European bid valuations risk discount push in Trump tariff fallout

The bid/ask spread has probably been the main obstacle to successful auctions over the past three years. While vendors had become more realistic in recent months, buyers are beginning to lean on market volatility unleashed by US President Donald Trump’s trade policy to see how much further they can push down bids.

“Bidders don’t actually feel that underlying valuations on most processes have changed,” claimed one banker. “The global economic uncertainty is just an excuse to make a lower offer.”

You can see why some deal advisors are calling opportunism on bidders’ part: not everything in Europe is doom and gloom.

Interest rates are down with the European Central Bank (ECB) today (17 April) cutting its benchmark rate to 2.25%, North American LPs are starting to turn their heads to European specialist funds as they seek alpha and diversification outside of the US, and Germany is leading a significant fiscal expansion that has the capacity to crowd in private capital across the European Union.

Opportunistic or not – there is scope for bidders to turn the screw. The interest rate cut reflected a “deteriorated” growth outlook, said the ECB, amid rising trade tensions. International Monetary Fund managing director Kristalina Georgieva has also said that trade conflicts will lead to “notable markdowns” in growth forecasts.

The ongoing divestment of Reckitt’s homecare brands is the most high-profile example of this so far. Reckitt’s own share price is down 9.4% from March highs. As a consumer-facing asset highly exposed to global manufacturing and distribution, it’s hardly surprising this deal has fallen under the spotlight.

Shortlisted sponsors Advent, Lone Star, and Apollo had been due to make binding offers at a valuation of GBP 6bn but non-binding proposals are reportedly coming in closer to GBP 3bn-GBP 4bn.

Meanwhile, in the mid-market, UK-based tour operator Audley Travel has been pulled from the market as vendor 3i would not accept the GBP 550m offered by last standing suitor L Catterton, this news service reported. Bidders were concerned about US consumer confidence and growth stateside had been a major plank of the equity story. The vendor had been holding out for a GBP 600m valuation.

Now it has to be said that 8% bid/ask spread may seem pretty narrow compared to the 20%-25% sector-dependent discount that sources said vendors were facing through 2023. But with Georgieva also noting today that “trade policy uncertainty is literally off the charts”, even more shielded sectors like services are likely to see some impudent bids from those looking to take advantage of market volatility.

Get low

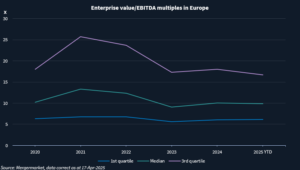

Valuations across the board have dropped since the heady days of 2021, particularly in the higher quartiles, but levelled out last year. As ever, it’s important to note our data only captures deals that managed to reach an outcome, with a long tail of uncompleted transactions because price expectations were not met.

Lower valuations for publicly traded companies amid significant stock declines over the past two weeks could set a lower benchmark for private markets, though the private equity industry is notorious for not consistently remarking portfolios. The Eurostoxx 600 is 10% lower than its year-to-date high seen just last month.

And yet concern over potential future cash flows in businesses impacted by tariffs and wider recession risk, alongside lenders adopting a more risk-off stance, means bidders may seek more upside buffer to allow for value creation post-deal. In short, a lower upfront consideration.

None of which is to say competition tension will disappear in the most attractive auctions. Indeed, vendors willing to part with prize assets at a time of uncertainty can rely on a slew of GPs driven by a pressing need to deploy capital.

French healthcare digitalisation specialist Softway Medical, which took binding offers in the days after Trump’s ‘Liberation Day’, saw Bain emerge as the winner on a 24x EV/EBITDA multiple against competition from Blackstone, EQT, Francisco Partners, Permira and Warburg Pincus.

Hold the line

How are vendors reacting in this febrile environment? While the likes of Audley Travel, Trioworld and MPM – all three perceived to be impacted directly by the impact of US tariffs – are being pulled, most sellers appear keen to continue with sale processes that are already underway.

Auctions already at cruising altitude will be signalled to attempt a landing rather than being told to turn around.

Which puts the ball into the bidders’ court – make too low an offer at NBOs and you risk not meeting the bid hurdle or the shortlist. The pinch point may come at binding offers, where suitors will have a wider understanding of their competition to help them decide what kind of offer to make.

Companies due to take first round bids in the next few weeks include Bencis-backed frozen-food wholesaler Elbfrost, procurement software provider business 3P, Portuguese hospital operator Luz Saude, and Swiss diagnostics firm Labor Team.

Italian insurer Prima Assicurazioni, and UK skin-care brand BYOMA will soon take final offers, with Davies Group and Objectway also in the second round.

In this most uncertain of times, some vendors may decide to come back another day. But the same dynamics weighing on equities and depressing valuations also mean LPs are screaming for returns. Many sellers, particularly GPs hungry to deliver distributions, may be willing to sacrifice a little on the valuation side to keep the wheel turning.