Into the Matrix: Generative AI dealmaking heats up — Dealspeak North America

Generative AI is now spurring a dealmaking boom, putting 2024 on track to be one of the busiest years yet.

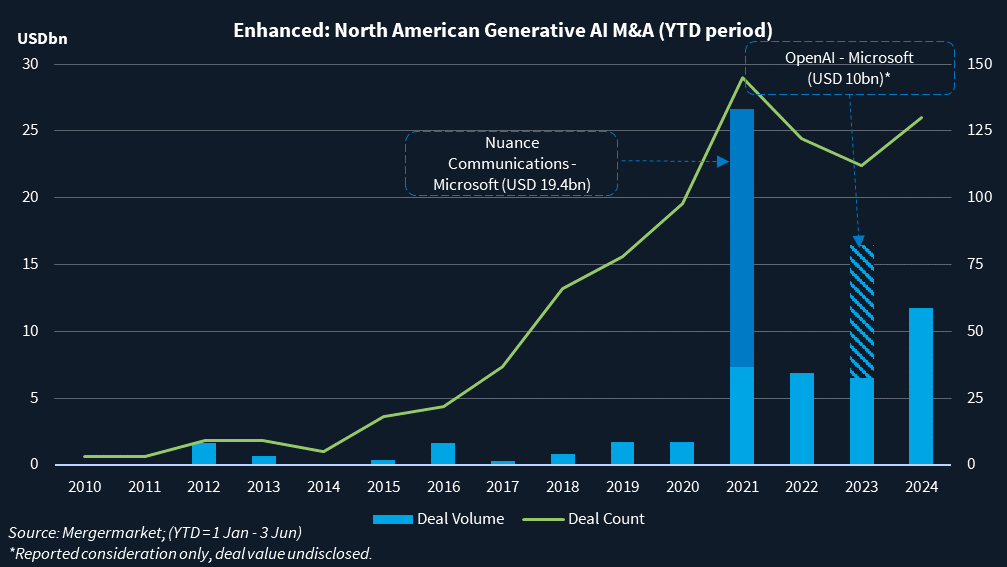

The number of deals in North America’s generative AI space reached 130 in the year to date (3 June) — close to 2021’s record of 145 for the same period, according to Mergermarket data. After dipping during the same period in 2022 and 2023, there has been a marked uptick in activity this year.

By volume, the USD 11.7bn in transactions inked during the first five months of 2024 lags the highwater mark of USD 26.7bn seen during the same period in 2021, though that was dominated by Microsoft’s [NASDAQ:MSFT] USD 19.3bn deal for Nuance Communications, a provider of conversational AI software.

AI deals are expected to pick up in the second half of the year as companies use acquisitions to land talent, startups in need of capital search for a market fit, businesses build AI for specific industry use cases, and the war for data heats up, sources say.

Data stack

A summary of the AI stack is useful. The hardware layer is dominated by chipmaker NVIDIA [NASDAQ:NVDA] but also includes Advanced Micro Devices [NASDSAQ:AMD] and Cerebras Systems. Then comes the cloud platform layer, offered by the likes of Amazon’s [NASDAQ:AMZN] AWS, Microsoft’s Azure, Alphabet’s [NASDAQ:GOOG] Google Cloud, on top of which AI foundation models are built, such as OpenAI, Anthropic, Cohere, and Meta Platforms’ [NASDAQ:META] LLaMa 3. At the very top – facing the user – is the application layer, which includes Jasper and Soona.

The big buyers of generative AI companies, unsurprisingly, will feature Alphabet and Microsoft, notes Boston Consulting Group managing director Clark O’Niell.

While opportunities in the hardware layer are limited – NVIDIA’s graphics processing units dominate in data centers – opportunity exists in the application layer, he says.

Tech firms like Microsoft and Meta are currently focused on training their own large-language models. A desire to work with companies that sit on vast amounts of data will likely manifest next, according to a sector advisor. That could result in a sale or partnering opportunity.

“This war is going to be fought over underlying data,” the sector advisor says. A case in point is Reddit’s [NASDAQ:RDDT] partnerships with OpenAI and Google to allow use of its real-time posts for training AI models.

Another example is Realeyes, a facial recognition company that has gathered more than 2 billion AI training labels globally over the last 16 years to help advertisers measure consumers’ attention and emotion via webcam. It is now working with some of the biggest tech platforms.

Talent wars

Part of what will also drive M&A in the AI industry is buying up companies for talent, also known as acqui-hires. Talent is not cheap: OpenAI reportedly offered pay packages of up to USD 10m to poach some of Google’s best.

Databricks’ USD 1.3bn acquisition last summer of MosaicML, a generative AI startup, brings with it a team of top AI engineers.

Cerebras Systems wants to acquire AI talent ahead of an IPO that could come later this year.

Great expectations

The venture capital environment for AI startups remains strong. A week ago, Elon Musk’s x.AI announced a USD 6bn series B funding round from Valor Equity, Vy Capital and Andreessen Horowitz, among others.

Perplexity, which has built a generative AI engine to challenge Google in search, has raised USD 165m since it was founded in 2022, and is raising more funds in 2024.

Investors, however, are becoming more cautious, as some companies have taken off and fallen very quickly, says Aaron Fleishman, partner at VC firm Tola Capital.

One example is Jasper, provider of an AI copilot for enterprise marketing teams, whose valuation was reportedly slashed after growth slowed.

Fleishman expects a lot of M&A in generative AI in the second half of the year. In part that is because startups are running out of capital – expect to see smaller tuck-ins, he says.

Industry niche

More traditional industries – such as financial services and pharmaceuticals – may acquire smaller AI companies that haven’t found a market fit, while also benefiting from their AI talent, Fleishman adds.

AlphaSense – which uses AI to scrape public filings, analyst notes and other documents to compile data for financial institutions – is one such company that has said it is looking at acquisitions. Another is Soona, a photoshoot and video platform that recently acquired Austria-based Mokker.ai, designer of an AI photo tool.

Since ChatGPT launched in December 2022, the world has changed. Another year from now, it will look markedly different again.