Hargreaves Lansdown bid increase could be justified as CVC consortium mulls next move – Morning Flash EUR

Our analysts pick out hints of future material developments in M&A and ECM situations to produce an exclusive report that offers short and long-term actionable ideas (no investment action should be taken without further investigation). If you have ideas for coverage, please email [email protected]

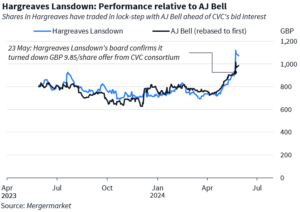

Hargreaves Lansdown‘s [LON:HL] board said it had rebuffed a GBP 9.85 per share offer from a consortium comprising CVC [AMS:CVC], Nordic Capital and Abu Dhabi Investment Authority (ADIA) last week (23 May) citing undervaluation as a key factor.

With shares in the stockbroker closing yesterday at GBP 10.72, 9% above the rejected bid, it’s clear the consortium will need to do better if it wants to secure a deal.

And there are a few factors which support the case for an improved offer, according to analysis by The Morning Flash.

Most prominent among them are the premium and valuation pitched by the consortium. The GBP 9.85 per share bid represented a premium of 6% to Hargreaves’ share price of GBP 9.33 on 21 May 2024, one day before the offer was made public. It should be noted the consortium’s offer was made at a much earlier date, on 26 April, when the offer represented a premium of around 34% to Hargreaves Lansdown’s stock price of GBP 7.36 a day earlier.

The bid implied a price-to-earnings ratio (PE ratio) of 14x forecasted earnings for the year ending 30 June 2024, according to data provided by Fidessa* and compiled by FactSet.

Key peer AJ Bell [LON:AJB] trades at 20x expected earnings for the comparable period.

There’s also a precedent transaction which indicates the consortium’s offer may have undervalued Hargreaves Lansdown. The GBP 1.5bn acquisition of close comparable Interactive Investor by Abrdn [LON:ABDN] in 2021 was conducted at a valuation of about 32x EBITDA.

At GBP 9.85, the consortium’s offer would have valued Hargreaves at around 10x forecasted FY24 EBITDA. AJ Bell trades at 14x EBITDA for the comparable period.

If CVC and its fellow bidders can up their offer, they should have a good chance of securing a deal. Peter Hargreaves, one of Hargreaves Lansdown’s founders with a shareholding of around 20%, sold 19.5m shares at a price of GBP 15.35 per share during February 2021. That indicates the founder could be open to an exit at the right price.

While a bid at that kind of level looks unlikely for now, a moderate offer bump could be enough to win support from the target’s board and key shareholders.

The consortium has until 19th June 2024 to make an offer for Hargreaves Lansdown under Takeover Code rules.

At a PE ratio of between 17x and 18x, Hargreaves Lansdown could be worth in the region of GBP 11.66 and GBP 12.34 per share, according to analysis by The Morning Flash. An offer in this range would represent a premium of between 25% and 32% to the target’s share price prior to when the consortium’s bid became public – albeit a much bigger bump compared to when the offer was first made during April.

*ION Analytics and Fidessa are ION Group companies