IGI, Sai Life Sciences or Inventurus? Investors set to focus on fundamentals, growth as Indian IPOs get competitive

- IGI’s IPO expected to be oversubscribed by 5x+

- Sai Life Sciences’ IPO priced aggressively at 203x earnings

- Inventurus’ IPO priced reasonably, with 30% grey market premium

The initial public offerings of International Gemmological Institute, Sai Life Sciences and Inventurus Knowledge Solutions come as investors are presented with too many options from the same country, among which only companies with solid fundamentals are set to collect most monies, said market participants.

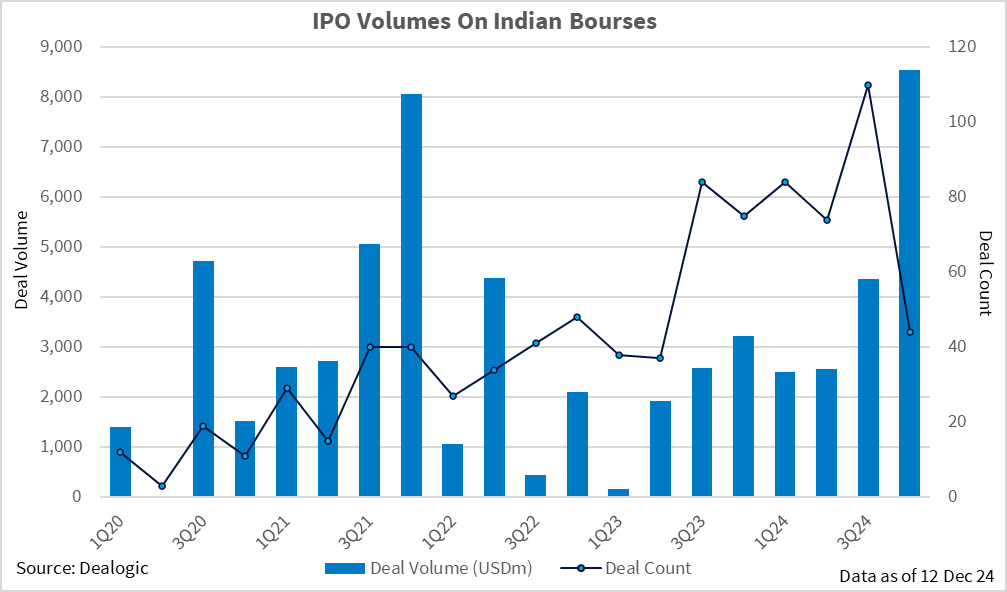

The three deals, which together will fetch over USD 1bn, coincide with a USD 944m maiden share offer by supermarket chain Vishal Mega Mart. They will add to USD 8.5bn already raised in the fourth quarter as of 6 December, rounding up what is set to be the country’s busiest IPO quarter ever, based on Dealogic data.

Blackstone-backed International Gemmological Institute (IGI) – whose plans for a listing in India was first reported by this news service – is expected to garner the most enthusiastic response of the three listings, an ECM advisor noted. It could be oversubscribed by 5x or more, he added.

India’s IPO market has been driven by strong investor sentiment and robust economic outlook, and investors remain selective rewarding fundamentally strong businesses with clear growth trajectories, said Utkarsh Sinha, managing director at Bexley Advisors.

Blackstone acquired 100% ownership in IGI in May 2023 from Fosun, and Roland Lorie for around USD 570m. It is raising USD 498m via the IPO which is a combination of primary and secondary share issuance by Blackstone. International Gemological Institute’s IPO has a price band of INR 397 – INR 417 (USD 4.6 – USD 4.9) and its books would be open for subscription from Dec 13 – Dec 17.

At the upper end, IGI would raise nearly USD 500m from the IPO, valuing it at USD 2.13bn, terms show.

Morgan Stanley India, Kotak Mahindra Capital, Axis Capital and SBI Capital are jointly running the deal, terms show.

Pharmaceutical contract research and manufacturer Sai Life Sciences, which is backed by TPG Capital saw a good opening on Wednesday with its book being subscribed 84%.

Its asking price to earnings ratio of 203x is too aggressive as compared to its peers, an analyst noted. Peers Divis [NSE: DIVISLAB] trades at 86x earnings, while Syngene [NSE: SYNGENE] trades at 73x earnings, per the NSE website.

The company reported a net profit of INR 62.3m in FY22, INR 99.9m in FY23, and INR 828.8m in FY24.

This significant rise in net profit in FY24 was clearly jaw dropping, a note by Bajaj Broking said.

Sai Life Sciences is raising USD 359m with a majority portion being an offer for sale. The IPO is offered at INR 522–INR 549 per share, valuing the company at USD 1.35bn. Books will close tomorrow (13 December).

Morgan Stanley India, Kotak Mahindra Capital, IIFL Capital and Jefferies India are the deal’s managers.

Tech-based healthcare solutions provider Inventurus Knowledge Solutions, is priced reasonably, at 54x earnings. It is commanding a grey market premium of around 30%, indicating a better-than-average response, the analyst said.

Inventures is looking to raise USD 295m in the IPO that’s entirely an offer of sale valuing the firm at USD 2.65bn,. Its books open today and will be available for subscription until Dec 16.

Gauging the euphoria of Indian investors for IPOs this year, Sinha noted. “India is one of only large economies of import which has economic and political certainty, which makes it an attractive destination for investible, return seeking capital. Couple that with increased retail participation at a higher level than ever and we have the recipe for a hot, if not overheated IPO market.”

J.P. Morgan India, Jefferies India, ICICI Securities, JM Financial and Nomura are managing the deal.

IGI, Sai Life and Inventurus didn’t respond immediately to emails and phone calls seeking comments.