Galderma block from EQT clears well after stock decline, US correction – ECM Deal Alert

- 15m shares sold at CHF 89 each, raising CHF 1.3bn

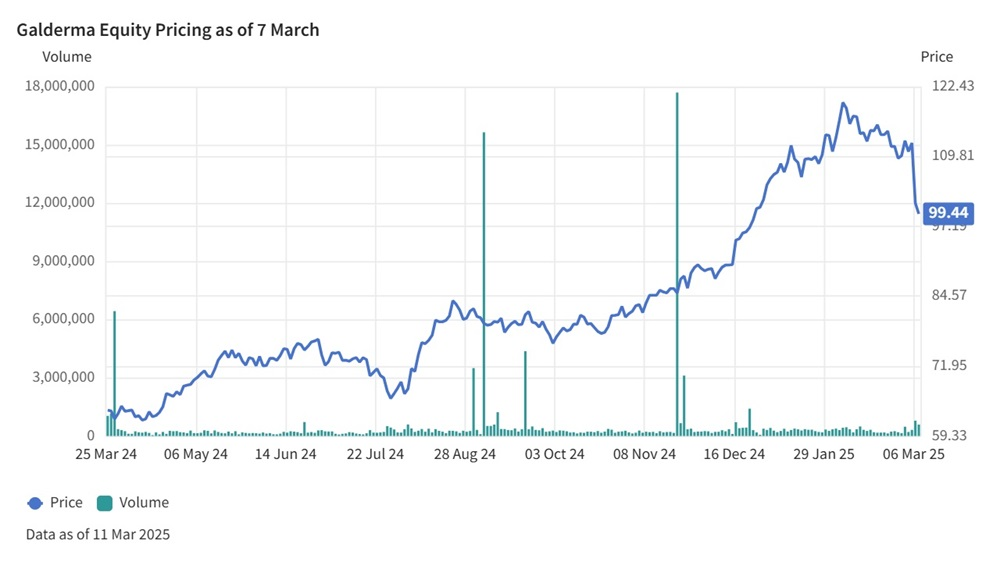

- Galderma shares down 19.3% in last month

- Price of Liquidity discount ratio -1.23x in line with March average

Swedish sponsor EQT [STO:EQT], alongside co-investors ADIA and Auba Investment, pushed ahead with a CHF 1.3bn sell-down in Swiss skincare company Galderma [SWX:GALD] after hours on 10 March, according to Dealogic, shrugging off grim progress on US stock markets and a torrid time for Galderma shares.

The S&P 500 closed 2.7% lower on 10 March, while the tech-heavy NASDAQ Composite suffered a 4% decline in what was the worst day for US stocks so far in 2025, compounding a miserable month for equities stateside.

Last night’s deal equally followed a torrid few weeks for Galderma shares, which had fallen 19.3% from its recent high of CHF 119.56 on 5 February.

The drop in the stock, despite generally solid full year results, has been attributed by some reports to a decline in its injectable aesthetics revenues.

Galderma is also heavily exposed to the US and is likely to be impacted by tariffs imposed by US president Donald Trump.

Despite stock-specific and wider market difficulties, EQT and its co-investors pushed ahead with the deal on Monday evening, showing a degree of fortitude in a storm of volatility.

The 15m share sale was priced at CHF 89 each, a 7.79% discount to the previous day’s closing price of CHF 96.52 per share, meaning the deal printed at a ratio of -1.23x to the percentage of the stake sold, as tracked by Dealogic’s Price of Liquidity (PoL) metric.

Over the past 30 days, the average daily trading volume for Galderma is 265k shares a day, according to data from Fidessa, meaning the block represented around 56 days of trading.

The monthly weighted average PoL so far for March is -1.2x to the percentage stake sold and was -1.5x a month ago.

While the Galderma trade was therefore in line with the March average, given the deal was widely expected, it might have landed an even tighter discount in an easier market.

This news service previously reported that the three shareholders were sitting on handsome gains after the strong post-IPO rally and were expected to sell-down after the lock-up expired on 19 February.

Although out of lock-up, the shareholders will have had to hold fire until Galderma posted its FY24 results on Thursday 6 March, meaning Monday 10 March was realistically the earliest monetisation opportunities for the three shareholders post-results.

Putting to one side wider market turmoil, the sponsor-backed trade was cleanly executed and attracted substantial demand.

Books were opened at 16:41 GMT and covered in just over ten minutes, according to two deal notes seen by this news service.

The transaction was launched following a wall-crossing exercise, according to the same deal notes.

A subsequent deal update indicated that the deal was “multiple times oversubscribed” at the final price.

BNP Paribas, BofA Securities, Goldman Sachs, Morgan Stanley, and UBS were global coordinators on the deal.

The EQT-led consortium listed Galderma in March 2024 at CHF 61.00 per share, at a market capitalisation of CHF 12.6bn, only slightly above the CHF 10.2bn figure it acquired the company for in 2019.

Both the 2019 acquisition and subsequent sell-downs were conducted through EQT-led holding company Sunshine SwissCo AG.

The block trade was priced at a market value of CHF 23bn, according to Dealogic, still well above the entry price and IPO price, despite recent declines.

As this news service has previously reported, Galderma has a significant following among many of the long-only investors who bought it at IPO.

The company’s largest institutional shareholders, as of the end of last year, include Wellington Management, Fidelity Management & Research, BlackRock, Vanguard and TIAA, according to Dealogic data.

Last night’s three selling shareholders, who now own a combined 48.2% stake in the company, have agreed to a 90-day lock-up which ends on 11 June.

On the morning of 11 March (10:09 GMT), Galderma shares were trading at CHF 91.16 each, 2.4% above the block strike price.