IPO filings accelerate as market enters pivotal phase – ECM Pulse North America

The US IPO market is gaining momentum as companies take advantage of a stable macro backdrop and strong deal execution heading into the second half of 2025.

A string of high-profile filings, including Figma, Accelerant, NIQ, and McGraw Hill, suggests that issuers are growing more confident in both investor appetite and market receptivity.

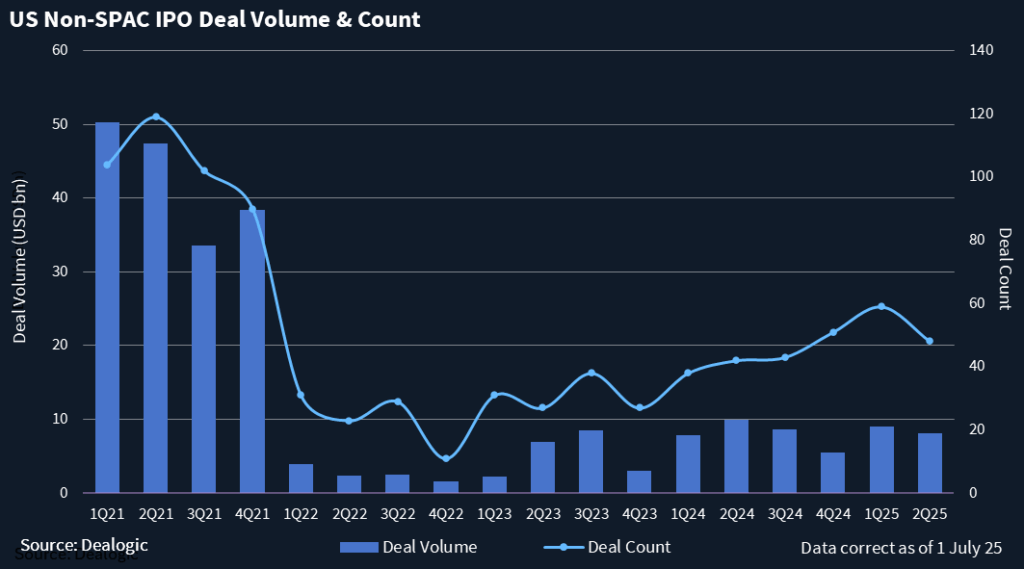

The pace of IPOs is now the fastest since 2021, according to Daniel Polsky, ECM managing director and co-head of syndicate at William Blair, who noted that roughly 40% of IPOs this year have priced above their range, double the level seen in 2024.

“There’s real buy-side receptivity, and that’s translating into strong outcomes and fueling a positive feedback loop,” he said. “More companies are gaining confidence and stepping forward to file.”

While the latest filings span sectors from software to insurance to data analytics, the breadth itself is becoming the story, which many see as a compelling sign of a functioning market.

“We want to see not just one outperforming pocket but a wide mix of sizes, sectors, sponsors, and types of businesses all able to access the market,” Polsky said.

Importantly, tech is re-emerging, achieving a powerful comeback. The return of venture-backed names is now complementing what had been a sponsor-led market. So far in 2025, VC-backed IPOs have on average surged 450% from their initial price compared to about 18% for PE-backed IPOs, the Pulse recently reported.

Secondary components are becoming increasingly common at IPO, and a significant portion of PE-backed names from 2024 have already returned to market with follow-ons, in some cases more than once. In May, Carlyle Group and GIC sold a 9% stake in the Scottsdale, Arizona-based aviation maintenance company StandardAero, which listed last year. The block trade mirrored a March sell-down by the two shareholders in the same name.

(Mostly) open

These dynamics are expected to carry forward into an active autumn pipeline.

“You really can’t have a functioning IPO market without tech coming back,” Polsky added. “We’re finally seeing that in a meaningful way this year.”

The current environment follows a volatile second quarter. April’s tariff-driven disruption led to execution delays, but May and June made up for lost ground. IPO activity that had slowed temporarily came back stronger, helped by improved equity index performance and renewed demand across institutional accounts.

Still, this is far from being an open-for-all environment. Most of the filings seen in recent days are not speculative. With investors enthusiastic but selective, marquee names are reviving confidence across banking circles that there is strong demand for growth, particularly when accompanied by clear profitability trajectories and limited tariff exposure.

While July may bring near-term quiet around the holiday and earnings season, expectations for the third quarter remain high. Macro risk is still part of the equation, but it has not stalled momentum.

Participants are keeping a close eye on interest rates, particularly the Fed’s response to economic data. However, it is widely expected rates will hold steady at its July meeting, as it waits for better signs of inflation and labor market softening.

Bankers agree that beyond near-term market dynamics, the deeper constraint in the IPO market over the past two years has been on the supply side, not demand.

Speaking to the rising momentum, one capital markets lawyer observed, “We would have hoped to see this come sooner.”

One senior ECM banker expressed satisfaction with the outcome of recent transactions.

He noted, however, that the flow of names coming to market remains well below what the current demand environment could support.

Still, the results seen so far bring sentiment to a level of optimism that only two months ago would have seemed unwarranted, if not outright reckless.

As we get deeper into July, green shoots are outnumbering red flags.