Healthcare technology: R1 RCM deal shines light on revenue cycle sector — Dealspeak North America

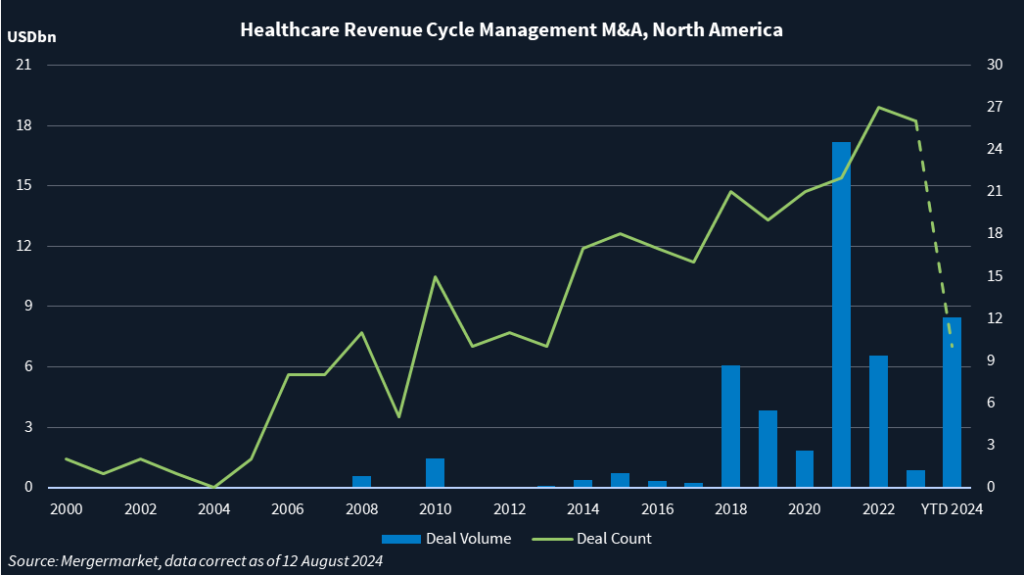

Revenue cycle management (RCM) has become one of the brightest stars in the healthcare technology firmament after the USD 7bn bid for R1 RCM [NASDAQ:RCM] from private-equity groups TowerBrook Capital Partners and Clayton, Dubilier & Rice on 1 August.

The attraction is simple: Financial sponsors and strategics continue to see blue sky for growth both organically and through acquisition in a highly fragmented market that quite literally pays the bills in healthcare.

RCM software helps hospitals, doctors and other healthcare groups bill for services and collect payments.

“It’s clearly at the top of the pyramid” for healthcare information technology (HCIT) players, says Mark Cherney, managing director of The Cherney Group, an advisory to private equity and family offices in the healthcare services area. “It can make the difference between profitability and not.”

“Improving collections and preventing denials improves cash flow and the bottom line for healthcare providers, especially in a time of razor-thin margins and increasingly complex and onerous coding and reimbursement rules and regulations,” adds Michael Siano, managing director and HCIT lead at Lincoln International.

Private equity play

One major tailwind that provides RCM companies with a large and growing addressable market is the aging of the American population, adds Siano.

More than 46 million adults aged 65 and older live in the US, a number that is expected to almost double by 2050, according to some industry estimates.

Private equity likes RCM players primarily because they have long-term contracts with healthcare providers that offer strong and predictable revenue streams, according to Lloyd Price, a partner at Nelson Advisors specializing in healthcare. They are also scalable and have the potential for operational improvement. And because healthcare providers only need one RCM system, the relationship tends to be sticky, he adds.

Other deals are likely to follow suit, predicts Price.

Cherney says he consults with 40-50 financial sponsors on a regular basis, and “they’re all looking, they’re all interested” in R1 RCM or a peer of appropriate size and expertise in the billing and collections business primarily.

Technology-driven RCM companies can command multiples of 20x EBITDA or more, say dealmakers. In April, Model N agreed to a USD 1.28bn buyout by Vista Equity Partners for USD 1.28bn, roughly a 25x multiple of EBITDA, according to one HCIT banker.

More services-driven RCM players see lower multiples in the mid-to-high teens, say dealmakers. RevSpring, a healthcare IT company, sold in March to a group led by Frazier Healthcare Partners for USD 1.3bn, or roughly 13x EBITDA, this news service reported.

The RCM landscape

Some RCM groups are focused on one specialty such as ambulatory surgery centers, others are multi-specialty. Yet others offer RCM packaged with other software, such as electronic medical records, practice management or patient engagement tools. All are seen as attractive potential targets.

Only a handful of large players with more than USD 100m in EBITDA exist, according to Siano. Besides R1 RCM, other large players include Ensemble Health Partners (backed by Berkshire Partners and Warburg Pincus) and Carlyle-backed CorroHealth.

Few mid-market players with around USD 30m to USD 100m in EBITDA exist too. They include ChrysCapital-backed GeBBS Healthcare Solutions.

Most players have less than USD 30m in EBITDA, says Siano.

Active pipeline

The most active private-equity buyers in the RCM space include Vista, KKR, Silver Lake and Carlyle Group, says Price. All have a history of investing in HCIT generally and any could make a rival bid for R1 RCM, says Price. One impediment: Towerbrook already owns a 36% stake.

In any case, the deals for R1 RCM, RevSpring and Model N should push other strong assets to market.

Vista Equity-backed Greenway Health was exploring a sale in March, Medlytix plans to relaunch a sale effort, and Accuity kicked off its process in May, according to Mergermarket.

Both Meduit Group and Elevate Patient Financial Solutions are working with advisors on a sale, while GetixHealth tried to sell for a third time in February.

Active strategic buyers include Constellation, Oracle [NYSE:ORCL], and UnitedHealth Group [NYSE:UNH], says Price. Others include RLDatix, Ventra Health and Med-Metrix.

RCM companies in the spotlight

| Company | Financial Sponsor | Financials | Latest Intel |

|---|---|---|---|

| eIVF | Atlantic Street Capital Management | USD 7m EBITDA | eIVF taps Harris Williams for sale, sources say |

| Shearwater Health | WindRose Health Investors | USD 50m in EBITDA | Shearwater Health appoints Harris Williams to explore sale, sources say |

| VisiQuate Inc | Sixth Street Growth | USD 30m in revenue | VisiQuate taps Houlihan to explore sale, sources say |

| GeBBS Healthcare Solutions Inc | ChrysCapital Investment Advisors | USD 800m deal valuation | Hillhouse, CVC, Carlyle among shortlisted bidders to acquire GeBBS Healthcare Solutions – report |

| Knowtion Health | Sunstone Partners | N/A | Knowtion Health exploring sale, sources say |

| Medlytix | N/A | Medlytix to restart paused sale effort, sources say | |

| Elevate Patient Financial Solutions Inc | The Edgewater Funds | Marketed off USD 50m-USD 60m in EBITDA | Elevate Patient Financial Solutions exploring sale, sources say |

| Meduit | NexPhase Capital | USD 50m in EBITDA | Meduit Group exploring sale again, sources say |

Source: Mergermarket, data correct as of 09 August 2024