Healthcare M&A in recovery — Dealspeak North America

Healthcare dealmaking is back on the mend in some subsectors.

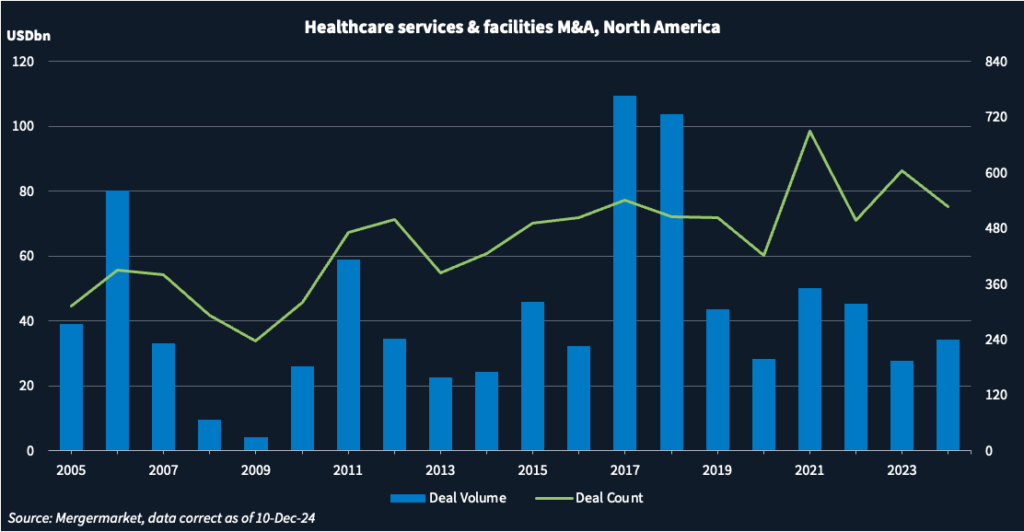

Fourth-quarter deal volume for North American healthcare services and facilities has surged to USD 14.8bn, the highest level in three years, according to Mergermarket data.

For the year-to-date (10 December), the data shows volume of USD 34.3bn, up 24% compared to the whole of last year. The number of healthcare transactions, however, fell from a record high of 689 in 2021 to 526 in 2024 YTD.

But with interest rates trending downwards, easing inflation and the elections behind us, a surge in healthcare M&A could happen in 2025, said dealmakers.

The election of Donald Trump as president and the Republican sweep of Congress could lead to loosening regulations on banks, which are eager to lend into deals again, and ease regulatory scrutiny on private equity buyers, according to Roger Strode, a healthcare M&A lawyer at Foley & Lardner.

Financial pressures on healthcare facilities faced with rising labor costs, plus the concern smaller clinics have of highly damaging data breaches, could lead to increased healthcare M&A, said Strode and Jeanne Whalen, a healthcare lawyer at Dykema.

Mergermarket knows of 475 US and Canadian companies either in the market or expected to come to market, of which 78 are in the healthcare sector.

Regulatory push-pull

The Supreme Court’s June decision to overturn the Chevron doctrine, which takes away the ability of government agencies to interpret laws and gives it to the courts, will impact the healthcare sector.

“We may see a pullback” in the authority of the Department of Health and Human Services (HHS) and other healthcare agencies, said Strode. If that happens, “companies will feel empowered to do more creative dealmaking.”

In addition, the Federal Trade Commission, HHS, and Department of Justice, launched an inquiry in March into private equity’s role in healthcare consolidation, citing concerns about “maximizing of profits at the expense of quality care.”

Under the Republicans, “the witch hunt” against private equity should weaken in intensity, even if left-leaning senators maintain it, said Strode. “Scrutiny certainly gets slowed down greatly,” he said.

Myriad state regulations around data privacy also will drive many smaller clinics and hospitals to sell to larger organizations that have better systems or insurance in place, said Whalen. “Data is going to continue to be a driver, particularly on the sell side.”

Behavioral health and dentists

Behavioral health – whose services include mental health, substance use disorder, eating disorders, counselling, autism services and myriad others – has seen a resurgence of M&A in recent months.

Recent deals include Behavioral Innovations’ sale to Tenex Capital and Caravel Autism’s transaction with GTCR. That should spur momentum for other sponsor-backed platforms looking for a ‘second bite’ PE recapitalization.

Atar Capital-backed Clarvida, previously known as Pathways Health & Community Support, is one behavioral health platform that could exit to another financial sponsor in 2025.

Other areas attracting PE interest include fertility clinics and dental service organizations (DSOs), although the latter faces headwinds.

The number of DSO buyouts has sunk substantially in 2024 YTD to 41 from 2023’s record of 75, according to Mergermarket data.

The DSO industry suffers from over-leverage and limited growth, leading some financial sponsors to use continuation funds given the lack of buyers, said Rich Beckman, a strategic advisor at Beckman Consulting. Many also face operational challenges, including staffing remote locations, rising wages, and obtaining higher reimbursement rates.

Larger DSOs are seeking bargains, especially of so-called “fixer-uppers” with lower EBITDA multiples, looking to replicate the approach used by Great Expressions Dental Centers (GEDC), added Beckman.

“Several PE firms want to sell their DSOs and they hope that as interest rates decline, the market will become more receptive,” he said.

One exploring a sale, Mergermarket reported, was Staple Street Capital-backed Eastern Dental.

Hospitals

The expiration of 2020’s federal stimulus from the Coronavirus Aid, Relief and Economic Security (CARES) Act laid bare many of the financial issues faced by smaller hospitals, exacerbated by rising labor costs, staffing shortages, inflation, and softening reimbursement rates, said Strode.

Large hospital systems that remain financially strong are “now seeing opportunities to bring other hospitals and health systems into the fold,” said Strode.

Major hospital transactions in 2024 included the sale of several operated by Steward Health Care System, which filed for bankruptcy protection in May.

“We are currently seeing an uptick in the number of financially distressed hospitals up for sale [or] disposition across the U.S., both inside and outside of bankruptcies – most of which will close the first half of 2025,” said Gary Herschman, a healthcare transactional attorney at Epstein Becker & Green.