Drone deals soar as opportunities emerge beyond defense – Dealspeak North America

- Drone M&A gains momentum with 46 transactions in 2025

- State, local government counter-drone demand may fuel M&A beyond defense

- Foreign hardware ban opens gap for new entrants

Activity in the drone technology market remains largely tied to defense spending, but opportunities in the midmarket are emerging outside the federal government sphere.

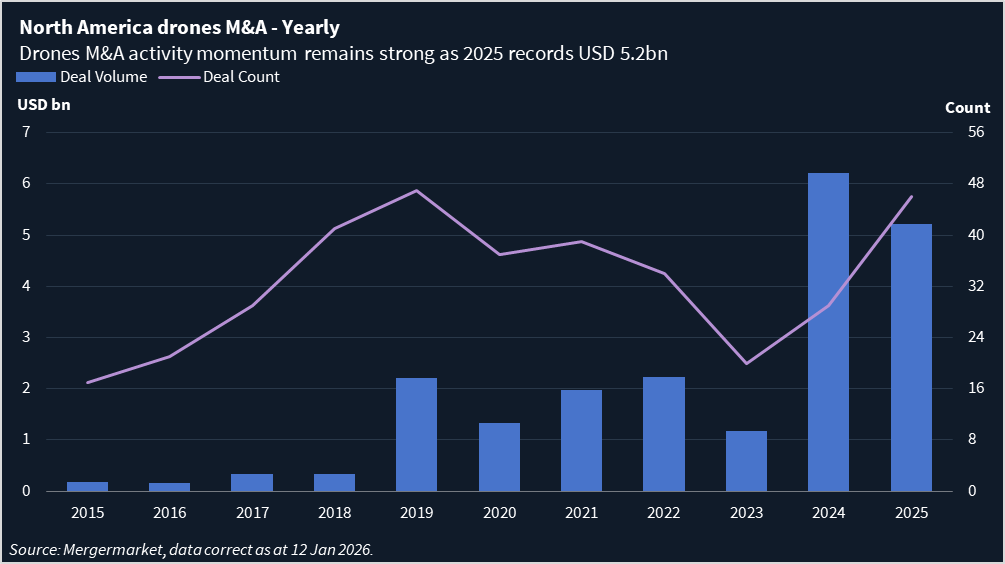

In North America, the number of deals in the drone and unmanned aerial system (UAS) space surged to 46 in 2025, up sharply from 29 in 2024 and 20 in 2023, according to Mergermarket data. Deal volume in each of the last two years dwarfs anything seen in prior years by nearly threefold, even as it dipped in 2025 to USD 5.2bn from USD 6.2bn in 2024.

The transactions are largely dominated by defense. All four deals exceeding USD 1bn fit this profile: Arlington Capital Partners’ sale of Bluehalo to AeroVironment and three capital raises by Anduril Industries. Drone, defense and aerospace software markets have all received significant tailwinds from global conflicts, this news service has reported.

The main catalyst remains the US defense budget, said Mark McKinnon, partner at law firm Fox Rothschild. US President Donald Trump has floated the idea of a USD 1.5tn defense budget for the next fiscal year, up from USD 1tn. But with a slim Republican majority in Congress, expectations for that are tenuous, he noted.

Beyond defense

Although defense dominates drone M&A, nine-digit transactions are emerging for companies that offer broader business applications.

In-Situ, which makes environmental monitoring drone tech, agreed to sell to water safety and quality company Veralto for USD 435m in November 2025. Zipline, which provides drone delivery of emergency medical supplies, raised USD 250m in 2021 and later sold stakes to Anderson Investments in 2023 and Smallcap World Fund in 2024.

US state, tribal and local governments are poised to become a major new pool of drone customers, said McKinnon. A US federal law enacted in December 2025 created a framework for these entities to gain the authority to use counter-drone or drone-detection technology to track, seize, or disable UAS.

McKinnon said this change is creating a market larger than the federal government for counter-drone and drone detection.

“The federal government, in terms of the FBI and The Secret Service, doesn’t need that much equipment,” he said. “But there are so many state and local governments that would like to have some capability.”

Many small companies in this niche – with limited sales so far – could become attractive targets to midsized and large companies that want to add these products, McKinnon said.

Foreign hardware ban

Also in December, the long-awaited ban on many foreign-made UAS came into effect, most notably affecting market heavyweight DJI, which is based in China.

Mariah Scott, CEO of drone software platform American Autonomy, said the change has created a “once-in-a-generation opportunity to reset the market, which has been dominated by these Chinese proprietary systems.”

Scott estimated DJI’s US market share at 80%. About 93% of drones in agriculture – American Autonomy’s initial focus – are made by Chinese companies. “That’s a massive market hole that’s going to be filled,” she said.

American Autonomy is approaching that opportunity with a pick-and-shovels strategy, countering DJI’s closed ecosystem by offering an open system that allows users to share and analyze data, Scott said. The company, which sold the integrated hardware operations of its former entity Rantizo to a specialized investment group before rebranding, plans to raise capital in the coming months.

While the effective ban of DJI and other foreign manufacturers could cause some disruption, many overseas hardware providers will likely find ways to comply with the requirements through waivers and establishing US-based manufacturing operations, McKinnon said. Acquiring their way into the US market is less likely, given high multiples and builders’ preference for their own processes, he added.

Companies to watch in 2026

- EagleNXT (formerly AgEagle) – The agricultural drone maker is exploring acquisitions to diversify into defense, surveying and mining.

- Shield AI –The developer of AI-powered fighter drones, valued at USD 5.3bn last March, is planning a large private round in mid-to-late 2026 ahead of an IPO.

- Chaos Industries – The counter-drone radar company raised a USD 510m Series D at a USD 4.5bn valuation in November to ramp up manufacturing.

- Fortem Technologies – The counter-drone technology startup is raising USD 50m Series B in 1Q26, with a strategic review expected in 2H26.

- Neros – A maker of first-person view (FPV) drones with US Army contracts, Neros raised USD 75m Series B in November and aims to build the US’s first one-million drone factory.

- Kratos Defense – Its Mako, Valkyrie, and Gremlin drones have drawn speculation of a Northrop Grumman bid.