Fintech IPOs tiptoe back as market demands discipline

Initial public offerings of financial technology companies are staging a cautious comeback. After two bruising years marked by volatility and valuation resets, fintechs are again venturing into the public markets, but with greater restraint.

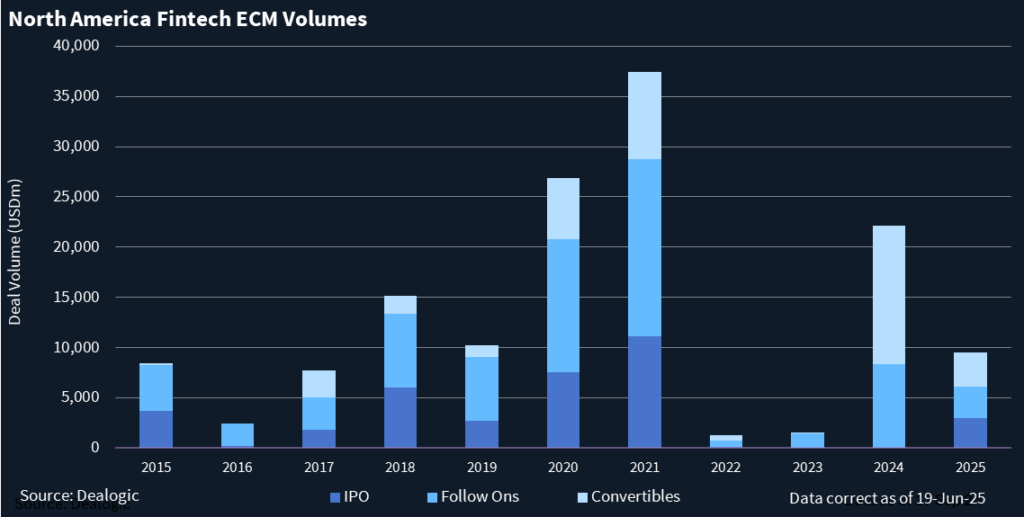

So far in 2025, North American fintech IPOs have raised USD 2.99bn across six deals in 2025, a sharp rebound from a total absence of listings in this category last year. While still shy of the USD 11.1bn raised in 2021, volumes have already outpaced 2022 (USD 148m) and are on track to surpass 2023 (USD 5.6bn).

“There’s a growing sense that the IPO window is reopening,” said an industry consultant.

Until recently, many fintechs opted to stay private, buoyed by ample venture capital and the increasing use of secondary share sales to provide liquidity. “The urgency just wasn’t there,” the consultant said.

IPOs are often viewed more as visibility milestones than growth necessities. Several companies already publish detailed financials and operate with public-company discipline.

Chime helped shift sentiment. One ECM banker said the listing “vindicated the fintech pipeline” and showed that fintech IPOs can succeed if valuation expectations are grounded. “The success of Chime’s performance shouldn’t distract from the shift in buyside perspective,” the banker said. “Issuers are going to take note and negotiate more realistic valuations.”

That reset is central. Most fintech names from the last IPO wave still trade below issue price. Chime, with its interchange-driven model, is seen as a cleaner story than Klarna, which faces regulatory scrutiny around lending and monetization pressure in buy-now-pay-later (BNPL). “They’re two very different animals,” the banker added. “Each one will have to prove itself.”

Crypto names have added energy to the market. Circle’s debut was viewed as a breakthrough. “It broke the IPO window wide open,” said a sector advisor. With Coinbase now in the S&P 500 and legislation advancing to regulate stablecoins, institutional investors are showing renewed interest. eToro also tapped into the momentum.

An accountancy firm partner noted that crypto infrastructure stories are resonating with investors, especially those focused on profitability and retention. Platform strength and customer durability now matter as much as growth itself, the sector advisor said.

Down-round IPOs are becoming normalized. Chime sought to enter the public markets at a markedly reduced valuation, reaching a fully diluted market cap of USD 11.6bn, which was well below the company’s USD 25bn valuation in 2021.

“That stigma is fading,” said the sector advisor.

A fintech lawyer said many issuers ultimately face the same choice: “It’s not the valuation we hoped for, but it’s one we can live with.”

With June historically strong for IPOs, some issuers are moving quickly before summer slows activity. Another lawyer warned that tariff uncertainty could again weigh on sentiment. But for now, the relative calm is giving prepared companies a window to move.

Fintech follow-on activity has also rebounded, with USD 3.17bn raised across 16 deals in 2025; full-year volumes for 2024 stood at USD 8.3bn. Convertibles, long favored by companies in the wider tech sector, have seen volumes reaching USD 3.19bn across 12 transactions so far, yet it is too early to say if issuance can reach the double-digit USD 13.7bn seen last year.

Several names remain on investors’ IPO watchlists – both medium and long term. Plaid is in no rush but plans to go public once it can demonstrate profitability and product momentum, said Freya Petersen, head of corporate affairs.

Revolut is still debating whether to list in the US or London, following its UK banking license approval and amid growing US political uncertainty.

Monzo, in the meantime, continues to downplay short-term IPO talk, with CEO TS Anil recently saying the bank is not focused on going public. Still, investor meetings have begun, with Morgan Stanley expected to play a lead role ahead of a possible 1H26 debut, as reported.

Brex is preparing a private round to clean up its cap table and bring in crossover investors before a potential listing.

After years of hesitation, fintechs are re-entering public markets with tempered expectations, a sharper focus on fundamentals, and a clear-eyed view of what today’s investors demand.