. The Fed confirmed this week that rate cuts are off the table for now. Global trade tensions remain unresolved. Supply chain recalibrations continue. That leaves issuers split in how and when to approach the market.

Two of the most notable April window holdouts illustrate the divergence that is increasingly shaping up on the IPO runway.

eToro, the social trading platform, is gaining traction with investors after initial feedback rounds. Sources told this news service that the buyside is engaging meaningfully, and a revised valuation is more palatable in the current climate. The company’s tech-enabled financial services model and strong growth metrics continue to attract attention. Given the company is a trading platform that is thriving in an environment of investors buying dips and selling rallies, the IPO could be just the candidate for this market.

By contrast, Klarna is choosing to wait. The Swedish payments giant has paused its IPO plans while management assesses market signals more closely. Sources close to the company say the team is very protective of valuation and the optics of a debut in volatile conditions.

As summer approaches, the divergence is increasingly visible. Some companies are ready to move, disciplined, well prepared, and willing to price sensibly. Others are watching, waiting, and weighing risk more cautiously.

This is not a market that reopens automatically. Each deal has to earn its place in the hearts of equity investors.