European dealmakers brace for busy 2025 as financing conditions ease

The following Dealspeak reviews M&A activity for EMEA. For the global M&A highlights, please click here.

European dealmakers expect a busy 2025 with easing financial conditions expected to provide a further boost to sponsor activity across most sectors and geographies, according to Mergermarket’s Trendspotter series*.

In addition, asset management looks set to be an active sector for consolidation among strategics in the year ahead while data centre energy suppliers are expected to seek large amounts of long-term capital.

A mood of cautious optimism among dealmakers moving into 2025 comes on the back of a respectable if not stellar result for M&A in 2024, according to Mergermarket data.

Deal volumes in Europe, the Middle East and Africa (EMEA) hit USD 883bn in 2024, up 15% on 2023, but still a long way from the record years of 2021 (USD 1.6trn) or 2007 (USD 2trn). Activity in 2024 was 16% below the 10-year average for EMEA deal volumes of USD 1.05trn.

Europe accounted for 91% of the EMEA deal volumes, followed by the Middle East (6%) and Africa (3%). Meanwhile, tech was the most active sector (16%), ahead of finance (11%) and utilities and energy (10%).

The largest deal of the year was Adnoc’s takeover of Leverkusen, Germany-based chemicals group Covestro [ETR:1COV], worth EUR 16bn, which is expected to close in the second half of this year. The deal is so large it accounted for nearly 2% of EMEA deal volume.

Easing financial conditions boost PE buyouts

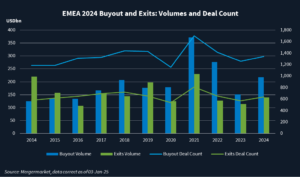

A rebound in private equity buyouts during 2024 driven by improving financial conditions was a key driver of EMEA M&A activity. Buyouts by financial sponsors increased 43% from USD 151.3bn to USD 217bn, according to Mergermarket data.

The European Central Bank (ECB) slashed interest rates to 3% in December, its fourth cut of the year. It had previously set rates as high as 4.5%. ECB President Christine Lagarde has said the direction of travel is clear next year, even if the pace of further cuts will be decided on a meeting-by-meeting basis.

Meanwhile, the Bank of England kept the UK’s key interest rate on hold at 4.75% just before Christmas. The benchmark rate reached as high as 5.25% during 2023 and early 2024. As in the eurozone, investors currently expect the BOE to reduce interest rates early next year.

Lower central bank interest rates in 2024 were largely offset by increased yields at the medium and long-end of benchmark sovereign yield curves in Europe, the US and the UK. But central bank action helped boost sentiment and spreads narrowed on the primary high-yield issuance which is often used by financial sponsors to finance M&A transactions, according to Debtwire research.

Still, PE buyouts remain a long way off the record USD 371bn tally during 2021 which came in the sweet spot between the first rollout of COVID-19 vaccines in late 2020 and Russia’s invasion of Ukraine, which sparked a global geopolitical crisis, during February 2022.

Megadeals in the pipeline

Europe’s largest deal of 2024, Covestro’s acquisition by UAE state-backed oil and gas giant Adnoc may provide an insight into dealmaking trends in the year ahead. Adnoc is expected to use the German chemicals company as a platform for further buys of European and US chemicals assets, as reported in October.

Deals with buyers from the Middle East and European targets will also feature throughout 2025. Sovereign wealth funds (SWFs) from the region are increasingly becoming more hands-on as they are help their national champions internationalise.

The National Shipping Company of Saudi Arabia (Bahri) [Tadawul:4030], which is backed by Saudi Arabia’s Public Investment Fund (PIF) and the Saudi Aramco Development Company (SADCO), is a name to watch. It wants to buy asset-light logistics firms in Europe and North America with revenues above EUR 1bn, as reported.

Meanwhile, asset management firms across Europe are looking at consolidation. One name to watch is Canaccord Genuity [TSE:CF], which has engaged bankers from Fenchurch Advisory to manage a review of its wealth management operations in the UK.

Finally, Spanish utility Iberdrola [BME:IBE] is launching a data centre unit sale with an initial valuation of EUR 2bn. It plans to invest up to EUR 10bn in the subsidiary, creating an opportunity for providers of long-term capital.

With a solid pipeline and barring unexpected shocks, 2025 should be a good year for European dealmakers.