Germany’s Evolv launches solar debt fund

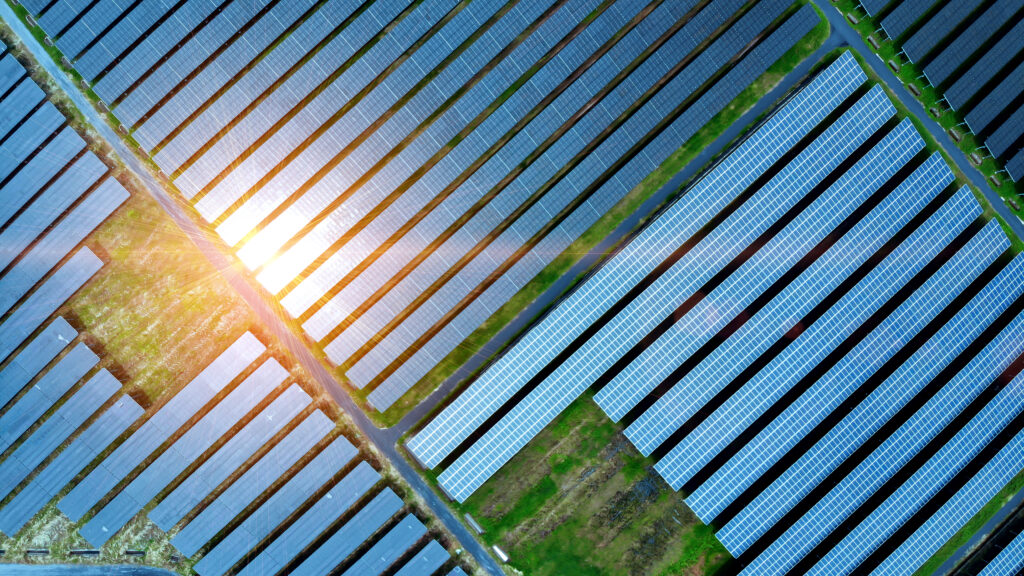

German infrastructure and real estate investor Evolv Asset Management has launched its inaugural renewables fund, a solar debt fund called Evolv Alternative.

The fund is looking to raise EUR 300m, co-founder and CEO Marc Drießen told Infralogic in an interview. It aims to reach a first close this December and a final close in December 2025. It targets German solar projects in development stage, providing debt financing, and can also opportunistically finance related assets, such as energy storage.

Ticket sizes will start at EUR 5m and average around EUR 10m.

Evolv already has EUR 15m worth of investments ready, waiting seed financing and an additional pipeline of EUR 37m. The fund, which will be marketed in Europe, targets a net return of 8% for its investors.

Evolv Asset Management is a renewable energy and real estate-focused firm established in 2023. It currently manages EUR 300m in the real estate sector. It is part of the Fox Group, which is a Hamburg-based investment firm with EUR 3bn under management focusing on real estate, renewables, infrastructure and digital businesses in the fintech, proptech and cleantech sectors