Explosive India IPO scene attracts more issuers

- Stable economy, favorable business environment lures investors

- Foreign PE and VC firms back listings

- Upcoming IPOs from Hyundai, Swiggy, and Vishal Mega Mart to fuel momentum

India has grown into one of the largest global equity capital markets issuance hubs behind the US.

Experts across borders vouch the country is the place to be for IPOs in 2024. Funds are ensuring they invest more and also exit some of their good portfolios to bring returns home, with sector activity spanning logistics to electric vehicles.

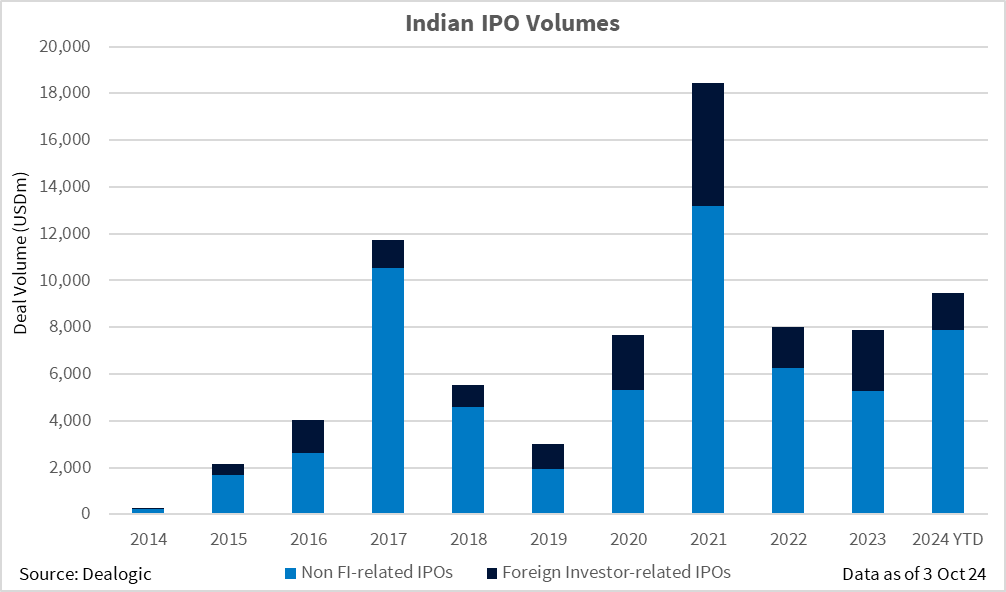

Indian IPOs have already recorded USD 9.4bn from 269 deals this year, an increase on the previous two years, which each almost hit USD 8bn in issuance. IPO activity has been strong since 2019, with 2021 recording a record of USD 18.4bn in deal volume, according to Dealogic.

Notable IPOs this year included electric two-wheeler maker Ola Electric [NSE:OLAELEC], the largest IPO to date, which raised approximately USD 734m; telecom operator Bharti Hexacom [NSE:BHARTIHEXA], which raised USD 511m; and mortgage lender Aadhar Housing Finance [NSE:AADHARHFC], which raised USD 358m.

This week, prospective candidates including Hyundai Motor India, Swiggy and Vishal Mega Mart received clearance from the capital markets regulator, the Securities and Exchange Board of India (SEBI) for their IPOs, pointing to more activity before year-end.

A market on fire

Like many markets around the world, the Indian stock market experienced a boost during the COVID-19 pandemic, driven by a global surge in liquidity as central banks slashed interest rates and injected capital to stabilize economies.

“In Asia, the surge in investor interest has led to substantial capital deployment, with India being a key beneficiary,” said Amit Singh, partner at Linklaters. “This year, India is one of the top IPO markets globally [and] particularly in Asia, with an unprecedented number of listings.”

Multinational corporations have been shifting their focus away from China in recent years due to geopolitical tensions, leading to greater emphasis on other Asia markets, said Keerthika Subramanian, capital markets partner at Winston & Strawn. By 2023, the growth of India’s economy attracted record inflows from foreign institutional investors, she noted.

