IPO market gears up for second-quarter surge as Trump effect takes hold – ECM Pulse North America

- Prospective issuers target April-May for IPO launches

- Large-cap deals abound, including Venture Global LNG and Smithfield Foods

- USD 50bn IPO issuance expected this year, surpassing 2024’s USD 30bn

US investors are preparing for an acceleration in IPO supply in the second quarter, driven by optimism over improving market conditions, proactive issuer engagement, and expectations of pro-business polices from the second Trump administration.

“We are in a world where growth in the US domestic market is strong, the GDP is very robust, and the buy side has plenty of capital to put to work,” said Deutsche Bank‘s Head of Americas ECM Nick Williams.

The second quarter is shaping up as a litmus test. Private equity and venture-backed companies are largely holding their powder dry until full-year results are finalized, targeting the April-May window for launching. Success here could set the tone for years to come.

“If we see strong outcomes in Q2, it will further reinforce plans for issuers looking ahead to 2026,” Williams noted.

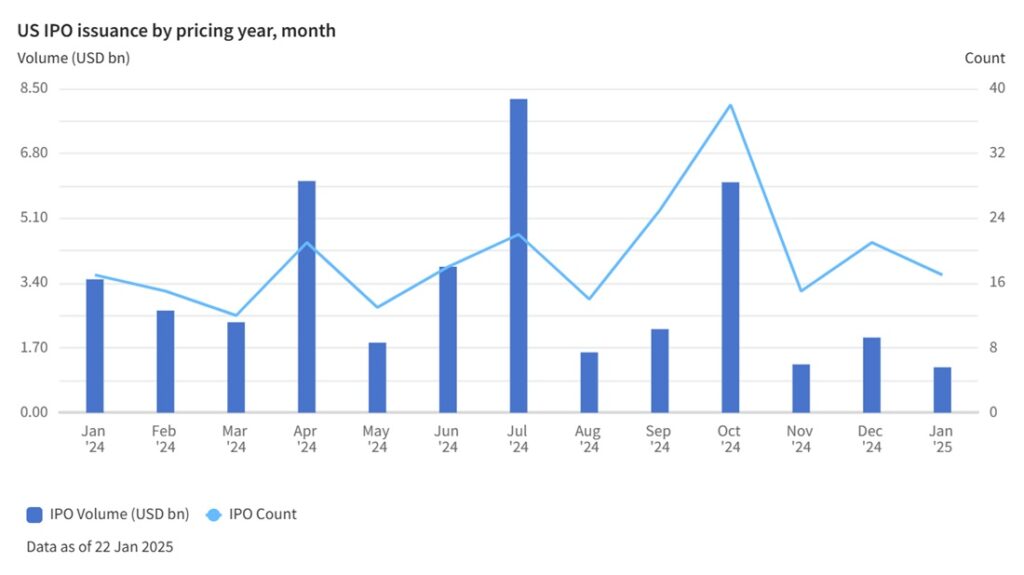

Several advisors believe US IPO issuance this year could top USD 50bn, exceeding 2024 volumes of around USD 40bn.

Large-caps take the bacon

There is also some 1Q activity for investors to get their teeth into.

Live IPOs include the multi-billion listing of liquid natural gas company Venture Global LNG. The deal was set to be potentially the largest IPO in the sector ever recorded. However, the LNG exporter yesterday cut target valuation for its listing to USD 65.3bn, significantly lower than the more than USD 100bn it had initially aimed.

Meanwhile, Smithfield Foods, the American bacon maker owned by Hong Kong’s WH Group, is in the market with an IPO that could raise between USD 870m and USD 939.6m; the valuation could be as much as USD 10.7bn.

“Bacon in the United States is an equity story that you can bet will resonate,” said one investor following the deal.

Other notable deals for later in 2025 include the suburban Chicago-based medical equipment manufacturer Medline, which has already filed confidentially with the SEC. There are also several tech-focused firms eying a listing this year, including CoreWeave, targeting a valuation of over USD 35bn, e-Toro, targeting a valuation of around USD 5bn, and Klarna, which could be valued between USD 15bn and USD 20bn.

This year’s crop of IPOs represents a host of mature businesses which have achieved significant scale while private, making them particularly attractive to growth investors seeking established but high-potential opportunities.

Traditional energy and cryptocurrency companies appear particularly well-positioned under the Trump administration, with regulatory tailwinds providing compelling narratives for investors.

KPMG‘s Shari Mager reported a surge in companies that filed confidentially in late 2024, now poised to pull the trigger. “Some firms have spent two years meticulously preparing,” she said. “They’re ready to move fast when their window opens.”

Among the most recent filings are Thoma Bravo-backed Sailpoint, as well Trive-backed space and defense firm Karman.

Yet caution remains. Most issuers are waiting to gauge secondary market conditions and see Trump’s policies take full shape. Last year’s troubled 1Q for IPOs left many potential issuers wary.

As Williams put it: “The rearview mirror is always critical in the IPO market even if we are selling the future.”