Follow-ons from 2024 IPOs on track to fulfill year of abundance – ECM Explorer North America

- 2024 IPO cohort makes up significant volume of blocks

- Sponsors selling shares while stocks are high

- Lock-up expiries to trigger more transactions in 4Q

Despite a dip at the beginning of this quarter, Q4 is still expected to be a busy time in terms of follow-on transactions.

Block trades related to the 2024 IPO cohort have accounted for the bulk of 3Q issuance and a slew of high-profile transactions closed at the end of September.

So far, Q4 has had lower volumes, though ECM bankers and advisers say this is more of a temporary slowdown rather than a concerning stop.

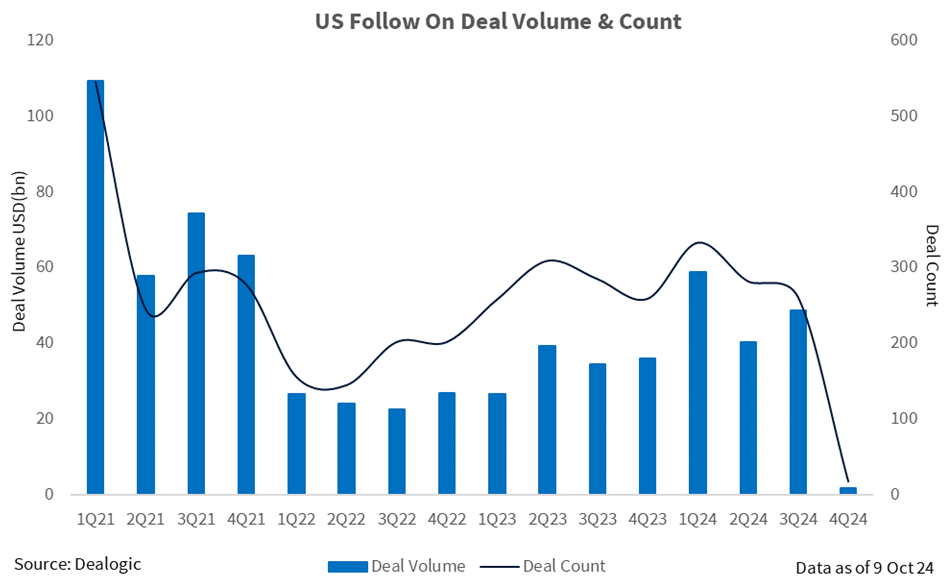

According to Dealogic, Q3 alone recorded USD 48.7bn in follow-on deal value, higher than USD 34.6bn in the same period the year before.

The previous two quarters have consistently outperformed the same periods for the past two years. So far in Q4 there has been USD 1.7bn in issuance from 16 deals.

Issuance has been steady since Labor Day, with one banker referring to “a ton of follow-ons.”

There were several jumbo billion-dollar September sales in newly listed companies, such as UL Solutions [NYSE:ULS], PACS [NYSE:PACS] and GE HealthCare [Nasdaq: GEHC], the spin-off from GE [NYSE: GE]. Last month there was also a USD 2.5bn block trade in oil and gas company Diamondback Energy [NASDAQ:FANG], as well as in another 2024 IPO, Viking Holdings [NYSE:VIK].

The banker, who was close to the UL Solutions deal, said sponsors have been alert when it comes to selling shares while stock prices from recent IPOs are high, showing that they are keen to recycle capital at the earliest opportunity.

“UL Solutions doubled its market cap” the banker said, adding that other issuers are planning to take advantage of surging stock prices on recent IPOs.

An ECM lawyer also picked up on the activity, which he expects will continue with a slew of transactions in the second half of this month and especially in the run-up to the end of the year immediately after the election.

“We are expecting sponsors to sell down more,” he said. Some prospective candidates are summoning underwriters as they gear up for the moment the lock-up breaks, he added.

This news service recently highlighted potential opportunities such as a lock-up expiration for Vertex Aerospace, which holds a 54.4% stake in V2X Inc [NYSE: VVX], ending on 19 October. Further expiries are on the radar for recent IPO debutants such as Ibotta [NYSE:IBTA] and Centuri Holdings [NYSE:CTRI].

“This is the indication IPOs are working, money is flowing and investors are up for those deals,” said another banker. “The message is that IPOs have done well enough that investors are happy to see another deal within a lockup of 80 days.”

Ahead of 2025, this banker said that these are clear signs that the IPO market is starting to work as it should. “Companies can do follow-on offerings sooner than normal, and this is a trend we expect to see continuing,” he noted.