India’s IPL teams take page from Man Utd, Atlanta Braves’ listing playbook but challenges abound

The entry of private equity firms RedBird Capital Partners and CVC Capital Partners into India’s IPL cricket league in 2021 marked a tectonic shift in the country’s sporting industry, until then dominated by corporate ownership.

RedBird – which has interests in Italian football club AC Milan and the Boston Red Sox, among others, – picked a 15% stake in the Rajasthan Royals for an undisclosed sum. While CVC Capital with a portfolio that spans investments in F1, rugby and football, bought the Gujarat Titans franchise for INR 56.3bn (then USD 700m).

Cut to 2023, IPL franchises are toying with listing plans on Indian bourses – following in the footsteps of their western counterparts, Manchester United [NYSE:MANU], Atlanta Braves [NASDAQ:BATRK] and Madison Square Garden Sports Corp [NYSE:MSGS] whose portfolio includes the New York Knicks – as owners sense an opportunity to cash-in and raise fresh capital for their respective clubs from the public markets.

At least two IPL teams – Kings XI Punjab and Delhi Capitals have reportedly been weighing an IPO.

Mergermarket’s report in October noted that the owner of Kings XI Punjab, KPH Dream Cricket has picked banks to conduct feasibility studies with details such as issue size and exact timeline to be subsequently ascertained.

Meanwhile, the Chennai Super Kings franchise trades in the unlisted market with a valuation of around INR 60bn (USD 719m), as per a September local media report.

“Most of the franchises have all the ingredients that are required to get themselves listed. They have a set and tested business model, generating revenues consistently, profit making, good visibility and have created brands. The only question would be the valuation,” said Santosh N, Managing Partner at D&P Advisory, which offers sport advisory services and is a publisher of IPL valuation reports.

It is a great consumer facing story in what is essentially a recession proof business, Pinak Bhattacharyya, senior vice president at IIFL Securities noted.

Other teams in the 10-team cricket league include Sunrisers Hyderabad owned by Sun TV Network [NSE:SUNTV], Royal Challengers Bangalore held by Diageo group subsidiary United Spirits [NSE:MCDOWELL-N] and Mumbai Indians owned by Indiawin Sports, a subsidiary of Reliance Industries [NSE:RELIANCE].

Numbers game, interested suspects

The Board of Control for Cricket in India (BCCI) sold media rights for 2023-27 men’s IPL for INR 483.9bn (USD 5.8bn) – of which television rights for the Indian subcontinent were bought by The Walt Disney Company India-owned Star for INR 235.7bn, while digital rights were bagged by Reliance Industries-owned Viacom18 for INR 237.5bn.

Around 40%-50% of BCCI’s central pool collected via media rights is distributed to the franchises, which translates to around INR 4.5bn – INR 5bn (USD 54m – USD 60m) in earnings per team per season, a managing partner at a mid-market PE fund with investments in sport sector noted. In addition, the teams also earn from distribution of league title sponsorship and team-specific associate sponsors.

Media rights which form the bulk of revenues are expected to rise further, as it renews in 2027. A stable increase of at least a 15%-20% is minimum, founder and CEO of Indiantelevision.com Anil Wanvari said. The rise may be exponential if digital players and large streaming giants enter bidding fray, he noted.

Buying interest including for IPOs could bring in conventional anchor investors ranging from sovereign wealth funds, mutual funds, insurance firms and foreign portfolio investors among others, the PE managing partner said.

Anchor investors could include marquee names as Abu Dhabi Investment Authority, Qatar Investment Authority, Public Investment Fund and CPPIB could partake in such issues in view of the league’s popularity, the managing partner noted, pointing to Bloomberg’s report on Saudi Arabia’s interest in buying a stake worth USD 5bn at an enterprise value of USD 30bn.

The “fear of missing out” is real, he said tongue-in-cheek.

Among retail investors, a portion of their investors are likely to be fans wanting to own a piece of their favourite teams, Shinoj Koshy, partner at Luthra & Luthra Law Offices said. Even if it does not generate large returns, the retail investors might buy it for sentimental value and their connection with the team, Koshy noted.

Proceeds from the primary share sale via the IPO would be deployed for expansion purposes including buying cricket franchises in other geographies including leagues in the US, Europe, Middle East and Africa, the PE managing partner said.

Peep, peer, peek

IPL is the second largest league in the world with revenues of over USD 10bn, only behind US’ National Football League (NFL) that rakes in over USD 18bn in topline, per media reports.

In terms of valuations of individual teams – the US league dominates with NFL’s Dallas Cowboys pegged at USD 9bn followed by MLB’s New York Yankees at USD 7.1bn and NBA’s Golden State Warriors at USD 7bn, per a September 2023 Forbes report.

In IPL, Mumbai Indians remain the highest valued franchise with a USD 1.3bn enterprise value in 2022, Forbes reported.

On an average, each IPL team would command a valuation of around USD 1bn, the PE managing partner noted.

