Franchise interest at ‘fever pitch’ as private equity takes notice — Dealspeak North America

When franchise service organization FranDevCo sold to L2 in January, the auction process attracted 100 private equity firms, according to Patrick Galleher, managing partner of sell-side adviser Boxwood Partners.

Likewise, when Hagan Kappler stepped down as CEO of Riverside Company-backed Threshold Brands, a holding company for home services franchises, in early 2023, she got calls from 36 private equity firms to gauge her interest in their franchise businesses.

Private equity interest in franchises “is at a fever pitch,” said Kappler, now CEO of Daisy, a venture capital-backed home automation franchise. “The interest continues to increase each year,” said the executive, who recently attended the International Franchise Association convention, which counted several PE groups as sponsors.

“Franchising is almost like a mini diversified fund,” said Scott Sutton, Chief Development Officer at Empower Brands, a multi-brand franchisor of commercial and residential services backed by MidOcean Partners. “Private equity has become bullish on the sector.”

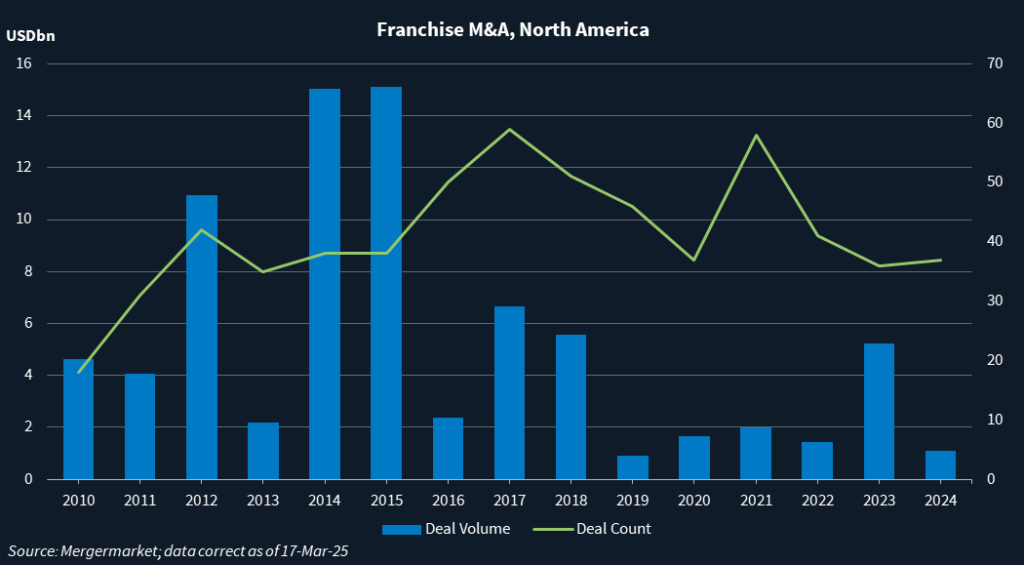

Despite the strong PE interest in franchises, North American M&A volume has been volatile, Mergermarket data shows.

Deal volume in 2023 jumped to USD 5.2bn, the highest level since 2018, before sinking to USD 1.1bn in 2024. This is partly because only five of last year’s 37 transactions disclosed deal value, an unusually low proportion. In prior years between 25% and 50% of transactions disclosed deal value. That makes the number of deals arguably a better metric. Since 2010, deal count has been on an upward trajectory, punctured by troughs in 2020 and 2023.

Growth levers

Franchise businesses offer PE firms two levers of growth: brand acquisitions as well as franchise footprint expansion.

That’s been the case for Unleashed Brands, a youth enrichment platform backed by Seidler Capital since 2023, and LaunchLife International, a Phoenix Partners-backed franchisor of postsecondary and K-12 educational institutions. Unleashed Brands CEO Michael Browning told Mergermarket that in addition to continuing to acquire, it plans to cross-sell new brands to existing franchisees. LaunchLife CEO Darryl Simsovic, meanwhile, told this news service that the company will acquire globally and grow organically by deploying its Academy of Learning or Pitman Training curriculum to English-speaking jurisdictions around the world through franchisees in India, Australia, and the Middle East.

The strong PE interest stems from a desire for recurring revenue and highly profitable businesses, a profile similar to software companies but at more attractive valuations, Kappler said. On the downside, franchises are highly regulated, she noted.

Riverside is a longtime franchise investor. It was the majority owner of The Dwyer Group from 2003 to 2010 before reinvesting in 2014 and then selling it to Harvest Partners in 2018, after which it was rebranded Neighborly. Harvest Partners sold Neighborly to KKR in 2021.

Other PE groups that have invested in franchise platforms include BCI and Apax Partners, backers of residential services platform Authority Brands. Princeton Equity Group and Roark Capital also have several franchise platforms.

Franchisee runway

Valuations for franchise businesses continue to be strong. As long as the companies have proof of concept, strong franchisee relationships, and have enough royalties to support operations, these businesses can trade in the low to high teens of EBITDA, Sutton said.

Private equity sponsors also have been making investments at the franchisee level lately, an emerging trend. “It’s an interesting opportunity for franchise owners in the future. I think we’re going to see more of that,” Sutton said.

A case in point is Restoration Alliance, a Tacoma, Washington-based ServiceMaster Restore franchisee. Kevin Condon, partner with Hidden River Strategic Capital told Mergermarket in January that there are more than 800 franchisees across 14 countries in the Restore system serving residential and commercial customers. The company is only interested in acquiring businesses within that ecosystem.

“There is a lot of runway to grow our business and help the entire franchise system to grow its presence,” he said.