Froneri sponsor PAI Partners targets USD 2bn for second continuation fund

- GSAM lead investor as PAI re-flips from 2019 CV

- Transaction is expected to close in September

PAI Partners is considering a USD 2bn raise for its second continuation vehicle (CV) involving UK ice-cream manufacturer Froneri, according to two sources familiar with the matter.

CVs are vehicles that are designed to extend private equity (PE) ownership of companies beyond the expected lifespan of a previous fund.

Goldman Sachs Asset Management (GSAM) is anchoring the new CV as lead investor, both sources noted. The deal is expected to close in September, one of the sources and a third familiar with the situation said.

Evercore is advising PAI Partners on realising liquidity from Froneri, according to media reports.

One of the largest single-asset CV-on-CV transactions in the market, the transaction could value Froneri around EUR 15bn including debt, according to a press report.

GSAM intends to acquire limited partnership (LP) interests of more than 25% in PAI Strategic Partnerships II, the new CV formed to control PAI’s 50% stake in Froneri. The general partner (GP) had held the asset in the 2019 PAI Strategic Partnerships I CV formed in 2019, which also housed Italian eyewear company Marcolin, with the latter sold to VSP Vision last week.

LPs in PAI Strategic Partnerships I included Goldman Sachs Private Equity Group (part of GSAM), HarbourVest, Carlyle’s AlpInvest, Aberdeen Standard Investments, and the Hampshire Council Pension Fund, according to Mergermarket data.

Froneri was formed as a 50/50 joint venture between PAI and Nestle in 2016 – and the Swiss food giant is set to continue holding its own stake. Once the latest CV move is completed, PAI’s stake would be shared between its latest flagship fund, PAI Partners VIII, and the CV, as per the press report.

In July 2024, Abu Dhabi’s sovereign wealth investor ADIA was reported to be weighing a EUR 1bn investment in Froneri.

In the European summer, Froneri raised a EUR 2.9bn-equivalent euro-US dollar term loan B and EUR 1bn-equivalent of senior secured notes to fund a EUR 4.4bn dividend shareholder distribution in connection with the proposed CV. The transaction was regarded with some trepidation by several market participants, who noted that the deal would double Froneri’s total net leverage from 2.8x to 5.9x, according to a Debtwire report.

However, others pointed out that the company still demonstrates strong operating performance and strong cash flows, while drawing comfort from Nestle’s continued participation in the venture. Froneri generated about EUR 1.43bn in EBITDAE in 2024, the Debtwire report noted. Froneri defines EBITDAE as EBITDA before exceptional items and share-based payment charges.

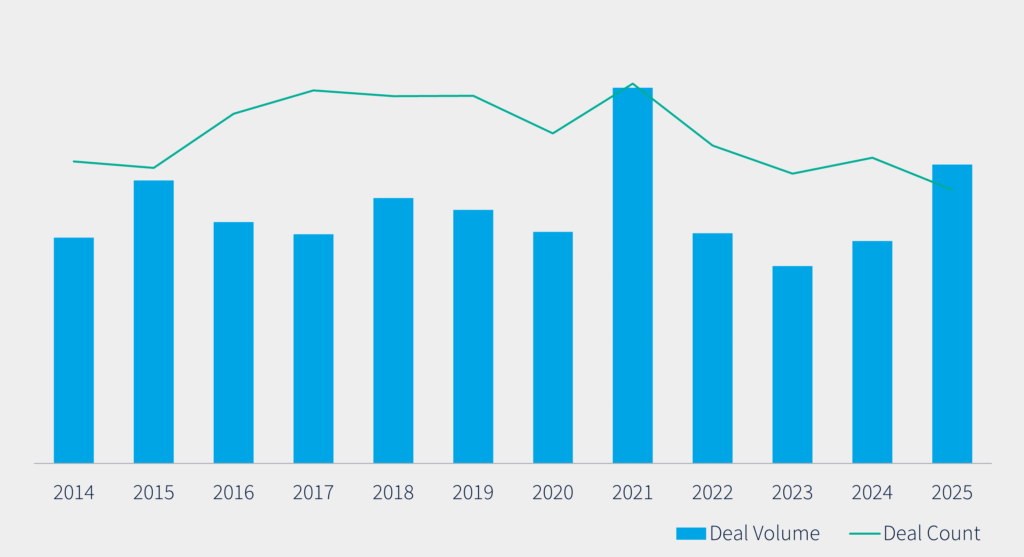

CV launches continue their strong momentum this year, with New Mountain SRC Continuation Fund topping the charts as one of the largest single-asset CVs ever raised, closing USD 3.1bn in April for its healthcare data analytics company Real Chemistry.

With the secondaries market maturing, CVs for existing continuation vehicles running up to the end of the term are emerging as another route for sponsors looking to extend the runway and as an option to generate liquidity for investors, this news service previously reported.

PAI Partners and Nestle declined to comment. GSAM and Evercore did not respond to requests for comment.