European SaaS hit by AI crosswinds as defensibility, data, discipline rule – Dealspeak EMEA

What do you do when the hype train departs for the next station? For a long stretch since the late 2010s, software-as-a-service (SaaS) had seemed the ideal sponsor investment, marrying tech valuations with strong cash flows.

The emergence and acceleration of AI models, adept at coding tasks, has complicated that picture and raises the question of just how much value the SaaS segment will add in the coming decade. Apollo has reportedly shorted several enterprise software providers’ loans on precisely this basis, per the Financial Times.

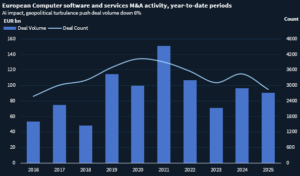

European software M&A flows this year reflect that uncomfortable shift, with activity cooling as some suitors play the waiting game to see how AI technologies impact the space.

Deal volume year-to-date (YTD) stands at EUR 90.4bn, down 6% year-on-year (YoY), according to Mergermarket data. Yet this haul remains highly consequential – and in line with the 10-year average.

Pullback from highs seen over the past five years clearly reflects a sharper investor lens on what AI does to software moats, rather than a wholesale retreat from the category.

Within the SaaS segment, AI “is exposing models that weren’t defensible to begin with,” according to Anurag Verma, senior managing director at Continuum Advisory Partners.

The picture is bifurcated. Set against the questionable business cases are SaaS business that are embedded in mission critical workflows, sitting on defensible proprietary data, or operating in regulated environments. These continue to attract premium attention.

Indeed, the recent GBP 1.05bn acquisition of UK-based payments services player GoCardless by Netherlands-based fintech peer Mollie (itself backed by Blackstone, EQT, TCMI, General Atlantic, Alkeon Capital and HMI Capital) was a meta play on European SaaS. GoCardless not only utilises the SaaS model but also positions itself as a major service provider to companies operating in the segment.

Buyers remain keen on platforms that serve as systems of record, with real-time demands, and regulatory scrutiny, elevating the cost of getting it wrong.

In financial services specifically, “AI is being used as an intelligent abstraction layer, enabling rather than disrupting these platforms,” Verma said, reinforcing rather than eroding stickiness.

Suitors have more concern about generic software businesses though “where AI can replicate simple, repeatable functionality,” Verma argued.

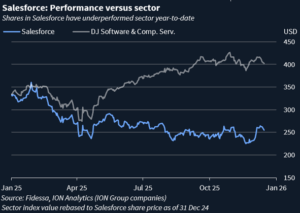

Some of these jitters are affecting listed comparables, which are then “messing with people’s valuations”, a London-based silver circle sector lawyer told Dealspeak.

He pointed to US-listed Salesforce, which is investing heavily in AI and dubs itself the “#1 AI CRM”. Those investments may come good – and Salesforce is arguably the victim of its own success, with no more worlds to conquer given its mammoth market penetration.

Nonetheless, uncertainties over this shifting landscape have seen the stock underperform peers in 2025.

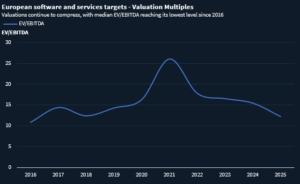

European software deal multiples have taken a knock in response.

“Where there is uncertainty around product defensibility, technology differentiation or client stickiness, that risk is now being more clearly and consistently priced into valuations,” according to Michael Maccallum, Partner and Head of Origination at Queen’s Tower Advisory.

The median EV/EBITDA multiple of deals with disclosed values this year has fallen to 12.3x versus 15.5x in YTD25 and well off the 10-year high of 26x seen in 2021.

Source: Mergermarket, data correct as at 16-Dec-25

Certainly, numerous auction processes are hitting barriers and trimming valuation expectations can be one way to bridge the gap to an exit. Mergermarket’s proprietary Missing in Auction universe (of targets where a sell-signal was tracked but no transaction has resulted) contains 116 European software companies.

With LLM models constantly iterating, it’s getting harder for undifferentiated vendors to keep up, absent a foundation in unique data or irreplaceable process integration, the lawyer said.

For private equity, this resets the playbook. Sponsors that have undertaken add-ons, then “sat back and just watched the multiples go up” will be in trouble, as focus turns value creation via acquisition integration, product velocity, and data hygiene, the lawyer added.

In this context, we can expect portfolio rationalisation through 2026 as owners exit assets “more obviously exposed to AI-related disruption,” dragging sector level headline metrics even as high-quality names rerate, Maccallum said.

And those high-quality names can continue to anticipate red carpet treatment from investors.

Valuations are strengthening “where AI clearly enables faster and better product development [and] broader platform functionality,” Maccallum noted.

The common denominators for scaling SaaS businesses and executing strong exits are defensible moats, deep workflow integration, and proprietary data.

In that context, European deal sluggishness feels merely a “pause for discernment,” Verma agreed.

That filtering will undoubtedly flush out some gems.

Listed Italian cybersecurity business Cyberoo fits the profile of companies seeking to be classified within the segment’s premium category, with a growth narrative tying together SaaS, AI and sensitive data handling. It may explore a minority stake sale to fund expansion plans, including M&A, Chief Marketing Officer Veronica Leonardi told Mergermarket earlier this month.

Businesses deploying AI to “accelerate innovation and deepen the customer value proposition [alongside] pre-existing barriers to entry” will enjoy premium valuations, Maccallum argued.

With some 162 active auction processes in the European software space, the 1Q26 pipeline is stacked.

Investors considering investment in the space are migrating away from SaaS as a buzzword towards those corporates boasting a wide, deep moat of activity in regulated workflows, proprietary data and skilled technological integration, including value-added deployment of AI solutions.

“AI isn’t killing SaaS,” Verma said. But it has killed complacency. If the AI hype train is about to depart, SaaS players’ best bet may be to buy a ticket.