IPO market shifts in 2025 as venture capital outperforms private equity – ECM Pulse North America

- VCs fuel new phase of market momentum

- Structural differences impact outcomes

After a prolonged drought in the public markets, the landscape for initial public offerings is starting to shift with venture capital-backed companies leading the way.

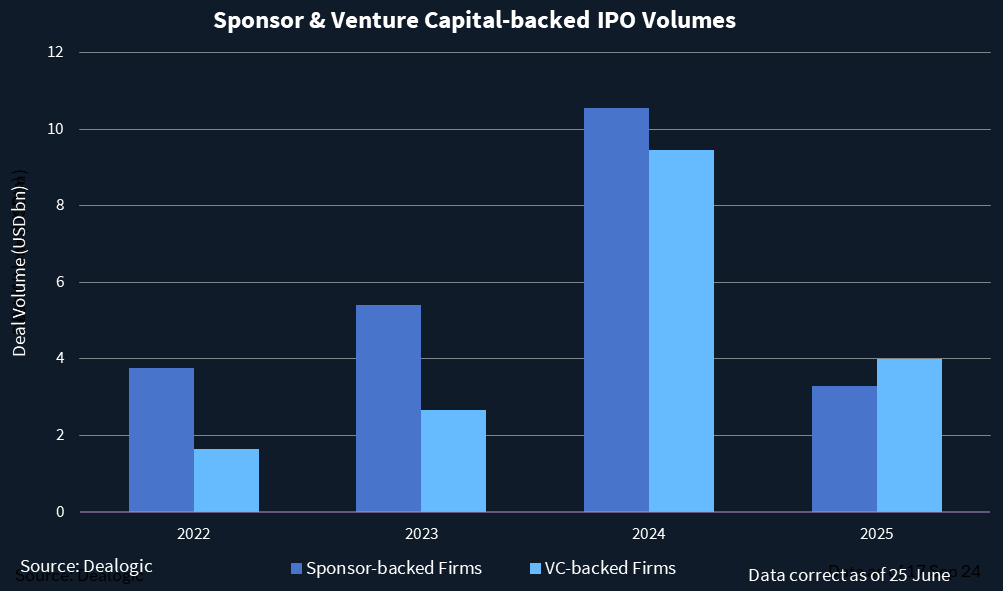

While private equity firms have dominated IPO issuance in recent years, 2025 is shaping up to be a breakout year for venture-backed names, driven in part by blockbuster performances from technology providers like Circle Internet Group and cloud computing startup CoreWeave.

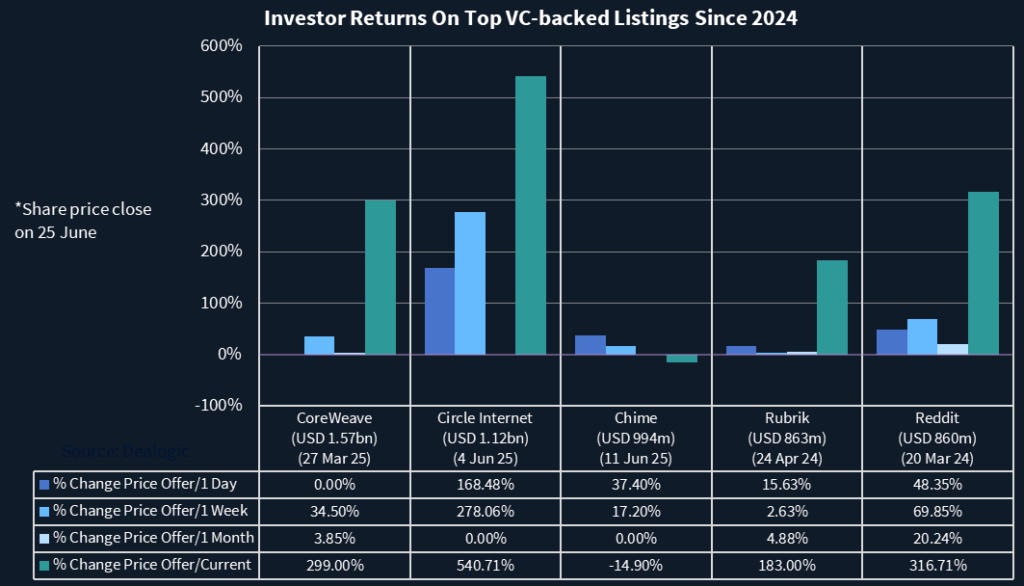

Few IPOs have captured the market’s attention like Circle, the New York-based stablecoin company. Since going public on 4 June, Circle’s share price has soared 750%, making it not just the best-performing USD 1bn-plus IPO in a one-month period, but also one of the most cash-generative IPOs in history, according to Dealogic. The USD 1.2bn deal has already generated USD 9bn in paper profit for investors — trailing only Visa’s 2008 listing in terms of aftermarket return. Within its size category, Circle stands nearly alone in delivering this kind of investor windfall so quickly, reinforcing the market’s appetite for high-growth, VC-backed tech plays.

Now VC-backed companies have taken center stage, energizing the market with fresh listings and strong aftermarket performance. So far in 2025, VC-backed IPOs have on average surged 450% from their initial price compared to about 18% for PE-backed IPOs, according to Dealogic. The total combined return for VC-backed IPOs in 2024 and 2025 is more than 117% on average while the total return for PE-backed IPOs is 53% on average.

“We’re seeing renewed interest from our venture-backed client base,” said Rich Segal, a partner at Cooley. “It feels like the beginning of a more sustained march forward. The pipeline is growing, and the base of potential issuers is broad.”

Today’s IPO environment is more cautious than the frenzied highs of 2021, but it is not stagnant. This latest cycle is marked by measured optimism, with VCs more willing to take their companies public, even if it means accepting short-term valuation cuts.