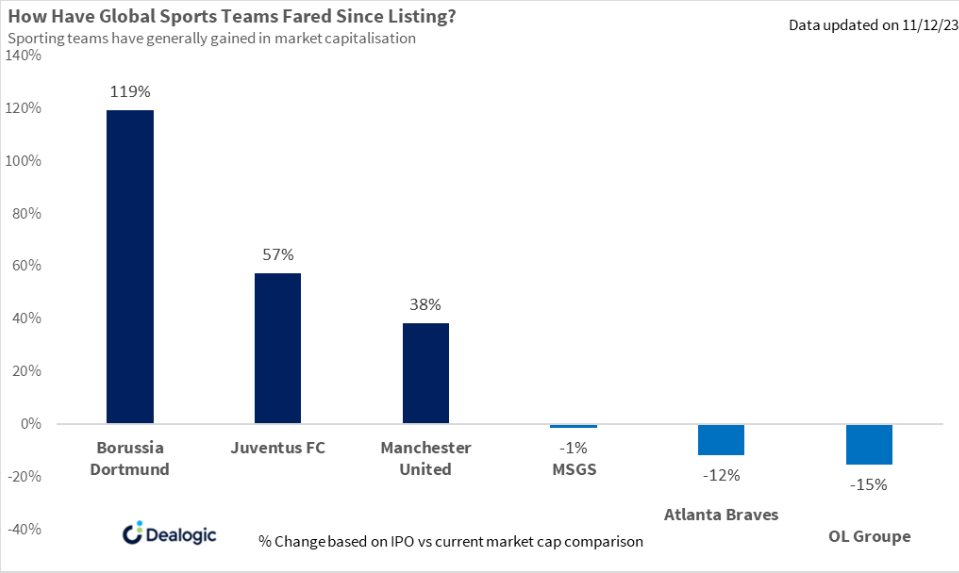

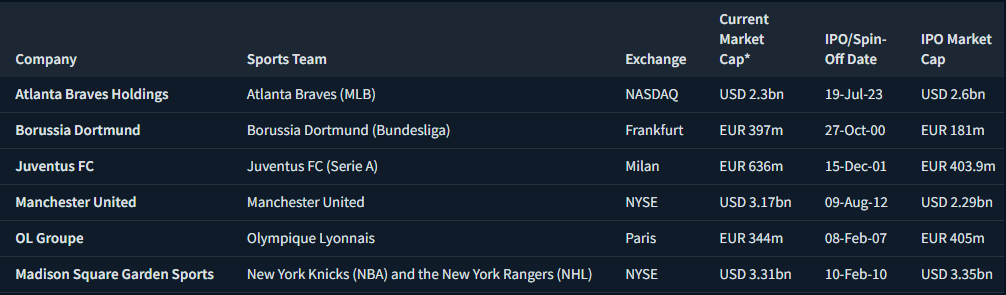

*Data as of 11 Dec 23

Among listed sports peers, Madison Square Garden Sports commands the highest valuation at USD 3.31bn, but its value has eroded from its listing in 2010.

Best performing peers include Bundesliga’s Borussia Dortmund which at EUR 397m (USD 428m) has more than doubled in value since listing in 2000, followed by Serie A’s Juventus [BIT: JUVE] 57% rise since 2001 and Manchester United at 38% after debut trading in 2012, as per Dealogic data.

Thou shall not pass?

The governing body BCCI’s go-ahead would be required for IPL teams to list. From a legal perspective, the key document for review would be the agreement between the BCCI and the franchises together with league related bye-laws, Rajat Sethi, partner at S&R Associates noted.

BCCI is often regarded as an ‘opaque’ cricket regulator and does not like much ‘external control’, the PE managing partner said.

Meanwhile, there is an over-dependency on BCCI for revenue generation, Santosh N of D&P Advisory noted that “almost 80% of the teams’ revenues are contributed by (BCCI’s) central pool that includes media rights.”

This is in contrast with global leagues, where the successful teams have a 50-50 mix of revenue from central pool and self-generated, he said.

Instances such as BCCI disqualifying teams in the past and events similar, could mean complete value erosion for investors, Santosh N said, pointing to Rajasthan Royals and Chennai Super Kings being suspended for two years in 2016-17, as punishment for ‘corruption and fraud’ by officials of the teams.

Also, the schedule for Indian Premier League is around two-three months between March and May each year which means there are no means of revenues for teams during rest of the year, the PE fund managing partner noted. However, it may also be noted that IPL franchise owners have bought sister franchises in other cricket leagues such as the Caribbean Premier League (CPL), South Africa’s SA20, UAE’s International League T20 (ILT20) and US-based Major League Cricket (MLC) that host the tournaments in other geographies during other months of the year.

Three teams each in CPL, ILT20 and MLC are IPL’s sister franchises while SA20 league is entirely IPLs sister franchises, but these leagues are very small and revenue generation is minuscule as compared with the IPL, the partner said.

The franchises should get their act together with respect to merchandising which is a significant revenue contributor to successful global leagues, Santosh N said.

Some of the global sport teams generate as much as 25%-30% of their revenue from merchandising as opposed to 1%-2% for IPL teams, he said.

However, there is a slim opportunity to make money from merchandise in India as piracy and counterfeiting dominate the market and, there is a dire need for official curbs and strict policies to be implemented, the PE managing partner noted.