Disruptive 1H25 fails to stem Canadian M&A deal flow

- Oil and gas dominates first half of year

- Undercurrent of deal flow still raging, dealmakers say

As Canada has gone elbows up in the face of geopolitical hostility, its dealmakers have not yet gone pens down.

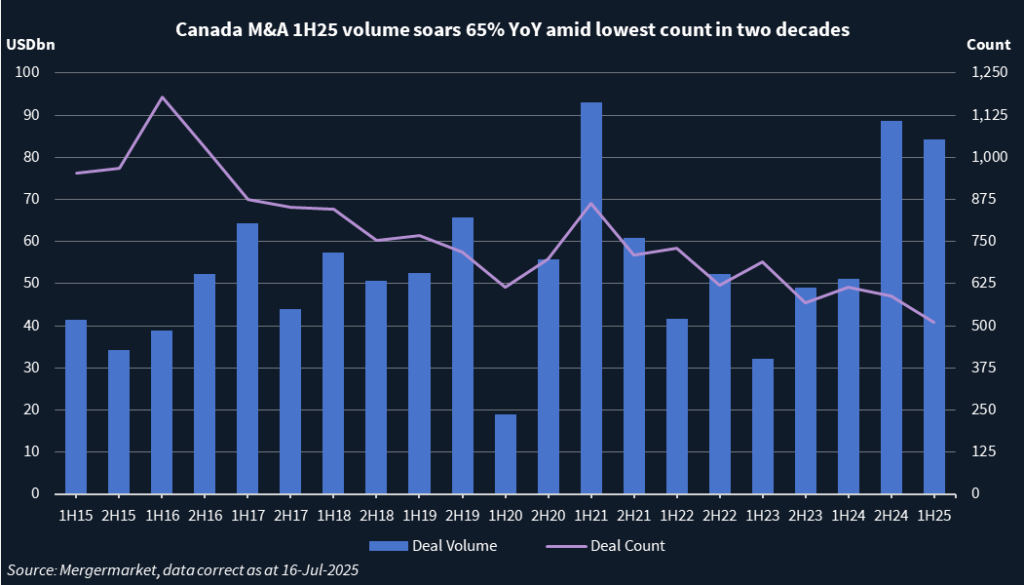

Large deals, particularly in the energy sector, manifest in a substantial year-on-year (YoY) boost to deal volume by dollar size. Canadian M&A totaled USD 84.2bn in the first six months, spiking 65% from 1H24.

This contrasts with deal count, which ebbed to its lowest rate in two decades at 511. However, despite the calmer waters, advisors and dealmakers say there is a strong undercurrent of deal flow.

For some, not even the T-word – whether that is tariffs or US President Donald Trump – can stymie optimism for the second half and 2026.

“Everybody is getting a little more comfortable with being uncomfortable,” says Brett Franklin, president of MNP Corporate Finance, who is based in Winnipeg, Manitoba.

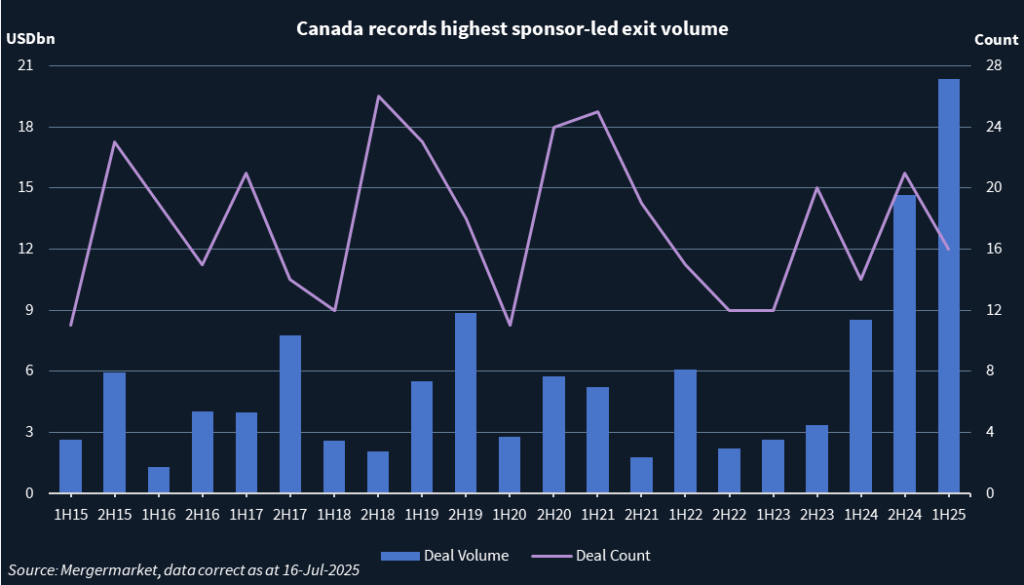

Private-equity (PE) activity followed a similar pattern. Sponsor-led buyouts jumped 65% YoY in 1H25 to USD 13.4bn although almost half of the volume came from CDPQ’s USD 6.7bn Innergex Renewable Energy deal in February. Exits, too, ballooned in volume despite a limited count, soaring 139% YoY to USD 20.3bn on 16 deals.

