IPO issuers feel out January window as early deals run first – ECM Pulse North America

- Large-cap IPO launches expected to build later this month

- Investor focus tilting toward disciplined offerings

The US IPO market has entered 2026 in a diligent setup mode. With a few companies already marketing new offerings, many large-cap issuers are positioning for launches later in January and early February, using the first weeks of the year to line up execution and gauge early signals.

The environment has remained broadly constructive. Recent geopolitical headlines, including developments tied to Venezuela and US President Donald Trump’s aggressive stance toward Federal Reserve chair Jerome Powell, have not translated into a sustained rise in volatility.

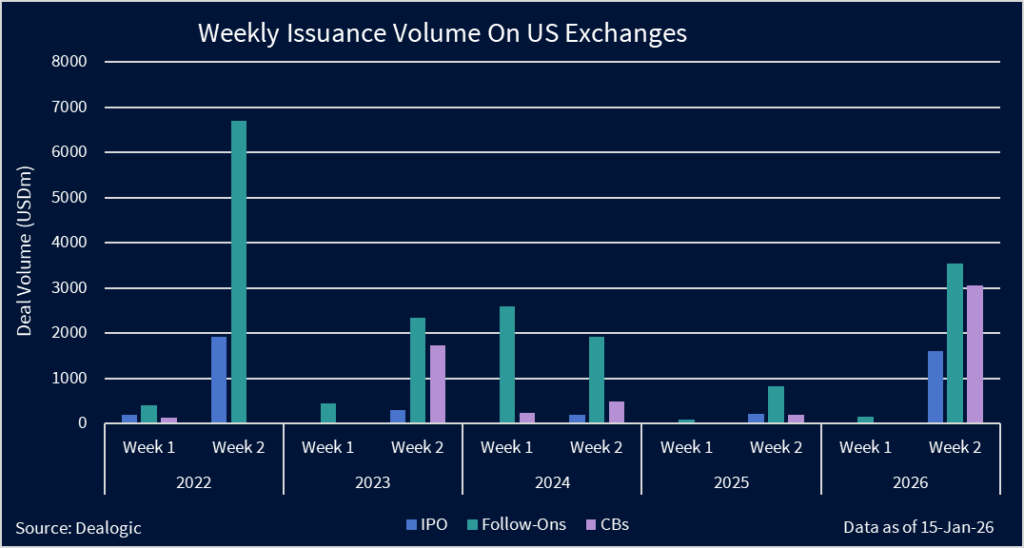

Early activity across equity capital markets has also been supportive. The second week of 2026 alone delivered USD 8.20bn across 33 ECM transactions, exceeding the combined first-two-week totals of 2025, 2024, and 2023, and coming in just below the comparable week in 2022.

Investor attention has so far been concentrated around industry gatherings, particularly the JPMorgan Healthcare Conference and the ICR consumer conference. Daniel Polsky, managing director in equity capital markets at William Blair, said the situation should prove temporary.

“I think you’ll see more activity starting next week,” Polsky said.

Caution has been playing out against a backdrop of live and pending transactions rather than a lack of supply. EquipmentShare and BitGo have both launched IPOs and begun marketing, while Bob’s Discount Furniture and Forgent Power Solutions have publicly filed registration statements and are moving through preparatory stages.

Motive Technologies and Once Upon a Farm are also widely expected to launch in the coming weeks, after pushing back earlier timelines following the federal government shutdown.

In the meantime, several issuers appear content to let those early deals run first. Filings have continued and preparatory work has accelerated, even as visible launches have remained staggered. For many companies, January has been less about forcing price discovery than about lining up execution.

Matthew Kennedy, senior IPO strategist at Renaissance Capital, said: “We’ve seen several deal launches, but we didn’t see an explosion of activity yet in January. Everybody wants to wait for someone else to test the waters.”

The timing around the MLK holiday has reinforced that view, he said. In a more typical year, issuers would either push to price ahead of the break or wait until after. This year, several roadshows have run through the middle of the week, with pricing deferred. Kennedy noted that the choice stood out. “In a normal year, companies would have chosen to price the week of the 12th rather than the week of the 19th,” he said.

One US capital markets lawyer said investors remain highly disciplined, with valuations and sector volatility under close scrutiny, and are rewarding companies that can point to predictable cash flows and scalable platforms rather than relying on forward narratives. Early strength in small-cap stocks has supported an acceleration in IPO filings, the lawyer said, but has not loosened expectations around quality.

This focus on discipline has also shaped views among sponsors. One ECM banker said January can work as an IPO window when owners approach the market with restraint rather than momentum. Where that optimism fades is in higher-beta offerings. “Where I’m not optimistic is this higher-beta stuff,” he said, warning against transactions driven by momentum rather than fundamentals. He pointed to scenarios where stocks open at elevated levels only to “slide 80% from there.”

Polsky framed that discipline in the context of how last year ended. The IPO market gathered momentum through the second half of 2025, culminating in Medline pricing the largest US IPO of the year in late December.

“Last year really emphasized how important it is to act when the window is open, because conditions can change quickly,” Polsky said.

That late-year strength has fed expectations for 2026, even as advisors stress that improved sentiment has not translated into easier standards.

“If you annualize what the second half did, this could be a USD 60bn year,” Polsky said, cautioning that individual transactions could quickly change the math.

Sector breadth has widened alongside that recovery. Technology and consumer remain prominent in pipelines, while industrials, insurance, and healthcare are playing a more visible role. Biotech has been particularly active after a back-end-loaded 2025.

Conversations around very large offerings, as well as so-called mega-deals expected later in 2026 that include the likes of SpaceX and Anthropic, are intensifying.

Polsky said the presence of potential mega-deals has reinforced the relevance of public markets as a financing venue, even if timing remains uncertain. As things stand, January is largely a period of calibration, partly shaped by ongoing blackout periods and with an expansive pipeline to look forward to.

“Early IPOs will be a good barometer for sentiment. The market has shown remarkable resilience,” Polsky said.