Fintech catches second wind as profitability, scale, new catalysts drive IPOs

- Issuers increasingly larger, better prepared, more resilient

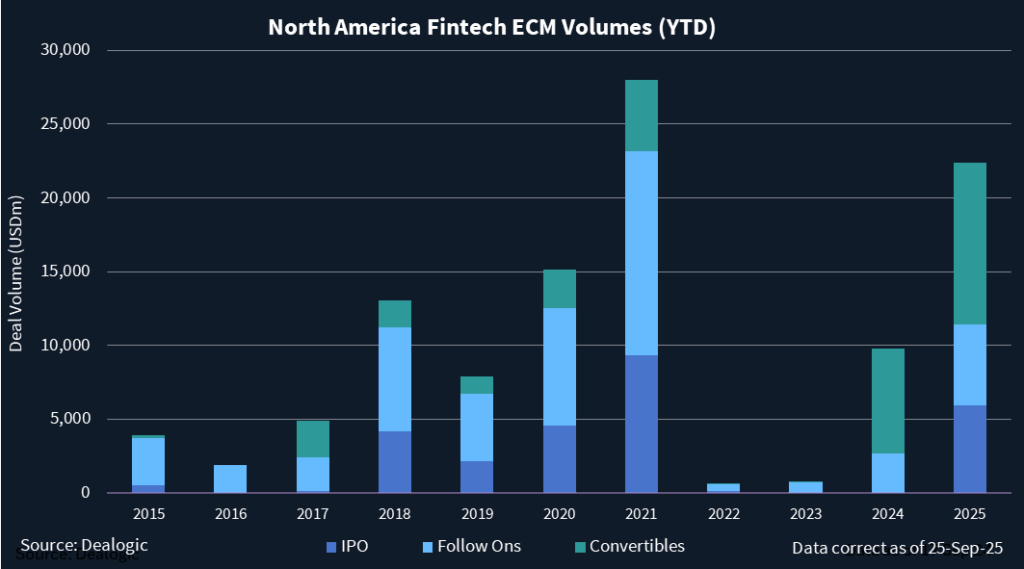

- Nine fintech IPOs have raised USD 5.92bn so far in 2025

- Convertible bond issuance for sector is highest on record

For much of the past decade, the rise of financial technology was defined by scale, speed, and the promise of disruption. Companies went public on potential, not profits. That story is shifting.

When Swedish buy-now, pay-later (BNPL) firm Klarna listed its shares on the New York Stock Exchange this month, it marked a turning point: investors were no longer satisfied with growth alone. Profitability had become the decisive factor.

“If you look at Klarna, they were already profitable. In the past you were seeing IPOs around potential, where this is really proving out the use case,” said Jonathan Langlois, US Payments Strategy leader at KPMG.

Klarna delivered not just black ink but scale — 111 million users and 790,000 merchants — that helped it price above market and jump 16% on day one. Its shares have since fallen to just above its IPO price. For many, the deal symbolizes how fintech IPOs are evolving: winners must combine profitability, unique value propositions, and exposure to fast-growing trends like embedded finance and stablecoins.

Devon Kirk, general partner at Portage Capital Solutions, sees the same forces reshaping private markets. “There are long-term secular tailwinds for fintech,” she said. “But a lot of generalist investors came into the space without fully appreciating risks unique to fintech. That exuberance has now normalized.” Where once capital-intensive firms traded at software-as-a-service-like multiples, valuation frameworks have grown more disciplined, she said.

Now, only companies with clear, compelling stories are breaking through, Kirk said.

IPOs return, but not for everyone

Klarna followed peers like Chime, Circle, and Figure. The pipeline is stirring again, with more listings in the queue and 2026 listing speculation swirling around marquee names like Stripe and Revolut.

Nine fintech IPOs have raised USD 5.92bn in North America so far in 2025, according to Dealogic. That is the most since 2021, when 15 fintechs raised USD 9.3bn.