Some buyout firms took a breather in the first half, but now see an abundance of opportunities in a less-competitive market compared with the cheap funding-fueled years of 2021 and 2022, says Franklin, who deals mostly in mid-market sellside M&A advisory across Canada.

“There is going to be a little bit more uncertainty, but the groups that jump in a little bit sooner will probably get access to more of those businesses and do more deals,” he says.

Oil and gas gusher

Oil and gas accounted for nearly 30% of Canadian M&A, generating USD 24.2bn across 18 deals, led by Sunoco’s pending USD 10.2bn acquisition of downstream energy company and retail operator Parkland. Separately, the utility and energy sector recorded 21 deals totaling USD 16bn, led by the USD 6.7bn Innergex Renewable Energy deal.

Myron Mallia-Dare, Partner at Toronto-based law firm Miller Thomson, points out that while oil and gas M&A picked up the large headline numbers, there is also a lot of interest in Canadian nuclear and renewables from foreign investors.

Other typically strong sectors, though, were less robust during the first half of the year.

Mining accounted for the smallest share of the Canadian M&A market since 2018, with USD 7bn spread across 40 deals, representing 8.3%. That said, the sector has already booked a substantial amount of volume thanks to Royal Gold’s USD 3.7bn pending acquisition of Sandstorm Gold.

Computers and electronics, while still notching the most deals of any sector, dipped to a double-digit count of 99, its lowest for a first half since at least 2014. Volume was relatively weak at USD 3.3bn.

Mallia-Dare explains that strategics and investors have been picking up Canadian Software-as-a-Service (SaaS) companies at advantageous prices in a tough funding environment, beset by trade uncertainty. “You are seeing many mid-market take-privates and buyers coming in and taking Canadian SaaS firms because we have seen lower dollar-value competitive bids,” he says.

Ins-and-outs of Canadian M&A

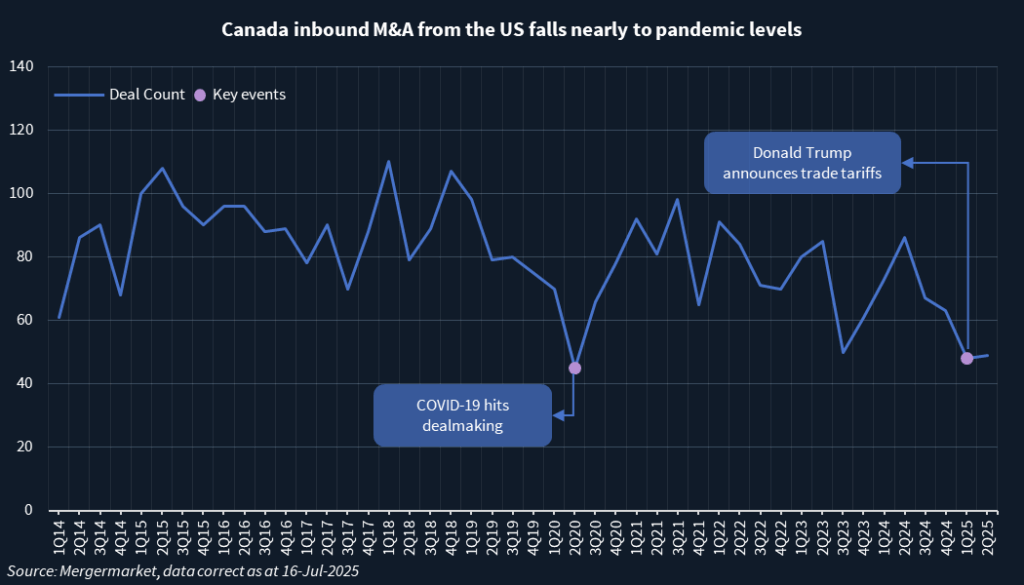

President Trump preceded his administration’s global Liberation Day tariffs with proposed tariffs on Canada and Mexico, and ever since the cost of trade with Canada’s largest foreign market has been in flux.

For the first time since 2014, inbound deals from the US dipped under 100 for a half-year, sliding to 97 transactions worth USD 18.4bn.

To counteract risks from US tariffs and arduous domestic regulatory scrutiny, Canadian buyers and sellers are discussing deal structures like earnouts and required spin-offs and divestitures, says John Emanoilidis, partner at Toronto-based law firm Torys.

“The activity levels are strong, but the bar for execution is much higher,” he says.

Meanwhile, domestic buyers chipped in USD 48.9bn across 338 deals. This marks the second-best half by volume in the past two decades, behind the previous half, which totaled USD 65.3bn across 379 transactions.

With that activity and many processes underway, Canadian dealmakers have not had time to worry about a cold shoulder from their neighbors to the south.

“The number of signed deals has not been up there, but we are all busy,” Emanoilidis says. “We are all as busy as we have ever been.”