HVAC dealmaking builds up steam – Dealspeak North America

Heating, air-conditioning and plumbing companies in North America have seen a surge in M&A activity, driven by aging equipment, stricter environmental regulations and retiring business owners.

Investors have been attracted to building services such as HVAC – that is, heating, ventilation and air conditioning – because of their high level of fragmentation and strong recurring revenue streams, said Robbie Kelley, a partner in Solomon Partners’ Business Services Group.

“Investors like industries driven by non-discretionary maintenance, repair and replacement services,” he said.

At the same time, business owners in a sector dominated by mom-and-pop operations, many of them founder-led, saw an opportunity to sell their companies to investors, according to Michael Mufson, managing partner at Mufson Howe Hunter.

“Many of these businesses are owned by baby boomers looking for an exit strategy, making this a mutually beneficial environment,” he said.

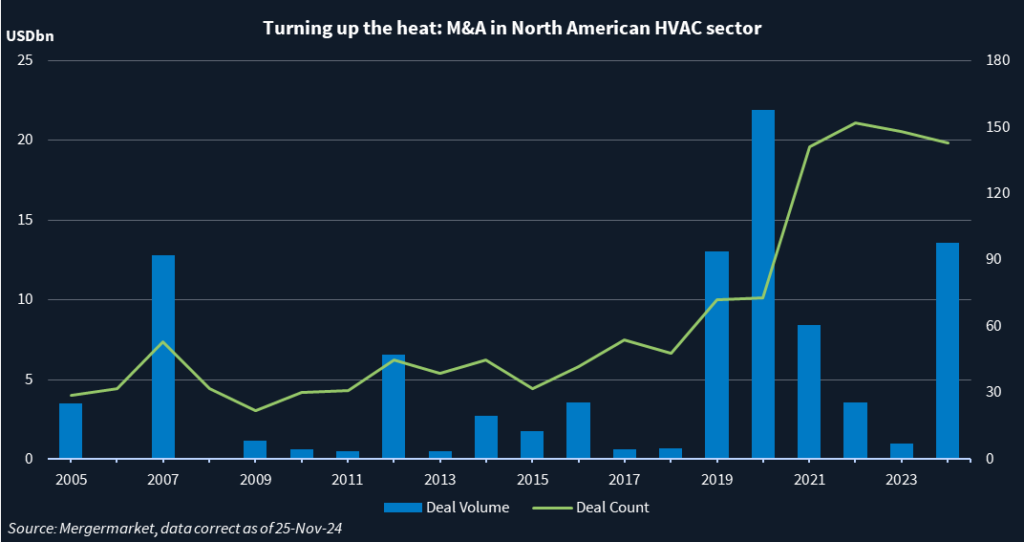

Mergermarket data shows deal volume for North American plumbing and HVAC service providers and manufacturers reached an all-time high of USD 21.9bn in 2020, as locked down homeowners, offices and commercial property managers made repairs and upgrades to mechanical systems. While volume sank in subsequent years, dropping to USD 1bn in 2023, it has jumped again to more than USD 13.5bn in the year to date.

Deal count is arguably a better metric since the value of most sector transactions is rarely disclosed. Activity swelled in 2019 and 2020, before a major surge from 2021 onwards, according to Mergermarket data (see chart below). The 143 deals signed so far in 2024 are on pace to surpass the record 152 transactions agreed in 2022.

Sponsors turn up the temperature

Financial sponsors are taking an increasing interest in North America’s HVAC and plumbing businesses.

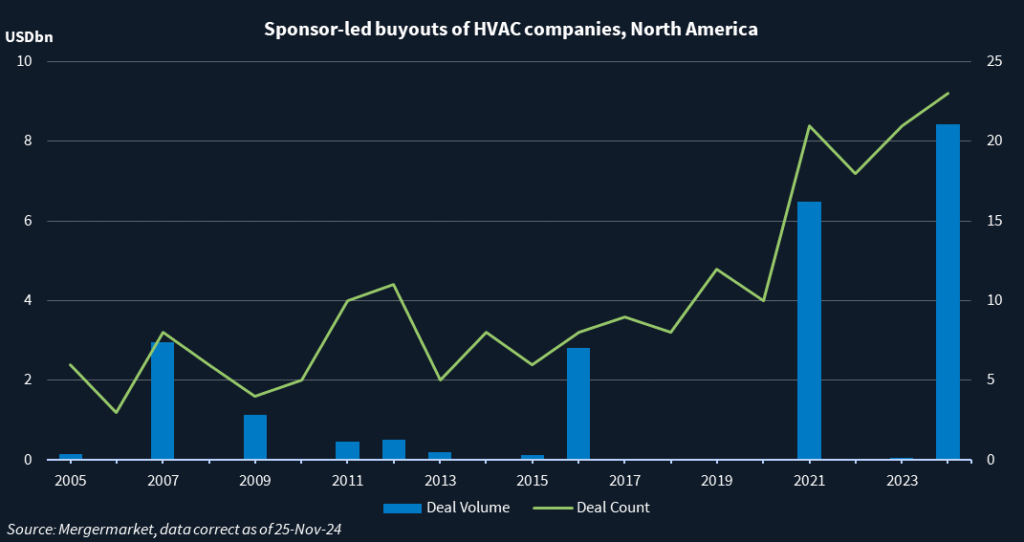

The number of buyouts has reached an all-time high of 23 so far this year, more than double the total in 2020, after which activity surged (see next chart).

Buyout volume has also increased to USD 8.4bn so far this year from USD 6.5bn in 2021.

In one of the year’s larger transactions, Sila Services, a provider of HVAC, plumbing and electrical services, was acquired earlier this month by the private equity business of Goldman Sachs Alternatives from Morgan Stanley Capital Partners.

Although terms of the deal were undisclosed, sources told this new service Sila had about USD 80m in EBITDA and the sellers wanted an exit multiple in the mid-teens.

Another large sponsor-backed deal included the sale of Emerson Electric‘s stake in Copeland to Blackstone in a USD 3.5bn deal in June.

The largest transaction, however, involved a strategic buyer: Bosch’s USD 4.6bn bid for Johnson Controls’ residential and light commercial HVAC business in July.

The heat is on

Industry insiders say the robust levels of dealmaking in the HVAC and building services space will continue for the foreseeable future.

Solomon’s Kelley said investors remain attracted to the space because of a large, aging installed base of HVAC equipment that will require significant maintenance and repair services – not to mention replacement – in the coming years.

For instance, the Environmental Protection Agency will require manufacturers to use more environmentally friendly refrigerants in residential HVAC systems from January 2025. To reduce greenhouse gas emissions, older refrigerants like R-410A to R-32 or R-454B will be phased out.

Decreasing carbon emissions and energy consumption is driving HVAC manufacturers to invest heavily in new equipment. That is expected to produce a backlog of work for HVAC service providers many years into the future, according to industry insiders.

Despite all the consolidation, thousands of independently owned businesses remain.

When growth in HVAC services inevitably slows, Mufson foresees HVAC parts suppliers and other adjacent sectors could become the next targets.

Evidence of that is starting to take shape. In October, Jordan Lee, a partner at private equity firm Kian Capital, told Mergermarket the firm had planned to invest in HVAC services, but pivoted to parts distribution instead prior to acquiring HVAC wholesaler Team Air Distributing.

Regardless, Mufson expects M&A activity to remain strong for the next few years. “There’s still a significant pool of sellers looking to exit and plenty of capital on the sidelines eager to be deployed,” he said.