Fireside chats replace books amid buyer’s market in US beauty sector – Dealspeak North America

- High-quality assets bypass broadly marketed approach

- Few strategics can offer ‘stretch’ multiples, PE appetite wanes

- Sellers wary of failed processes in a cautious market

For high-quality beauty assets, broadly marketed sale processes are giving way to quiet rounds of fireside chats with a select group of strategic buyers.

A dwindling number of strategics are actively taking part in M&A, and that, in turn, is driving down private equity interest, according to three investment bankers. Since last year, sellers are more often lining up meetings instead of seeking a wide pool of potential suitors.

“Hosting fireside chats is now the equivalent of sending out books,” a beauty sector investment banker said.

Among recent sales following this playbook, Amika – a hair care and styling tools brand backed by Bansk Group – initiated fireside chats with strategics, this news service reported last month.

PE firms are taking a more cautious approach than normal, favoring add-on acquisitions over new platform investments, said Kenneth Wasik, head of investment banking at Capstone Partners. This is partly because of market conditions and partly because the fundraising environment is more challenging.

“If you have a deal that you are looking for a higher multiple, a stretch multiple, it is more likely to come from a strategic buyer over a PE,” Wasik said.

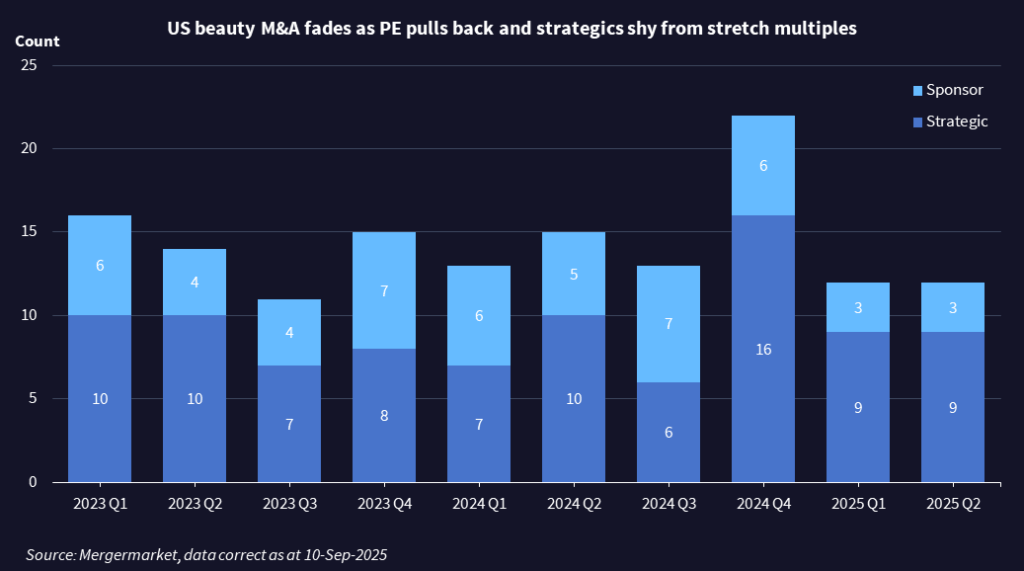

Financial sponsors accounted for 36% of beauty sector acquisitions since 2023, according to Mergermarket data. But in the first half of 2025, their share dropped to just 25% of deals.

Strategic acquirers, meanwhile, struck the only two deals valued at USD 1bn or more this year: L’Oreal’s pending USD 1.3bn acquisition of hair care company Color Wow and elf Beauty’s USD 1bn acquisition of skin care and cosmetic brand HRBeauty, which includes a USD 200m earnout.

Quiet market, lingering conversations

With PE’s diminished appetite, sellers are worried about tainting their image with a failed or paused process, another beauty sector banker said. Even top-quality assets aren’t seeing processes bear fruit, the banker added.

This trend has been ongoing since 2024, another consumer-focused banker said, and it will continue so long as earnings and stock prices remain depressed among public companies in the space. NYSE-listed Coty is a case in point: its FY25 revenue fell 4% and its share price is 41% down year to date.

Sale processes for beauty companies are never really “dead” – just quieter, another banker said. Many continue to conduct at least casual sale conversations with potential buyers even if their formal processes are on pause.

Mergermarket’s Missing in Auction feature tracks assets that have been in the market for more than six months without a transaction. They include the following beauty brands:

- Eos, a New York-based skincare and lip balm brand generating more than USD 100m in revenue, hired Centerview Partners to explore a sale, according to a December 2024 report.

- Erno Laszlo, a Trustar Capital-backed skincare brand, was in late-stage talks with Guangzhou Liby Group in March 2024 but no deal was ever announced.

- Kate Somerville Skincare, owned by Unilever, remains unsold more than a year after PwC was reportedly hired to explore a sale.

New assets testing the waters

Despite the cautious climate, some brands are quietly exploring their options. This news service has identified several that are testing the market:

- Starface, a founder-owned pimple-patch maker that generates more than USD 100m in revenue, hired Baird to explore its options.

- Bubble Beauty, a venture-backed skin care company with more than USD 100m in revenue, mandated Centerview Partners to explore a potential 2026 sale.

- Glamnetic, a founder-owned magnetic lash and press-on nail manufacturer, mandated Baird for a potential sale.