ESG deal and capital raising activity heats up amid climate-related reporting rule changes

- New regulation covers public SEC registrants, including issuers of stock and public debt

- Disclosures will also have implications for private market investors and their portfolio companies

A new SEC rule that will require US companies to summarize climate-related financial risks comes amid accelerating acquisition and capital raise activity in the governance, research and compliance (GRC) space.

Blackstone-backed Legence recently acquired San Diego-based A.O. Reed. Legence, which has made several acquisitions in the space, calls itself the world’s first Energy Transition Accelerator. A.O. Reed is a specialty mechanical contractor focused on building and servicing complex systems in mission-critical facilities.

In another deal, Holtara was created in January as a subsidiary of financial services giant Apex Group. Apex, a provider of services for asset managers merged the ESG solutions business it created in 2019 with MJ Hudson, which it acquired in 2023. Holtara’s ESG advisory service spans topics including carbon and climate, impact, diversity, equity and inclusion and supply chain.

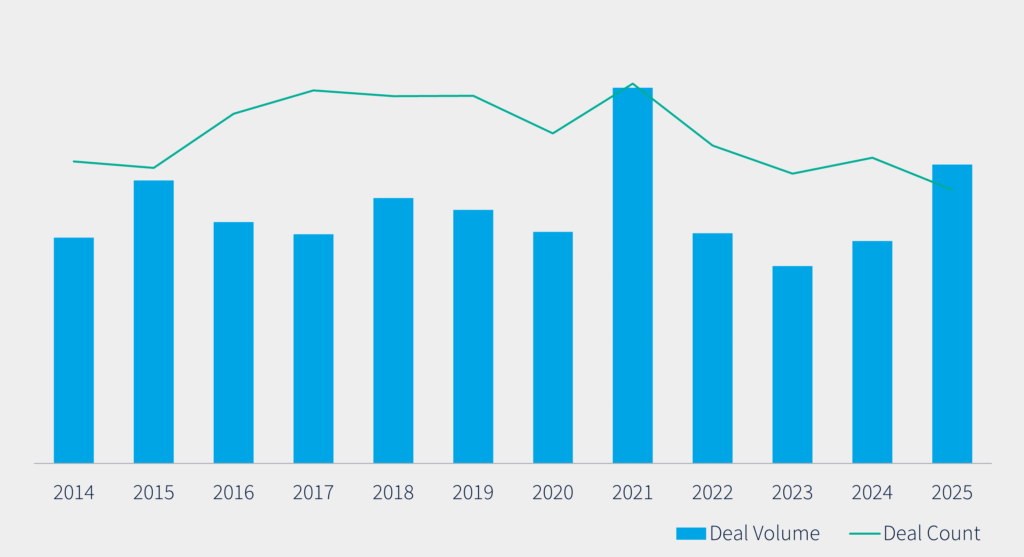

Deal volume for 2024 year-to-date has increased by more than 370% to USD 47bn across 43 deals, compared to all of 2023, where deal volume equaled USD 9.9bn with 78 deals, according to Mergermarket data. This is the highest year-to-date deal volume for the last five years.

Data includes environmental, social and governance issues, such as green, social and sustainability-linked bonds, as well as shareholder activism and M&A where these themes are a key driver.

Matt Hartman, senior manager of ESG and sustainability for consultancy Schneider Downs, said providers that have specialized experience in identifying climate-related financial risks, such as impact to physical infrastructure of severe weather events, have already been seeing some acquisition activity. It began after California passed its state law in October 2023 when the scope of the proposed SEC rule came to light, he said.

In addition to information providers, the rule will benefit providers of carbon offsets and renewable energy certificates, Hartman said. “They could see a significant uptick. Those need to be quantified,” he said. “They need to describe how they’re using these offset mechanisms to achieve their goals.”

This is particularly important for heavy industries such as manufacturing and steel production which heavily rely on offsets and carbon dioxide capture, Hartman added.

Fundraising is also heating up ahead of the rule change. Hamilton Lane just had the final close of its second impact fund, raising USD 370m to invest in sustainability-focused companies in developed markets, Managing Director and co-head of impact David Helgerson told sister publication Unquote.

Helgerson noted that a “significant amount” of the USD 4trn-USD 5trn of investment needed per year as part of the energy transition and the transition towards a net zero economy will come from private capital.

