ECM heats up with busiest August in years and September set to sizzle

- Follow-ons dominate deal flow, accounting for nearly half of total

- Strong investor appetite and pent-up supply drive increased activity

- Market backdrop remains favorable, but risks include potential volatility

It was a hotter August than usual for equity capital markets, turning what is typically a sleepy summer month into one of the busiest periods on record. Bankers say a combination of pent-up supply and strong investor appetite drove an unusually active wave of initial public offerings (IPOs), convertible bonds, and follow-on offerings.

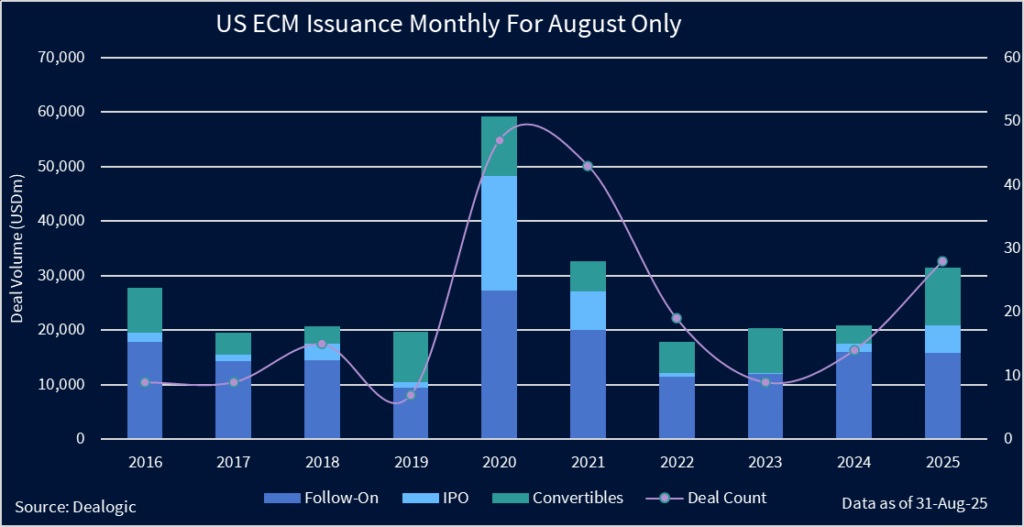

According to Dealogic data, 28 transactions totaled USD 31.6bn in ECM deal value, marking the most valuable August outside of the 2020–2021 pandemic boom. Follow-ons accounted for nearly half of the dealflow, while convertible bonds made up a third. IPOs contributed around 16% — notable in a month when new listings are usually rare.

“In the wake of the 2020–21 boom, equity capital markets have only been intermittently accessible to most issuers and secondary sellers over the last few years,” said Jimmy Baker, co-CEO and head of capital markets at B. Riley Securities. “So, there is a sizable IPO backlog and follow-on pipeline that has become conditioned to being opportunistic. August presented one of those windows of opportunity.”

Traditionally quiet, August has transformed into what David Bauer, co-head of equity capital markets in the Americas at JPMorgan, calls “a working month.” Even with vacations underway, bankers and investors stayed plugged in. “We’ve seen a steady flow of pitches and bake-offs, which looks set to continue into September and October,” Bauer said.

Mark Lehmann, CEO of Citizens JMP, agrees. “The idea that the world shuts down in August isn’t true anymore,” he said. “Kids go back to school earlier, more people are in the office, and the market backdrop was strong. Issuers saw an opening and took it.”

For some, the timing was also strategic. With an early Labor Day and a crowded fall calendar, several issuers wanted to get ahead of the September rush.

“Both things can be true,” Lehmann noted. “September will still be very busy, but August was an opportunity to beat the competition while demand was there.”

A balancing act

Investor reception has been a key driver.

“Deals are working, equities are trading well, and issuers are saying, ‘Why wait if the market is there right now?’” Bauer said.

Market sentiment indicators suggest a constructive backdrop: the VIX is subdued, and CNN’s Fear & Greed Index has been in “greed” or “extreme greed” territory all summer.

“Low levels of volatility in concert with a quality cohort of offerings gave confidence to even the most selective investors to deploy risk,” Baker said.

“We are also seeing AI investments and the cryptocurrency ecosystem attract outsized interest as investors position for more exposure to these megatrends,” he added.

Pricing has also been a balancing act. Bankers have leaned conservative, often selling just 10% of companies to ensure healthy aftermarket performance.

“It’s better to have investors feel good about the trade than push for the last dollar and risk a negative cycle,” Bauer noted.

Lehmann was blunter: “In hindsight, you’re always wrong. If a stock trades down, people say you mispriced it. If it doubles, they say the same. But demand and scarcity are driving valuations in a way I haven’t seen since the late ’90s.”

Sectors and structures

Growth stocks such as fintech and space exploration helped reopen the IPO window earlier this year, but activity has since broadened. Industrials, financials, consumer, healthcare, and tech are all active, with cybersecurity, insurance, defense, and AI now at the forefront.

“Five years ago, slide one of a pitch deck didn’t mention AI. Today, slide one is the AI strategy,” Lehmann said. “That alone has revalued companies overnight.”

In a twist, it is a recent acquisition that makes the case for IPOs, according to Lehmann.

The veteran ECM banker pointed to Aspen Insurance Holdings, which went public on the New York Stock Exchange in May. Last week, Tokyo-based Sompo Holdings signed a definitive agreement to acquire Aspen Insurance in a transaction worth about USD 3.5bn.

It showed the power of IPOs. “That was not a mysterious company that no one ever heard of,” he said of the 23-year-old business. “Going public set a valuation benchmark, the stock traded well, and then a buyer came in at a premium. The public market created value.”

Cross-border issuance remains healthy, with overseas companies increasingly weighing US listings. Despite geopolitical tensions, foreign issuers continue to choose the US.

“Our capital markets are the envy of the world,” Lehmann said. “Over the long term, the US stock market has outperformed globally, and that continues to attract foreign issuers.”

Convertible bond issuance has also surged, driven by elevated equity valuations, investor appetite for volatility, and relatively low coupons compared with traditional debt.

The road forward

Looking ahead, all three bankers see a packed calendar and healthy demand.

“The flywheel is working — issuers are getting good valuations, investors are making money, and that creates a positive feedback loop,” Bauer said.

Lehmann noted the high caliber of issuers: “There are a lot of really good companies ready to tap the market. That combination sets us up for a very active end to the year,” he said.

Whether investors agree with that assessment remains to be seen. “The market is going to be tested with another significant wave of supply in September, and the reception of those deals will be critical to this momentum being sustained into 2026,” Baker said.

Geopolitical tensions also continue to pose risks.

Volatility has stayed below the IPO-friendly threshold of 20 on the VIX, but turbulence could return. “Windows can be short-lived,” Bauer cautioned. “The lesson is to stay ready. Don’t go ‘pens down’ during volatility — be prepared to move when the market is open.”