One key difference between VC- and PE-backed IPOs is in how proceeds are used and how pricing is approached.

“VC backers are more willing to accept a discount on their offering,” said one source. “They can take that temporary hit and put the proceeds from an offering back into that company to grow it.”

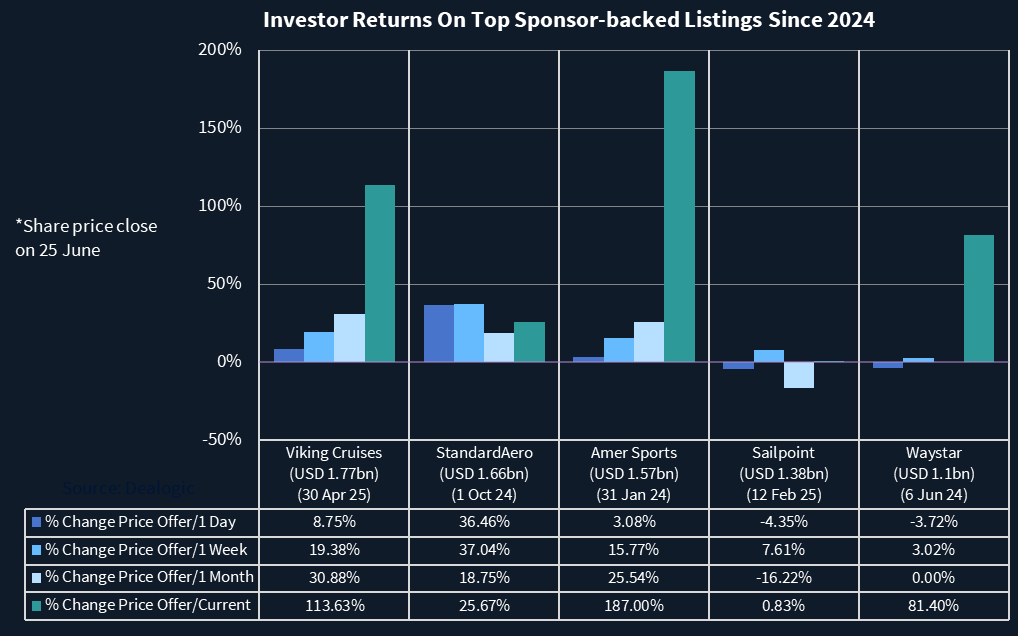

That long-term growth mindset contrasts sharply with private equity’s more immediate focus on returns. PE sponsors often use IPOs as a mechanism to begin exiting their positions and generating distributions to investors (known as DPI). That pressure to sell quickly can weigh on both pricing strategy and long-term stock performance, according to advisors.

As Conor Moore, global head of KPMG private enterprise, explained, VC-backed IPOs may not yet be profitable, but they typically show strong growth trajectories.

“There’s a path to profitability,” Moore said. “Logic would suggest they probably get a little more conservative on pricing compared to a PE IPO, where profitability is already in place, but revenue growth is slower.”

PE-backed IPOs also tend to carry a heavier debt than their VC-backed counterparts, and often the returns generated from going public are used to pay this load down. In contrast, VC IPOs generally use proceeds to reinvest in growth, R&D, or acquisitions.

“It’s rare that a VC-backed IPO is going to have meaningful debt,” said Moore.

This financial distinction also correlates with post-IPO performance.

While VC-backed IPOs have generally delivered stronger returns, many PE-backed companies that went public over the past decade have often returned to private ownership, frequently at valuations close to their IPO prices.

Notable examples include McAfee, the TPG-backed cybersecurity firm that went public in 2020 at USD 20 per share and was acquired by Advent International and Permira in 2022 for USD 26 per share.

Similarly, GTCR-backed media software firm Cision went public via a SPAC merger in 2017 at USD 10 per share and was taken private by Platinum Equity in 2020 for the same price.

Dun & Bradstreet also illustrates this trend. A private equity group took the company private in 2019, brought it public again in July 2020 with a USD 9bn market capitalization, and in March, Clearlake Capital Group announced a USD 7.7bn take-private deal, including debt. The USD 4.1bn equity component is expected to close in 3Q, pending shareholder and regulatory approvals.

Venture-backed tech companies, on the other hand, typically remained public for six years before re-privatization, and often at a premium, according to a banker. On average, these exits occurred at 50% higher valuations than their IPO price, he said.

Despite initial optimism at the start of the year for a revival of exit activity, PE-backed IPOs have lagged in 2025.

“It’s been slower than we expected,” said Mike Bellin, a partner at PwC. “When the tariffs came into play in April, many of them hit the pause button.”

Even so, activity is expected to pick up in the second half of the year.

“They have to raise capital, they have to turn over their businesses,” Bellin added. “We’re expecting significant PE activity in the second half.”

Part of the delay is structural.

Many PE-owned portfolio companies have been held for long periods, limiting the growth upside that typically excites public market investors. Combined with cautious macro conditions and geopolitical uncertainties, PE sponsors have been more reluctant to test the waters in the first half of 2025.

VCs, however, appear undeterred.

Bellin pointed to several venture-backed IPOs that priced above range this year and have since traded well. While many of those valuations are still below their last private funding rounds set during the 2021 capital boom, they are gaining momentum post-issuance. That performance is encouraging more startups to come to market.

If private equity firms return to the public markets in the second half of the year, US stock exchanges could see a more balanced mix of issuance. But momentum continues to build in the VC camp for now, as PE firms prepare for a comeback.

Circle and CoreWeave’s head-turning run may not be typical. But they underscore a key truth in today’s IPO market: Investors are once again willing to bet big on growth. And right now, that growth is coming from the venture side of the aisle.