Investor demand fuels IPO boom amid market highs

- Balance of power shifts in issuers’ favor

- Average 2025 listing is up more than 30%

- Risks loom, but sentiment stays buoyant

Initial public offerings have roared back to life this September, with bankers reporting one of the busiest windows since 2021.

Strong investor appetite, robust deal performance, and a healthy pipeline suggest momentum could carry into year-end — though risks from tariffs, inflation, and US policy remain in the background. Demand continues to outstrip supply, advisors note.

“For the hottest names, the balance of power has shifted in issuers’ favor. For good companies, the challenge is not raising capital but selecting the right investors,” said Angus Whelchel, head of private capital markets at Moelis.

That shift has eased pressure on profitability timelines, he added, with investors showing more flexibility as long as companies can demonstrate a path to scale and durable competitive advantages. Whelchel highlighted artificial intelligence infrastructure, data centers, and next-generation nuclear energy as thematic growth areas likely to dominate in late 2025 and beyond.

Still, he cautioned that macro conditions — particularly regulatory clarity and US tariff policy — will shape investor appetite.

Despite ongoing risks, the market has remained resilient, said Sumit Mukherjee, head of ECM market intelligence at JPMorgan.

“Market volatility tends to be good for active managers, and more than half of large-cap managers and over 70% of small- and mid-cap managers are outperforming,” Mukherjee said. “That outperformance is bolstering investors’ desire to deploy capital into opportunities like IPOs, which naturally come at a discount to public comparables.”

Recent deal quality has also impressed.

Compared to the exuberance of 2021, when early-stage companies rushed to list, today’s issuers are larger, more disciplined, and often profitable, advisors say.

Investor feedback has been constructive, oversubscription levels are rising, and the average IPO is up more than 30% in aftermarket trading, according to Mukherjee.

“Deals are being priced fairly,” he added. “That catalyzes demand, and companies are often able to price at the top or even above revised ranges.”

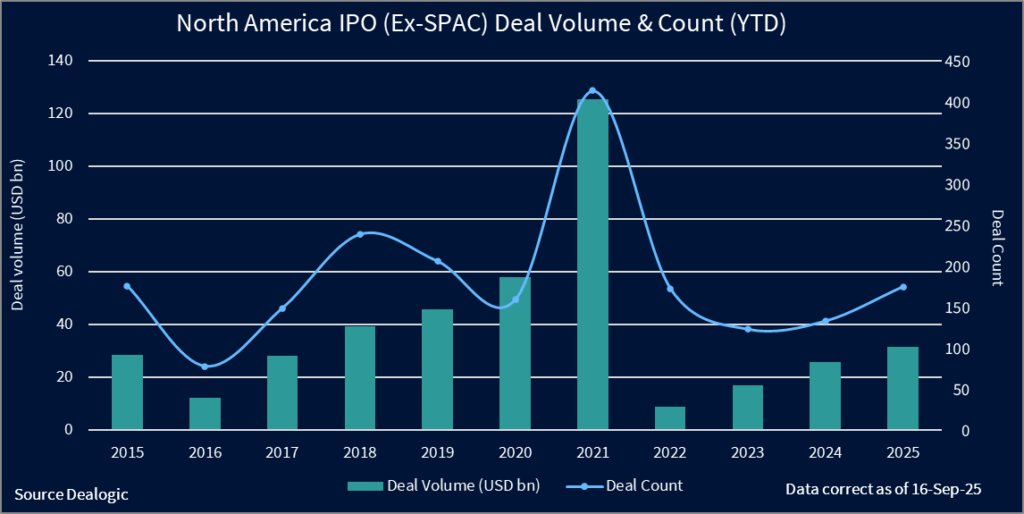

North America has seen 175 IPOs raise more than USD 30.5bn so far this year, excluding SPACs, according to Dealogic. That marks the highest count and deal value since 2021, when the reopening of the economy following the COVID-19 pandemic fueled a market frenzy.

This month has been particularly active, with 13 listings raising USD 6.2bn and more still in the queue. That marks the highest monthly IPO deal value in 14 months, and September is only halfway through.

Bankers expect another 20 to 25 IPOs could launch on US exchanges in 4Q across sectors from financial technology and crypto to defense technology, insurance, and consumer.

The backdrop is supportive: US equities have climbed to record highs, with the S&P 500 and Nasdaq repeatedly setting new peaks amid strong earnings and investor optimism.

Another banker described the current environment as “probably the most constructive market we have had this year, and for a while.” The breadth of new offerings is being met with strong investor engagement. “The virtuous circle is critical,” he said. “If these deals price well, it creates momentum for others and gives issuers confidence to return with secondaries down the line. That is how you reopen a market.”

Still, he warned issuers must remain disciplined. Many companies that filed in August were creating optionality, and with 3Q results pending, some issuance may slip into late November or December, the banker explained.

Investors, meanwhile, are wary of overloading portfolios in a crowded calendar.

The stock rally carries both opportunity and caution, said Portage Capital Solutions Co-Head Devon Kirk. Asked whether soaring indexes and surging IPO issuance point to bubble risk, she replied: “For sure. No one has a crystal ball on where markets go in the next 12 months. We hope to see steady growth and sustained IPO momentum, but macro risks could easily change that.”

The quality of issuers today is far higher than in previous cycles, she noted.

“The companies coming to market tend to be those with compelling stories and confidence,” Kirk said. “For example, Figure IPO’d last week — we admire that business. In general, the companies are larger, coming with very significant market caps. These aren’t the USD 500m IPOs of a few years ago. You really need scale now.”

She added that crypto exposure is a growing theme: “We’re seeing companies highlight exposure to crypto and stablecoins, which investors are excited about right now.”

For now, sentiment remains buoyant.

Investors are making money, issuers are finding receptive demand, and the long-dormant IPO market appears firmly back in motion — though whether it can sustain the pace into 2026 will depend heavily on the resilience of the broader economy.