French dealmakers get ready for market reignition

French dealmakers are feeling cautiously optimistic about the reignition of the market as they return to cruising speed after the Christmas break, experts in M&A and private equity (PE) said.

Although the market has a bullish feel, it will probably take a while to hit top speed. “The necessary adjustment between buyers’ and sellers’ price expectations to take into account the new economic conditions has not yet happened”, although an improving macro scene will help, Franck Portais, CEO at Alantra France, said. A pick up in activity could be expected by the second half, a banker added.

The highly anticipated EUR 2bn+ sale of Altice Europe’s digital advertising business Teads should reach its conclusion in 1Q24, potentially setting the tone for the market.

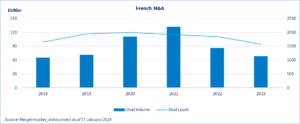

In 2023, French M&A volumes decreased by 20% to EUR 69bn across 1,581 deals compared to 2022, according to Mergermarket data. The year has had the lowest volume of sponsor-led deals in a decade as it registered 402 deals for EUR 22.6bn, a drop of around 43% compared with 2022.

However, central banks around the world are now holding interest rates steady and hinting at possible cuts in 2024. Market headwinds now feel less fierce, making dealmakers more confident, according to Marc Petitier, M&A Partner at White & Case. There could be a surge in PE activity as the debt market gradually recovers, he added.

Two sponsor-backed names to watch are BCF Life Sciences, which is working with Nomura on a sale; and Echosens, which has received inbound interest. BCF Life Sciences has a score of 58 out of 100, according to Mergermarket‘s Likely to Exit (LTE) predictive algorithm, while Echosens has a score of 59.*

“Funds were waiting for the market to stabilise but they still need to deploy so they are prepping their exits,” according to Cyril Kammoun, CEO and Managing Partner at Degroof Petercam Investment Banking in France. “Deals which have been postponed in 2021-22 could come back in the [European] autumn.”

Large-cap delay

The return of large-cap deals may take longer depending on how quickly market conditions stabilise in a year where political risks are high with two wars and looming elections in Taïwan, the European Parliament and the US, bankers and lawyers said.

In the meantime, trophy assets in high-growth industries like artificial intelligence (AI), deeptech, cybersecurity and software will continue to drive the market, dealmakers said. Small cybersecurity expert Vade Group hit the auction block at the end of last year, as reported.

Another name to watch is semiconductor components maker Linxens. Its shareholder, Tsinghua Unigroup, retained Deutsche Bank to sell its majority stake, as reported. The vendor would favour a sale to a private equity sponsor, with state-owned investment group Bpifrance and PE firm Ardian circling.

Meanwhile, deals involving financial services and healthcare will also drive the market. For example, sponsor Five Arrows Principal Investments (FAPI) mandated Arma Partners to prepare a potential sale of its portfolio company French wealth management software provider Harvest, in a sale process expected to launch this year, as reported. Harvest has an LTE score of 59.

When will the market pop?

A recovery in the market in the first quarter of 2024 seems realistic, although France is unlikely to hit the levels of activity seen in 2022 for the time being, Degroof Petercam’s Kammoun said. “We are working on a number of deals, with a pipeline driven by corporate deals, which represent around two-thirds of our pipeline”.

Strategic buyers are well and truly back at the table, a trend expected to continue this year, dealmakers said.

Industrials have come back quite strongly in 2023, including in tech, as PE-backed information technology (IT) services companies such as Inetum and Talan have sponsors that are pushing hard for acquisitions, Michael Azencot, Partner at Cambon Partners, said. “Trades used to dread dual-track deals but that is not the case anymore,” he added.

Last month, the sale process for French luxury crystal maker Baccarat entered its final stage, as reported. The buyer mix was dominated by strategics and some European family offices, including Switzerland’s Richemont [SWX: CFR], Austrian crystal producer maker Swarovski, and Finland-based Fiskars Group.

However, trade buyers are also affected by the macro difficulties. Trades are also suffering from the macro difficulties and “some might even want to dispose of non-core assets”, Portais of Alantra France said.

Clariane [EPA:CLARI], an operator of nursing homes, clinics and retirement homes, is an example of this trend. It announced plans for EUR 1bn in divestments in November.

by Myriam Mariotte and Arezki Yaïche in Paris, with analytics by Santosh Shetty

*Mergermarket’s LTE predictive analytics assign a score to sponsor-backed companies to help track and predict when an exit could occur through M&A, an IPO, a direct listing or a deSPAC transaction

To see more features discussing EMEA deal trends, please click here. To save this content search, select the star on the top right of your screen. Once you have done this, you can click the bell icon to activate email alerts for similar articles.