Going Dutch: Hopes rise for Amsterdam listings comeback

Things can only improve when you touch rock bottom, and the only way is up for the Euronext Amsterdam, once seen as the likeliest top neutral listing venue in Europe.

With the UK’s self-inflicted Brexit wounds cutting the LSE off from the European single market, Amsterdam was deemed the natural home for companies with a pan-European identity or those that wanted a foothold in the EU, without the political pressure of choosing between France and Germany as a listing home.

Its neutral appeal saw a splurge of issuance, particularly in 2021; companies like Universal Music Group [AMS:UMG], valued with a market cap of EUR 45.5bn, Allfunds [AMS:ALLFG], valued at EUR 10.9bn, and CTP [AMS:CTPNV], valued at EUR 7.2bn, all came to market that year.

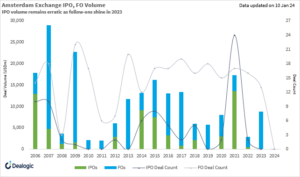

The momentum slowed to a virtual halt in 2022 and a complete stop in 2023.

Dealogic shows that there were zero IPOs on the Amsterdam Stock Exchange last year. In 2022, there was meagre IPO issuance of USD 451m.

There was USD 8.8bn in follow-on deal though recorded last year, driven largely by Mexican conglomerate FEMSA’s sell-downs in Heineken [AMS:HEIA].

One advisor noted that while handwringing over the future of the LSE has been ubiquitous, Amsterdam – a natural competitor— saw even fewer deals.

But there is hope, he said, adding that he was advising a financial services company in Continental Europe with international expansion ambitions which still sees Amsterdam as a natural location for its planned listing.

A local adviser expects volumes to pick up this year, although he added that, while he was “optimistic” on the deal pipe, he was “not bullish”.

Theon, a Cyprus-headquartered manufacturer of night vision and thermal imaging systems for military applications in Europe, is planning a listing preceded by a private placement of new shares worth EUR 100m.

Christian Hadjiminas, CEO of Theon’s parent EFA Group, intends to use the listing to expand production and explore bolt-on acquisitions.

Theon, which generated EUR 142.9m of revenue in 2022, is likely to benefit from the increasing importance of the defence sector as an area of strategic importance for Europe, said an advisor.

CVC Capital Partners, the global private equity firm, postponed a planned stock market listing in Amsterdam last year, but is expected to revisit the deal this year, a transaction that would likely add billions of euros to Amsterdam’s IPO totals.

Large backlog

There is still a logjam of other Amsterdam listings that could come through if markets improve. Frans Muller, the CEO of Dutch retailer Ahold Delhaize [AMS:AD], has said that it still too early for an IPO of its Dutch online retailer Bol.com, but there are hopes the deal could materialise in the next two years.

When contacted about the IPO plan, a Bol.com spokesperson added that management still believes that the company possesses considerable value which is currently not being fully recognized. “We like the optionality the business presents us and remain fully committed to revisit an IPO when market conditions improve and become more suitable,” she said.

A spokersperson for Coca-Cola Beverages Africa (CCBA), a previous Amsterdam IPO candidate, said the company remains committed to list once market conditions become more favorable.

In addition to these, ESW, an Irish E-commerce company backed by Swiss Post Ltd and LaPoste SA, announced plans to list in Amsterdam in 2022.

It’s time for bankers to reconnect with issuers.