“Fintech was on this great upward trajectory but then it took a bit of a pause for a few years. Now it is going back up,” Langlois said, noting that investor appetite is strong, especially for issuers tied to artificial intelligence or the blockchain infrastructure that supports cryptocurrencies. “If issuers have a very compelling case around AI, investors are going to be very interested,” he said.

Already, fintech AI investment in the first half of 2025 nearly matched all of 2024.

Langlois sees AI not as a job destroyer but as an enabler, driving efficiency and new products.

Both he and Kirk agree: The companies reaching the market today are larger, better prepared, and more resilient. Smaller IPOs are struggling. This is an era of multibillion-dollar entrants.

In addition to IPOs, there have been 31 fintech follow-ons this year, raising USD 5.49bn.

Convertible bond activity has been especially pronounced in the sector, with 24 equity-linked fintech securities raising more than USD 9.85bn so far in 2025 — the highest on record.

One reason for renewed optimism in the sector is regulatory clarity.

In the US, initiatives like the Genius Act are reshaping conversations around crypto and BNPL. What were once fringe ideas are moving mainstream. Langlois said BNPL adoption has accelerated with inflation, while earlier doubts about its resilience in downturns have faded. Klarna’s integration with Stripe shows how instalment options are becoming a seamless part of checkout flows.

Stablecoins, meanwhile, are sparking fresh enthusiasm.

Circle’s IPO “saw the largest pop on the day one trade,” Langlois recalled, reflecting pent-up demand for crypto exposure under a more favorable regulatory umbrella.

Banks are watching closely. Partnerships with crypto firms may evolve into acquisitions — especially if one major bank makes the first move. “It’s a copycat business,” Langlois said. “Once someone goes first, you’ll see others follow.”

The push and pull of M&A

While IPOs grab headlines, much of fintech’s momentum still runs through M&A.

Backers often see a sale as the quickest path to generating returns. “Institutional investors generally don’t get liquidity at the IPO price but only after lockups expire. That’s one reason many still lean toward M&A rather than IPOs, even as the market comes back,” Kirk said. “We’ll continue to see a robust private M&A market, both for companies without a perfect IPO story and for investors preferring earlier liquidity.”

Large fintechs are also using public stock as currency for tuck-in deals.

Software giants are buying smaller AI startups to guard against disruption. Yet the mega-deals many predicted have been scarce. “Larger deals are harder because of the complexity of aligning stakeholders. We’ve seen more tuck-in acquisitions instead,” Kirk said.

AI is reshaping M&A in another way: by lowering the cost of building new capabilities, encouraging many fintechs to prioritize organic growth, Kirk added. Acquisitions still matter for customer bases or niche expertise, but they are no longer the default growth lever.

From unbundling to re-bundling

Product expansion, however, is a growth driver.

Whereas early fintechs won by unbundling banks — offering narrow, specialized services — today, leading players are re-bundling, layering multiple products to deepen engagement, boost stickiness, and drive profitability, according to Kirk.

Rising customer acquisition costs have made this shift essential. “More products, more engagement, and stronger economics are the trend,” said Kirk, pointing to Chime’s strong engagement metrics as a driver of its IPO appeal. Chime’s stock rose 37% on its first day of trading, after pricing above its marketed range, but its shares are now down 42% from the first market close.

For Langlois, the lesson is clear: fintechs should treat IPO readiness as an 18–24-month journey, investing early in risk frameworks, systems, and controls. “It is best to go ahead and start to get your house in order now, that way you are ready when the market is right,” he said.

For Kirk, the opportunity lies in underserved markets — SMBs, migrants, and cross-border payments — segments often overlooked by incumbents. “Cross-border payments remain painfully slow and inefficient, which represents a massive TAM (total addressable market),” she said.

Together, their perspectives frame a fintech sector that has moved past its exuberant adolescence into a more disciplined, opportunity-rich maturity. IPOs are back, M&A is reshaping strategies, AI is fueling the next wave of innovation, and regulation is clearing long-standing doubts.

Fintech is no longer the outsider — it is becoming the system itself.