Gamida and South Hills add to healthcare bankruptcies; Red Lobster files in Florida – Weekly US Restructuring Insights Report

Debtwire’s Weekly US Restructuring Insights Report uses data from our Restructuring Database (RDB) (click here for access) to provide an overview of in-court restructurings in the country. The RDB covers bankruptcy cases with funded debt of USD 10m or more, however, exceptions to that threshold are made for a small number of select and otherwise notable cases. The charts and tables below exclude Chapter 15 filings, and the cut-off for new filings to be added to this report was midnight Sunday (19 May).

New Filings

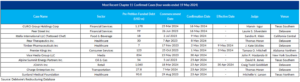

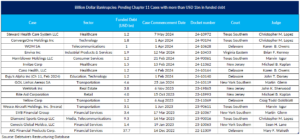

There were four filings last week that met Debtwire’s criteria: Biotechnology company Gamida Cell Inc, Colombian financial services firm Credivalores-Crediservicios SA, seafood restaurant chain Red Lobster Seafood Company, and nursing home operator South Hills Operations LLC.

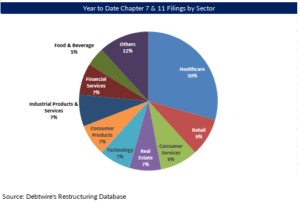

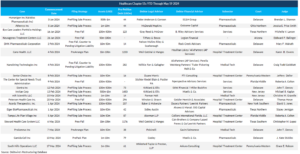

Healthcare continues to lead all other sectors in terms of new bankruptcy filings, accounting for 20 filings this year or 30% of all cases tracked by Debtwire after accounting for Gamida Cell and South Hills. Following Red Lobster’s filing, Consumer services is now tied for second – along with Retail – in terms of the number of bankruptcy filings in 2024.

The total number of year-to-date cases tracked by Debtwire is now 68 (all Chapter 11s) involving at least USD 29.95bn in funded debt versus 105 cases and USD 48.37bn debt in the same period last year.

DIP Financing

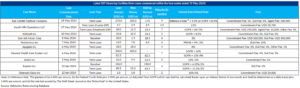

Two of the companies that filed last week sought debtor-in-possession (DIP) financing: Red Lobster (USD 275m) and South Hills (USD 43.74m).

Red Lobster’s proposed facility, which includes USD 100m of new money along with a USD 175m roll-up of prepetition secured debt, was the seventh largest DIP loan of this year.

South Hill proposed two DIP loans which will be provided by two different lenders (see below for DIP terms).

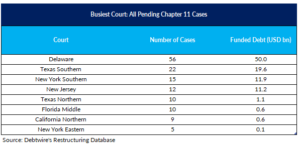

Busiest Court

The filing of Gamida in Delaware bolstered the court’s position as the top court in terms of both pending cases (56) and the amount of funded debt being restructured (USD 50bn).

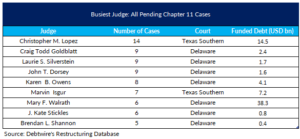

Busiest Chapter 11 Judges

Judge Christopher M. Lopez of the Southern District of Texas remained the busiest judge in terms of ongoing Chapter 11 cases tracked by Debtwire, as the table below shows.

Confirmed Cases

Curo Group and Peer Street obtained confirmation of their plans last week.