Another factor that helped Indian capital markets was the rise of domestic Indian investors, who had previously shied away from investing in so-called risky asset classes in favour of fixed deposits, gold or real estate. Low interest rates on traditional savings instruments and increased financial literacy prompted these investors to explore equities and mutual funds as alternatives for better returns.

India’s stable inflation rates, proactive fiscal policies and a favourable interest rate environment are cited by advisors among the reasons behind this constructive environment.

“India’s business environment, while challenging due to bureaucracy and slow-moving democratic processes, is improving. Prime Minister Modi’s administration is focused on being business-friendly,” Singh said.

In addition, India has experienced consistent GDP growth over the past two decades, often surpassing 6%-7% annually. The country’s expanding middle class is increasingly seeking new opportunities. “India boasts a large and skilled population, with millions in the middle class. This contributes to a robust domestic market and a favourable investment climate,” said Subramanian.

Foreign play

Foreign-backed assets and international companies with Indian investment arms are getting in on the game, too.

International private equity and venture capital investors are increasingly backing Indian IPOs. According to an EY report, nearly 41% of global IPO proceeds in 1H24 came from private equity- and venture capital-backed firms and India was a key region for such deals.

Subramanian noted how India’s economic policies have reinforced international investor confidence, with listings becoming a way to tap into the country’s economic momentum.

Still, domestic-backed IPO issuance has steadily recorded higher issuance than foreign investor-related IPOs. Domestic IPOs recorded USD 7.8bn in 2024 compared to USD 1.5bn from foreign-related ones. Since 2020, domestic issuance has hovered above USD 5bn, while foreign issuance was between USD 1bn and USD 2bn.

Ahead of next year, the pipeline is growing.

Blackstone [NYSE:BX] is listing its Antwerp-headquartered International Gemological Institute, which is planning to raise USD 476.5m. Meanwhile, Prosus-owned payments app PayU is currently picking banks to list in a USD 500m or more IPO. According to reports, South Korean electronics maker LG Electronics [KRX:066570] is considering listing its India arm to raise between USD 1bn and USD 1.5bn. Other multinationals are expected to follow suit.

“Many companies will proactively plan for a dual listing and will list in India while waiting for US market conditions to improve,” said Isabelle Freidheim, managing partner at Athena Capital.

Even domestic companies that were previously exploring ways to list in the US are increasingly turning their attention back home, including from multinational corporations pursuing local IPOs for their Indian units.

“This shift is driven by the uncertain and volatile nature of the US market, high regulatory burdens, and a challenging IPO environment in 2024,” said Winston & Strawn’s Subramanian.

In previous years, many Indian startups had registered their companies in the US under Delaware jurisdiction or in Singapore for ease of capital raising and a probable US listing. During the pandemic, Indian market regulators made it easier for startups, which are likely unprofitable companies, to list on the domestic exchange.

“Companies were previously scrambling to find optimal structures, such as holding companies, to list in the US. Some companies with structures in the UK are unwinding them to list in India, while others that listed in the US are considering delisting to return to India,” said Singh.

There is also a growing realization that US listings may not offer the best valuations, said Singh, citing the better recognition and liquidity IPO candidates can find in the local market.

In the pipeline

The pace of new IPOs in India is unlikely to slow in 4Q considering the regulatory approvals that have cleared the way to a slew of upcoming issues. Advisors are looking for new deals as they anticipate a further increase in issuer opportunism and investor demand next year.

Technology is likely to be one of the biggest recipients of IPO interest, said Athena Capital’s Freidheim. According to published sources, there are more than 100 unicorns in India.

Investments in the retail, consumer goods, pharmaceuticals and well-being sectors are also driving activity. With a large, aspirational middle class, segments such as home and instant delivery and e-commerce have seen valuations soar.

Potential candidates are already emerging. Indian shopping-commerce firm Meesho is preparing for an Indian listing to raise nearly USD 500m; as part of the process, the company is flipping its registration from Delaware to India. Shiprocket, a New Delhi-based e-commerce shipping company, is planning an IPO in 12 to 18 months, according to co-founder and CEO Saahil Goel. In addition, CarDekho, a digital car-retailing platform owned by Girnar Software, will submit documents for an IPO in March 2025.