One of Hamilton Lane’s portfolio companies, Novata, announced new funding in May.

Fifth Circuit grants stay of SEC’s newly adopted rules

The US Court of Appeal for the Fifth Circuit in March granted an emergency stay of the SEC’s newly adopted climate disclosure rules. If the stay continues for an extended period of time, it may delay implementation of the rules, even if the rules are eventually upheld, according to a report by Loeb & Loeb.

“A lot of litigation is being thrown at it,” and there is uncertainty associated with the upcoming presidential election,” said Yovanka Bylander, chief commercial officer and head of the Americas for Holtara, the newly branded unit of Apex Group.

For years, states, such as California, and the European Union have been calling for increased disclosures around climate risk.

Notwithstanding the recent legal challenge to the new SEC rules, whether it is state action from California, private market pressures from European limited partners or regulators, “someone will ask for this ESG data,” agreed Chase Jordan, global private equity ESG leader for EY.

Since October of 2023, certain public and private entities doing business in California have been required to make public disclosures of their Scope 1, 2, and 3 greenhouse gas emissions. The California Air Resources Board, the state regulatory entity overseeing the implementation of these laws, is due to issue regulations guiding the implementation of GHG disclosure requirements by January 2025.

The SEC rule, which takes effect in a staggered fashion, with the largest companies going first, relies on the framework of the TCFD, Task Force on Climate Related Financial Disclosure. Under the framework, “large, accelerated filers” must comply with the law for fiscal 2025, with the data due by 30 June 2026. These companies typically have more than USD 750m in public float, said Schneider Downs’ Hartman.

Bylander said most Fortune 500 companies are already disclosing their Scope 1 and 2 emissions because California requires it. ”California is like the fifth largest country in the world,” she said.

What’s more, the European Corporate Sustainability Reporting Directive will be effective for larger companies next year and that will affect the European operations of US companies, she added.

“Reporting requirements may evolve or come and go,” Jordan said. But he recommends corporations shouldn’t let their planning efforts go to waste. “Align your ESG activities to your business activities. When you do an annual budget, do an annual carbon budget.”

Market players jostling for position

EY and its fellow Big 4 consulting firms (PwC, Deloitte and KPMG) as well as strategy houses like BCG, Bain and McKinsey began preparing themselves two or three years ago for ESG reporting changes. “There were a lot of acquisitions two or three years ago. Several rounds of tuck-ins of boutiques,” Jordan says.

“At the end of the day, companies with very complex supply chains (such as retailers and automotive businesses) are probably a bit relieved because the SEC removed Scope 3 emissions quantification,” which would govern the entire supply chain. Instead, companies only have to report on risks for their own businesses, Hartman said. The new regulation covers any public registrant under the SEC’s purview, including issuers of stock and public debt. Hartman estimated that the rule will affect slightly more than 5,000 companies.

According to a report from Malk in April, while the SEC’s climate disclosure rule is for public companies, it has implications for private market investors and their portfolio companies. Publicly traded private equity firms and portfolio companies intending to go public would need to begin publishing climate disclosures in accordance with the rule. “The increased transparency and standardization of climate information from public companies may stir institutional investors’ appetites for similar disclosures from private market sponsors,” the report said.

Social and governance gets short shrift

While environmental impact remains the main focus of new legislation, Patrick Turner, managing director at Veronis Suhler Stevenson Capital Partners, maintains that the “S” `and “G” of ESG gets short shrift. “I personally think the S and G are just as important.”

Diversity is a big issue, Turner noted. “No one’s jumped on it in terms of ESG.” Governance is also taking a backseat, Turner says it affects financial disclosure, board oversight and succession planning. “It just shows how new the industry is. Anyone who’s going to sell to a public company or whose company is public has to address it.”

Turner predicts that large consulting firms such as Accenture, Bain and McKinsey and boutiques will scramble to provide the necessary data for compliance. “ESG helps the way you run your companies.” But he said “it’s hard for PEs to pinpoint the data. That’s the Holy Grail.” There is little data available to benchmark one company’s performance against that of others, he said.

At EY, ESG is tied to financial due diligence. “We do it routinely for most of our deals,” Jordan said. This has been happening in the last two years. “A lot of it is in response to market demand.”

Jordan predicts that because of their performance mindset, private equity-backed businesses “will be the first to implement this well.”